Post demonetisation hullabaloo is still fresh in our minds. It was no surprise that money found its way across all dormant accounts in India. This saw a sudden inflow in highest amount of cash through reactivating dormant accounts. This led to the Reserve Bank of India (RBI) to come up with a direction for Indian banks. On December 6, 2016, the RBI mandated banks to follow strict procedure for reactivation of dormant accounts only after proper due diligence and verification of account holders. A report published by the World Bank states that, about 43 per cent of the total bank accounts in India are dormant even though bank account penetration has surged in the country in the recent past

India has the maximum number of dormant bank accounts in the world. Whether we parked our money in dormant accounts or not, but post-demonetisation many individuals faced a lot of challenges pertaining to unused bank accounts,

Blame it to switching jobs, moving to another city or even country or even forgetting to use the existing accounts out of too many current or saving accounts in your name. However, its not all that dark too. If you are aware of the existence of dormant accounts, you can always choose to take proper action against the same. Here’s what you can do?

What is a dormant account?

Bank accounts, whether savings or current, which has not witnessed any kind of transactions over a substantial period of time (for one year or more) is rendered inactive. In cases where there have been no transactions in the account for over two years, the bank automatically reclassifies the same as a dormant account.

What kinds of transactions are considered for such accounts?

For the purpose of re-classifying an account as inactive or dormant, both type of transactions i.e., debit as well as credit transactions induced by you or the third party are considered. Some of the transactions include dealings done through cheque, deposit of cash, withdrawal of cash, Net-Banking, ATM withdrawal, transfer of fund to your or another account among others. . However, during the dormant period, interest will be still credited to your savings account regularly. The same is applicable for fixed deposits (FD) where the interest will be credited as and when the receipt matures.

That said, your dividend on shares or the proceeds of your FD in your savings account would also be considered as a customer-initiated transaction. Hence it will be treated as inoperative only after two years from the date of the last credit entry of dividend or FD, considering there is no other customer-induced transaction.

Which customer requests banks would not process?

Bank would not be able to process your requests for deliverables like debit card, cheque book and internet banking User ID/Password under Inactive account. Under a dormant account, bank would not be able to process your request for change of address, contact number, email address. Also, issuance of chequebook or deliverables and renewal of ATM-cum-debit card would not be able to get processed by the bank.

Here is how you can revive your sleepy account

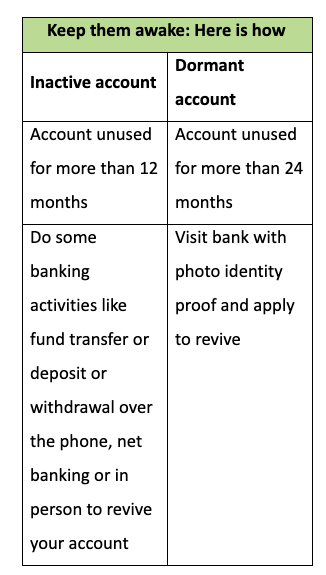

In order to bring your inactive account back to normalise form, you have to conduct some basic banking activities such as funds transfer, cash withdrawal or deposit, and bill transfer. You can also activate it through cheque transactions, by calling customer care or using your ATM cards at regular intervals. Many banks also provide activation through Internet banking which differs banks to banks.

In order to revive your dormant account, you need to contact your branch, and thereby submit an application to the bank stating a reason for the inactiveness of your account. Along with it you need to submit your identity proof. Your signature will be verified by the authorised banking personnel. That said, during the time of filling returns one need to submit details of all your accounts, including dormant and inactive ones.

Are there any penalties?

As per the RBI circular issued in 2014, with regard to this, no activation charges for inactive or dormant account. Banks cannot charge minimum balance penalty either on dormant or inoperative account. In order to avoid such situations and run to the branch for reactivation, carry out a transaction once in a while in all your bank accounts. This will ensure that your account remains active and reduces the risk of fraud.