Most of the Auto firms in India had a disappointing March quarter on the back of subdued demand; high fuel prices, higher insurance costs and liquidity squeeze in the economy. The increased ownership cost in addition to stress at the farm level hampered buying sentiment, particularly in 2Ws/PVs segment. Consequently, inventories were at record levels across segments and particularly it was highest in the two-wheeler segment at 60-70 days. Almost all auto companies are facing the issues of high inventory levels across the country, that has forced auto companies to cut production, companies which have cut down on production include big names such as Maruti Suzuki, Bajaj Auto, and Hero Motors. This slow down is directly reflected in auto sector earnings, which have seen sharp declines in profits across the board. Bellwether companies such as Hero Moto Corp, TVS Motor have been worst hit in terms of profitability.

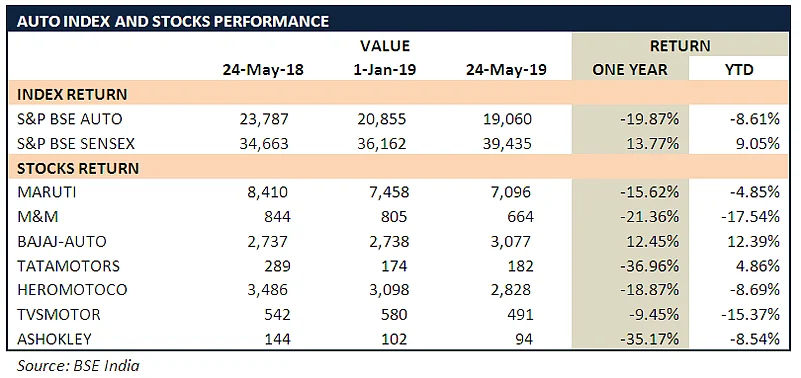

Dismal corporate earnings and adverse business environment has led to significant value erosion in auto stocks, the broader BSE Auto Index has lost almost a quarter of its value at a time when the Benchmark Indices Nifty and Sensex have been up by nearly 14%. Maruti Suzuki, has lost 45% of its market cap from its lifetime highs, the story is not very different for stocks in the two-wheeler, commercial and agricultural segments of the auto industry.

Going forward in the near-term, operating margins will continue to remain under pressure due to subdued volumes, higher commodity prices and adverse forex costs. On top of it, most companies will have to contend with continued product discounts to boost demand, which will further hamper the margins. The slowdown is expected to continue for the next couple of months for majority of the companies. However, it should be added that he sluggish demand sentiments may not continue for very long as the Indian consumer behavior when it comes to purchasing a vehicle is predictable, they are known to defer their purchases but do not shelve the idea of buying a vehicle altogether. In addition, significant amount of auto purchases happen towards the end of the year during the festive season, the impact of which will only be reflected in Q3 FY19 earnings.

There are several factors that can auto impact the auto sector demand in the near term, alleviation of rural distress, a normal to good Monsoon would positively impact the rural demand, also the tax relief that has been made available to the middle class will also lead to demand spurt for two-wheelers and small passenger vehicles. Furthermore, a lot of consumer demand has been put on hold in the anticipation of the results from the general election, following the results we expect consumer demand to pick up. Regulatory push, such as mandatory disposal of vehicles older than 20 years, new truck loading rules, expansion of roadways, rural road connectivity enhancements are all positive catalyst for the auto sector.

To summarise, currently most of the firms in this sector are facing challenges due to subdued demand, inventory buildup, higher fuel prices and a liquidity crunch in the market. The situation is further exacerbated due to higher production costs that have to be incurred to comply with enhanced safety regulations, and for the technological enhancement necessitated due to the new BS-VI emission norms. All these factors have led to the evolution of a new normal for the auto industry, where the premium valuations that auto sector stocks used to derive are no longer there. For companies in the auto sector to survive and thrive, a lot of adjustments need to be made and the winners will eventually be the companies, which adapt quickly. From an investor’s perspective the auto sector is expected to remain subdued for the next two quarters at least, those who have significant exposure in the sector patience would be the key, for traders it is advisable to sell auto stocks at each rally because the short-term rallies would not be sustainable. For long-term investors who want to gain exposure to the auto sector it is advisable to wait before jumping in as the auto sector rally is still far away.

The author is the Director Wealth Discovery/EZ Wealth.