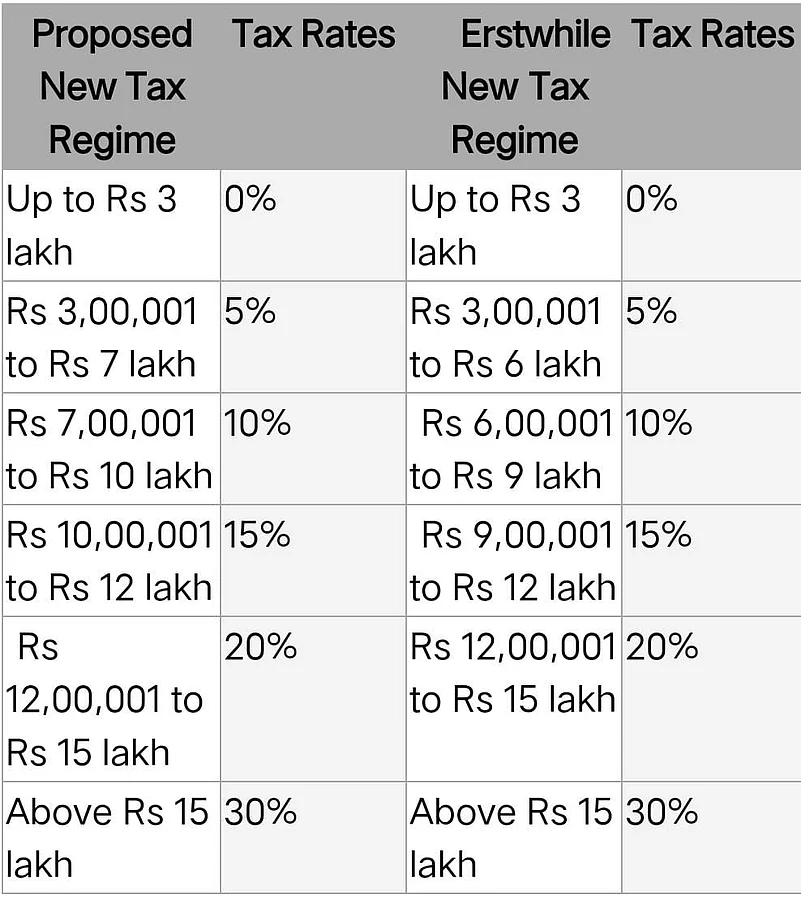

In the Budget 2024-25, after changes to the income tax slabs and standard deductions under the new tax regime, it's time to consider the new break-even deduction points where the old tax regime will be favourable. But first things first. The revision in the Budget primarily lessens the tax burden of individuals with taxable incomes up to Rs 10 lakh.

The main difference is the proposed new tax regime will tax the Rs 6-7 lakh income portion at 5 per cent and the Rs 9-10 lakh portion at 10 per cent, resulting in a tax savings of Rs 5,00 0. The standard deduction has also increased to Rs 75,000, meaning income up to Rs 7.75 lakh won't be taxed. This change will benefit salaried taxpayers by Rs 7,500.

In this case, where only a standard deduction is available where taxable income is Rs 7,75,000, tax under the old tax regime will come to around Rs 59,800 while the new tax regime charges you no tax.

Tax Out Go in Both Regimes

As per calculations shared by Chartered Accountant Mayur J Sondagar, for a salaried employee with a total income of Rs 16 lakh, taxable salary income after standard deduction will come to Rs 15.5 lakh for FY 2023-24 and Rs 15.25 lakh for FY 2024-25 under the proposed new tax regime. Tax payable will be Rs 1.65 lakh for FY 2023-24 under the erstwhile new tax regime and Rs 1,47,500 under the proposed new tax regime in FY 2024-25. After adding e-cess total tax will be Rs 1,71,600 and Rs 1,53,400 under the erstwhile new tax regime and proposed new tax regime respectively.

Background: Break Even Points when deciding Old Tax Regime vs New Tax regime

Even before the recent budget, when the new tax regime was less attractive, for incomes of Rs. 8-10 lakh, deductions of Rs. 1,87,500 to Rs. 2,62,500 were needed for the old tax regime to be favourable. For Rs. 12.5 to 15 lakh income earners, deductions of Rs. 3,12,500 to Rs. 3.75 lakh are required for the old tax regime.

New Break-Even Points After Union Budget 2024-25

Says Parveen Kumar, Partner, Direct Tax at Dewan P N Chopra & Co, "It can be said that for taxpayers having income (before deductions) between Rs 15 lakhs to 5 Crore, both regimes may be at par if a person is availing a total allowable deduction of Rs 4.08 lakhs. If deductions availed exceed such amount the old regime would be beneficial. For income up to Rs 15 lakh, one is advised to compare both regimes on their facts and choose accordingly."

However, as a general rule of thumb, it can be safely said to opt for the new tax regime if individuals earn under Rs 15 lakh. Because even before the more attractive new tax regime slabs were announced in the recent budget if you were earning Rs 15 lakh, you needed eligible deductions of Rs 3.75 lakh for the old tax regime to be more beneficial. Such high deductions are unlikely, so calculations are only necessary when income exceeds Rs 15 lakh.

The calculation shared by the Chartered Accountant Mayur J Sondagar shows that the breakeven point for qualifying deductions under the old tax regime is Rs 4.08 lakh. When eligible deductions are Rs 4.50 lakh, the old tax regime saves Rs 12,500 in tax. When the eligible deduction is Rs 5 lakh, the old tax regime saves Rs 27,500 in tax.

"Whereas, for income exceeding Rs 5 crore, generally the new regime will be beneficial as there is a significant savings in surcharge and in turn the tax rate by 12 per cent," Kumar said.

Another calculation prepared by Sameer Gogia tax consultant at Deloitte shows how tax outgo and breakeven points work for higher income category