There are several financial instruments in which you can park money to claim tax deductions under Section 80C of the Income Tax Act. The nature of tax savings could be by way of saving, investing and in certain cases even spending money, with the combined limit of Rs 1.5 lakh. Although the advantages of long term investing cannot be emphasised more, there is one financial instrument that could be the first investment vehicle for scores of taxpayers—the equity-linked saving schemes (ELSS). The ELSS comes with a three-year lock-in, which is the shortest compared to other tax savings avenues.

Extra edge with equities

ELSS are mutual funds in which investments qualify for tax deductions; make them your first choice of tax savings

The ELSS is an open-end equity mutual fund that doesn’t just help you save tax but also lets your money grow. The three-year lock-in works to the advantage of both the taxpayer as well as the fund manager as both get the necessary time to counter market volatility. The taxpayer has the added advantage of being in a fund where only other taxpayers are investors, making them fairly homogenous in their construct. Further, the exposure to equities gives the investor the edge to earn higher returns, which have the potential to beat inflation.

Investment strategy

Although the investment objectives of all ELSS are the same, the way the funds are managed and how the investment strategy is adopted differ. So there is ELSS which may have a large-cap orientation or one which could adopt a multi-cap approach. The varying strategy adopted also gives an opportunity to select a fund that is managed in a manner that it suits their risk appetite. Says Mahesh Patil, co-CIO, Birla Sun Life AMC: “Quality orientation involves selecting companies run by professional managements backed by strong promoters when building the fund’s portfolio.”

Then there are fund managers who swear by the benefits of diversification to spread risks and optimise returns. “Invesco India Tax Plan’s portfolio has a healthy blend of growth and value, but is growth biased. We invest across market capitalisation with a blend of both large-caps as well as mid-caps with a long-term view. Hence the portfolio is managed with a very low turnover,” explains Vinay Paharia, fund manager, Invesco Mutual Fund.

Says Lakshmikanth Reddy, VP and portfolio manager, Franklin Templeton Investments—India: “We follow a bottom-up approach, and invest across market-cap. The idea is to have a mix of large and mid/smallcap stocks that can help the fund deliver superior risk-adjusted returns across market cycles.” Franklin India Taxshield is designed to be sector-agnostic with “prudent” limits on exposure to any single stock.

“My strategy is guided by a pure stock-determined approach. I look at corporate earnings for the next two years and how the cash flow profile of the company is going to improve; if a company is delivering an X ROE, what will lead to growth in the coming days,” says Rohit Singhania, VP and fund manager, DSP BlackRock Investment Managers. In case of small- or mid-cap companies, he looks at the scalability and its plans for capacity expansion.

The lock-in advantage

One advantage for fund managers when managing ELSS is the three year lock-in. As much as the lock-in forces an investor to stay invested for a fixed period, it also gives the freedom to manage the fund without the fear of redemption pressure during market swings. “The lock-in allows investment decisions to be taken with a longer term outlook as there would not be fears of redemption. We, however, do build a significant part of our portfolio with a 2-3 year view,” says PVK Mohan, head—equity, Principal PNB AMC.

Fund managers have the flexibility to invest in companies that can deliver. “The lock-in plays an important role. It helps in taking medium- to long-term view on stocks of emerging quality companies and helps us to invest in early stages,” says Patil. The lock-in also helps fund managers stick to their mandate and stay invested even in times of crisis. “So the fund takes the best advantage of staying invested in equities during times of panic, helped by a three-year lock-in and tries to generate superior risk-adjusted returns over the long term,” adds Patil.

“We typically stay fully invested and the cash exposure is only to meet liquidity needs. This is because our product portfolio comprises long only products—a product structure that by design forbids managers from taking cash calls,” says Reddy.

“Our fund typically invests about 50 per cent of the assets in a portfolio of attractive mid-caps. This is possible because the three-year lock-in provides us with the flexibility to do so, thereby enhancing the prospects of the fund,” says Paharia. The flipside of this approach, of course, is market risk and lack of liquidity for three years. Taxpayers who are willing to stomach the risk in the short term are likely to choose this option.

Mix ‘n’ match

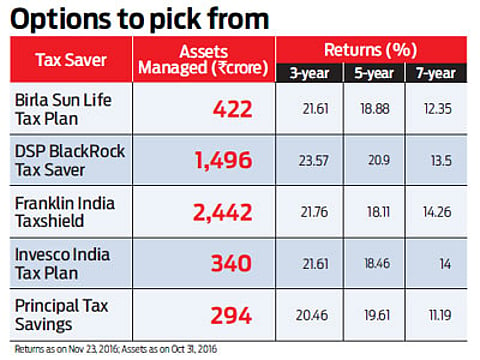

The decision to choose an ELSS from over 40 available schemes is a daunting task. As an investor, you need to take into account several factors while identifying the scheme that fits your needs. Performance history of the fund manager as well as the scheme is the most critical parameter. Market outperformance is important as is consistency of returns. Look at returns over the long-term period instead of being dazzled solely by their recent performance.

More importantly, do not get taken in by their returns during a bull run. “Their performance in down markets should be understood as you do not want your tax-saving money to go down south in bear markets,” advises Vidya Bala, head—mutual fund research, Fundsindia.com. Analyse the fund’s risk profile, its track record and consistency in performance—the wide choice allows you to pick a fund that meets your needs than blindly invest in tax savings options.

As for exiting the fund, unlike other tax saving options where the tenure of the instrument most often results in exit, there is no such compulsion to exit an ELSS once the lock-in ends. Once your lock-in is over, you could stay invested in the scheme.

The three-year return on all ELSS ranges from 12.22 per cent to 28.66 per cent as on November 24, 2016. What it means is that even the worst performing ELSS earns higher than any of the guaranteed return tax savings options, making ELSS an automatic first choice investment and tax saving option.