Organized Crime and Corruption Reporting Project (OCCRP) published a new report which cited evidence of stock manipulation by Adani Group. OCCRP provided the alleged documents to The Guardian and Financial Times, who have published their own reports on the issue.

In January this year, the group was rocked by a report published Hindenburg Research. Following Hindenburg allegations, the conglomerate had lost over half of its market value. The new OCCRP report claims that it has accessed documents which provide fresh insights into the allegations of stock manipulation.

Following the publication of the new report, Hindenburg Research said, "Finally, the loop is closed. The Financial Times and OCCRP report that offshore funds owning at least 13% of the free float in multiple Adani stocks were secretly controlled by associates of Vinod Adani, masking the relationship with 2 sets of book."

Notably, the new report has come after markets regulator Securities and Exchange Board of India (SEBI) submitted its report in the Adani-Hindenburg case. The apex court had set up an expert panel and asked SEBI to investigate the allegations of stock manipulation and regulatory violations regarding public shareholding and related party transactions.

What Did OCCRP Say In Its Report?

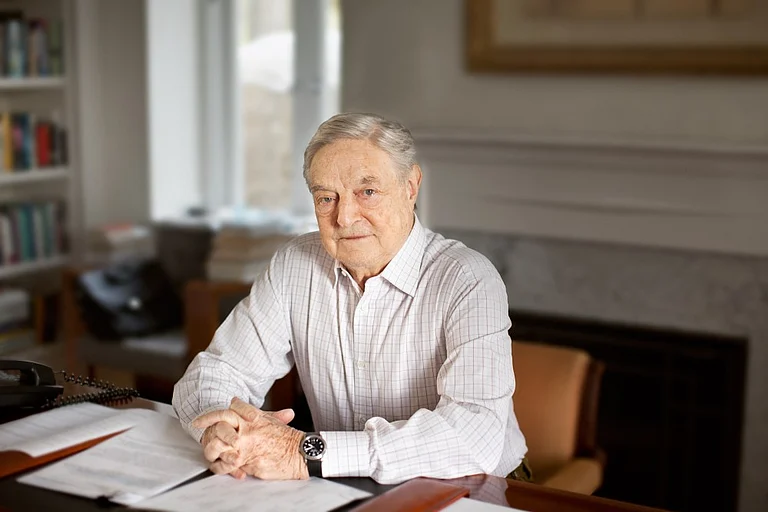

The George Soros-funded group said in its report that two investors, identified as Nasser Ali Shaban Ahli and Chang Chung-Ling, traded Adani Group shares worth millions of dollars through Mauritius funds. The documents accessed by OCCRP allegedly show that the management company in charge of the investments in question was advised by a firm run by Vinod Adani, brother of Gautam Adani.

OCCRP referred to SEBI’s investigation into 13 overseas entities holding Adani Group stocks. According to the investigative report, it has found origin of funds used by two of the entities under the scanner of markets regulator.

Emerging India Focus Fund (EIFF) and EM Resurgent Fund (EMRF), the two entities in question, allegedly received large sums of money from Chang and Ahli. The money infused in EIFF and EMRF was channeled through four companies and a Bermuda-based fund called Global Opportunities Fund (GOF).

The report also delved into the question of whether the two investors and their funds are connected to Adani Group. Indian regulations require listed companies to ensure that promoters don’t hold more than 75 per cent stake in a company. The connection of Chang and Ahli becomes important in this context.

OCCRP mentioned in its investigation that the names of two men have surfaced in two separate investigations by Directorate of Revenue Intelligence (DRI) into alleged wrongdoings by Adani Group. The two investigations were carried out in 2007 and 2014 respectively.

According to OCCRP, DRI named Chang as director of three Adani companies involved in the case. Another investigation revealed that Chang and Ahli were directors of two companies later owned by Adani Group.

While the connection of these two investors has been in spotlight, the new report alleges that their investment was coordinated with Adani family. A firm ultimately owned by Vinod Adani, Excel Investment and Advisory Services Limited, allegedly provided advisory services to EIFF and EMRF. Interestingly, the agreement for this was signed by Vinod Adani himself in 2011.

Letter To SEBI In Spotlight

OCCRP reporters accessed a letter sent by DRI in 2014 to SEBI. The content of the letter, according to the report, could help in understanding the source of funds used by Chang and Ahli.

The DRI letter reportedly said that the money from the scheme it was investigating was sent to an Emirati Company which forwarded the amount to a Mauritius Based holding company owned by Vinod Adani. This amount was again loaned to another company owned by him, Assent Trade and Investment Pvt Ltd.

Interestingly, this company allegedly infused the money into GOF, the same Bermuda-based firm used by Chang and Ahli.

Adani Group Reaction

Following the publication of the report, Adani Group responded with a strong statement dismissing the allegations made by OCCRP.

The statement said, “We categorically reject these recycled allegations. These news reports appear to be yet another concerted bid by Soros-funded interests supported by a section of the foreign media to revive the meritless Hindenburg report. In fact, this was anticipated, as was reported by the media last week.”

The group added that these reports have used closed DRI cases and added that the adjudicating authority had already given a clean chit in the case.