Mumbai-based Charmi Soni is very particular about what her 2-year-old son, Abeer, wears—only the best will do for him. “I shop from brands like Zara, H&M and Adidas because I want him to be comfortable and also stand apart from the other children in our vicinity,” she claims.

Charmi is part of the tribe of Gen-Z and millennial parents who have a no-holds-barred approach when it comes to clothing for their little ones. Armed with a growing disposable income and exposure to brands due to social media they are propelling India’s kids apparel market, which was valued at $ 21.6 billion in 2023, according to Imarc Group.

While many global and indigenous brands have happily jumped onto the bandwagon to cater to this clientele, a new segment is now emerging—preloved kidswear. Mi Arcus, a startup selling baby and maternity products, wants to grab a piece of this growing market.

According to Future Market Insights, the global second-hand apparel market is estimated to be valued at $ 43.49 billion in 2024 and reach $ 125.18 billion by 2034 growing at 11.1% CAGR during this period. The demand for this clothing is mostly driven by getting good quality brands at cost-effective prices, growing awareness about sustainability and democratising access due to e-commerce and social media. Balancing the right kind of marketing promotions and focused advertising with the appropriate product assortment and merchandising opens up a new revenue stream for startups like Mi Arcus.

Kidswear is the ultimate example of fast fashion as children between the ages 0-to-six-years outgrow their clothes within months if not weeks. Kidswear swap stores, online or offline, are catching the eye of parents who seek the best brands for their children without burning a hole in their pocket.

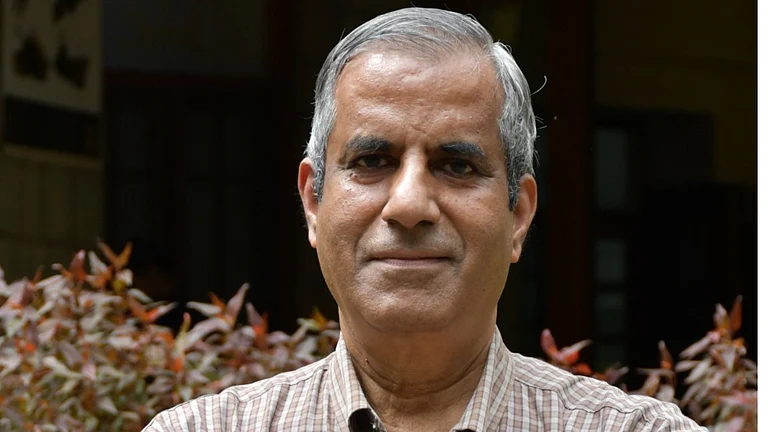

“There are times when parents buy an expensive dress for their child to wear for a special occasion, but they can’t use it again as the child has outgrown it,” said Gian Singh, founder of Mi Arcus. Moreover, he added that this could Now, Gian is considering rolling out the thrift store concept for kidswear. In addition to opening a new revenue stream for the company, the company can also tap export opportunities by selling these pre-owned products to lower-income countries at reduced costs.

This year, Mi Arcus is experimenting with ways to encourage its customers to return products they have purchased from the company once their kids have outgrown it and offer them store credits for future buying. It is part of its three-pronged strategy ticking altruistic and business boxes.

This move is part of its CSR efforts to provide clothing to underprivileged children, by giving them washed and darned clothes. Also, giving the product a second life helps it adhere to its sustainability principles. And finally, offering buyers store credits binds them to the brand, increasing its user stickiness.

Learning From Legacy

Gian is adept at identifying upcoming business trends; it is a legacy that he has inherited as a fourth-generation entrepreneur. His earliest memories growing up were watching Russian planes landing and taking off at the farms adjoining his ancestral house in Ludhiana.

After moving to India post-partition, his family started Jawandas to manufacture sweaters, which its partners sold to Russian companies. In 1972 they introduced Oster India to cater to indigenous retail partners, which currently has an annual turnover of Rs 8200 crore.

Post-liberalisation in the 1900s, these middlemen were eliminated. This move improved our margins and also reduced their purchase cost for our buyers and these Russian buyers would come to our house in their private jets to buy in bulk and export to their country,” he recalled, adding that one buyer even gifted Gian a Samoyed puppy.

