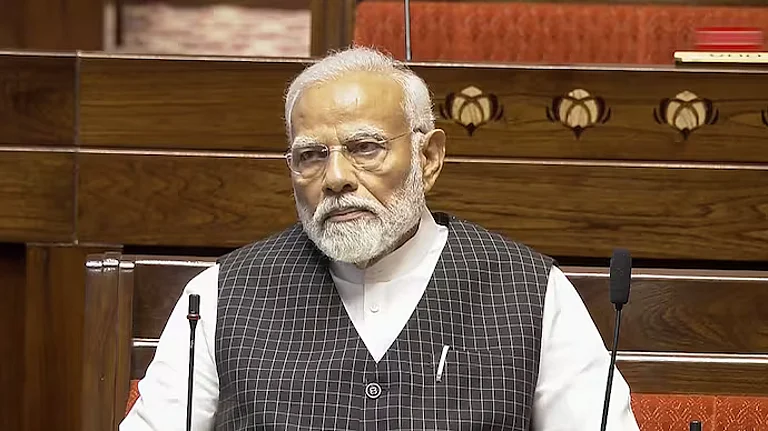

The recent Lok Sabha elections delivered a setback to the Bharatiya Janata Party (BJP), triggering a period of intense self-reflection within the party's hierarchy. The once-pervasive aura surrounding Prime Minister Narendra Modi's administration appeared to dissipate suddenly, leaving behind a tangible disquiet among voters. Central to this discontent was the issue of jobless growth, which emerged as a pivotal concern, prompting a re-evaluation of political alternatives and challenging the entrenched notion of TINA (There Is No Alternative).

Not long ago, the BJP under Modi exuded an aura of invincibility, buoyed by slogans like “abki baar 400 paar”. However, the electorate's verdict underscored their sovereign right, emphasising that no leadership, irrespective of its dominance, can afford complacency. A marginal shift in electoral fortunes could have paved the way for opposition parties, leveraging promises of socialist reforms, to assume power.

Balancing Act

In the aftermath of this electoral setback, Sitharaman confronted a daunting task as she presented her seventh consecutive Budget. Straddling the imperative to sustain India's growth momentum while addressing accusations of favoritism towards corporate interests, Sitharaman executed a delicate fiscal balancing act.

The Budget was crafted to embody a right-wing fiscal ethos—prudent yet infused with welfare-state elements. Maintaining a fiscal deficit at 4.9%, a significant improvement from the interim Budget's projections, underscored Sitharaman's commitment. This feat was achieved through bolstered non-tax revenues, buoyed notably by dividends from the Reserve Bank of India and public sector enterprises.

Sitharaman's proposals were laser-focused on stimulating job creation, particularly within the manufacturing and formal sectors—a pivotal strategy in an economy grappling with structural employment challenges. Central to her approach was the introduction of the employment-linked incentive (ELI) scheme, designed to invigorate the formal sector by offering Employees’ Provident Fund Organisation (EPFO)-registered new hires incentives equating to one month's salary spread over three months, with the salary eligibility cap of Rs 1 lakh per month.

Additionally, the Budget advocated for government-backed initiatives to subsidise EPF contributions for both employers and employees, while encouraging top 500 companies to engage Indian youth through paid internships, thus nurturing a skilled workforce essential for sustained industrial vitality.

Despite these initiatives, lingering questions persist regarding their efficacy in catalysing meaningful job creation, particularly in an economy historically reliant on government infrastructure spending to stimulate growth. Whether these measures will indeed translate into tangible employment gains remains a critical concern.

A notable budgetary allocation included Rs 26,000 crore earmarked for infrastructure development in Bihar and Rs 15,000 crore for Andhra Pradesh—a move seemingly influenced by political alignments and aimed at addressing infrastructural deficiencies, particularly in Bihar known for its crumbling bridges and flyovers.

Give and Take

Budgets, however, are not devoid of the sway of economic lobbies, shaping the distribution of tax burdens and policy priorities. The salaried class, though vocal, found the Budget's increase in standard deduction from Rs 50,000 to Rs 75,000 per annum offering marginal relief, amounting to Rs 17,500 annually. Conversely, a 2.5% rise in long-term capital gains tax on stock market investments sought to align with similar levies on bank deposits, amidst a sustained bullish market.

Looking ahead, the challenge of stimulating consumption in the economy looms large. While developments in infrastructure and tourism sectors across eastern Indian states like Bihar, Odisha, and Jharkhand may bolster gross domestic product (GDP) growth and government expenditure, recent electoral trends suggest a populace yearning for substantive employment opportunities and increased purchasing power —the Budget does nothing to boost it immediately.

The reduction in customs duties on precious metals like gold, silver and platinum may resonate less with voters ahead of crucial assembly elections in six states over the next 15-odd months. Modi's task, buoyed by this fiscally prudent Budget, will be to reconnect with voters and articulate a compelling vision that resonates as effectively as before the pivotal June 2024 elections.