Between 1991 to 2000, his family set up over four factories in Punjab to keep pace with the growing demand. However, their export business came to a standstill after Russia’s 1998 financial crisis. Fortunately, they still hand another golden egg to crack—Oster.

In 2000, leveraging its manufacturing and distribution capacity, it ventured into two business segments. One is home furnishing products like blankets, quilts and bed sheets for the Indian market, a division that currently averages Rs 100 crore in revenue. The second venture was exporting to the European market.

In 2001, they began supplying throws to IKEA specializing in blends like wool and acrylic—a business Gian’s father came along with Jawandsons, and which currently contributes €50 million in revenue. After Gian and his brother joined the team, the trio decided not to repeat the mistake they made with their Russian suppliers; that of depending on a single customer.

“From 2013, we started exploring more European buyers. Today 50% of our business comes from other global brands like H&M, Zara, Walmart, Kmart, Natori, Asda UK, through Jawandson with an annual turnover of around Rs 500 crore,” Gian said.

In 2019, he decided to look after the domestic trade, while Gian’s brother took charge of the global trade. “While 70% of our business is export-oriented, the remainder is with select Indian brands like FirstCry where we offer blankets, sleeping bags for children, etc. We added this product category after realising that finding a domestic bulk buyer for sweaters was tough given its limited and seasonal nature,” he explained.

Minding The Way For Mi Arcus

Deducing the potential for kids' products, Gian launched MiArcus in 2020 as an e-commerce brand. Today its footprint spans 12 online marketplaces and 40 physical outlets. In 2024, it registered Rs 75 crore in turnover, up from Rs 35 crore in 2023 and Rs 14.35 crore in its maiden year.

Gian maintains that its 40% repeat customer rate is a key reason behind this doubling growth. Moreover, by sourcing 40% of its inventory from Jawandsons, it gains benefits on economies of scale by getting products at viable prices.

To keep pace with its doubling revenues, the company is increasing its omnichannel presence. It will augment its 40-store network by opening 20 more, especially focusing on northern India since this region drives its business given the demand for winterwear for kids.

It will also double down on the number of outlets it has in key cities. “We have 8 stores in Delhi, 1 in Srinagar and 12 in Punjab, and plan to open four, one and five outlets in these respective regions. We feel that the ROI is better when you undertake targeted marketing in the same city, as it helps build brand awareness, which can get otherwise diffused if you spread it across various cities,” Gian stated.

The company signed actress Kareena Kapoor as its brand ambassador when it launched its first two stores. It gave Mi Arcus the necessary pull factor as customers of kids' products feel comfortable when it is endorsed by a popular face.

The company did not renew Kapoor's brand contract after it ended in September 2023, as it had adequately leveraged her presence for marketing. Now, it is considering roping in celebrity couples for brand endorsements. After all, in this era of co-parenting, the father is equally and extremely involved in the purchase decisions for their young ones.

New Associations

Last year, Mi Arcus took the licence for the American comic brand, Peanuts, and rolled out its first collection featuring Snoopy Dog in October 2023. “Its licensing partner, CPLG, was happy with our performance and said that we had sold four times what the company had expected,” Gian said. It was eager to offer MiArcus the license for Peppa Pig, but Gian wants to capitalise on the Peanuts brand extensively before adding other brands to its franchise portfolio.

“Moreover, our stores are around 2000 square feet, so we can do a maximum of two license characters, unlike brands like H&M that do around 10 given the massive size of their outlets,” Gian added, adding why the company is focused on online business, as it offers more opportunities to add more brands in the practically unending storefronts in the virtual world.

For now, MiArcus is concentrating on social media marketing, 5 to 7% of our revenue goes into marketing and 80% of that marketing will go on social media. Right now, the company’s average rating on e-commerce platforms like Myntra and Amazon averages 4.3 out of 5. While its product range comprises bibs to cribs and all in between, several white spaces keep coming up, offering it growth opportunities. Tapping these is how Gian hopes to achieve his goal of opening 50 more stores and Rs 120 crore within three years.