Not long ago, the defence sector was the darling of its India’s start-up scene. The government, awash with optimism, proclaimed that India would be a drone superpower by 2030. The Innovations for Defence Excellence (iDEX) scheme, with an ambitious budget of nearly Rs 500 crore, was introduced to spur the growth of defence start-ups.

Seven years later, India’s defence start-ups are struggling. Funding has been difficult to come by and orders are few and far between. The few orders that come are for emergency provisions which many early-stage start-ups lack the wherewithal to deliver. They eventually end up with bigger, better-networked companies.

“Even with cutting-edge technology and innovation, start-ups sometimes receive no offers. Meanwhile, companies with industry connections secure tenders,” says the founder of a drone start-up whose company participated in iDEX.

The founder, who agreed to comment on this story only on condition of anonymity, further says, “Even if my company does manage to fetch an order of Rs 100 crore, we will get a maximum of 15% advance. It is tough to raise the remaining amount. The process is extensive, there is wear-and-tear which costs a lot.”

Losing Out

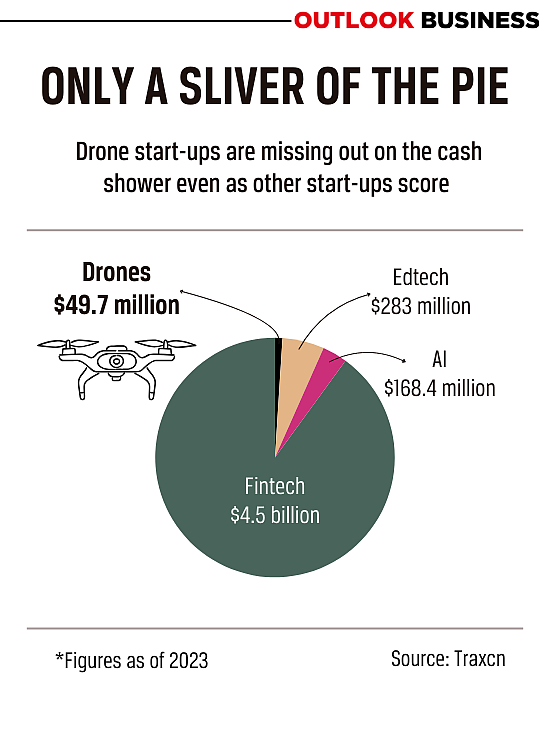

India has around 300–400 start-ups in the defence and aerospace (D&A) sector. And most of them are struggling for funds. An Invest India report recently pointed out that the sector has largely been overlooked by venture capital and early-stage investors. This is at a time when start-ups in sectors like fintech and edtech have attracted investment despite the blowups at Paytm and Byju’s.

Data from start-up curator Tracxn Technologies shows that Indian drone manufacturers, who make up the bulk of Indian defence start-ups, attracted $49.7 million in funding in the 2023 fiscal. Edtech, on the other hand, attracted $283 million, and fintech a whopping $4.5 billion. There are experts who say the sector is too new and will take time to grow. But the artificial intelligence (AI) sector is new too, and it has managed to secure three times the amount of funding as defence—$168.4 million.

One of the reasons for this contrast is the very nature of defence start-ups. These typically require long timeframes to make products, involve high costs and cannot promise quick returns to venture capitalists (VCs). An angel investor on condition of anonymity shared that VCs refrain from venturing into defence because of strict government policies and restrictions.

“Investors know deep down that this is not a business-to-consumer venture where profits will start showing soon. In fact, they might never show. Defence start-ups are a risky bet in India,” he says. Arjun Naik, chief executive of drone manufacturer Scandron, says most defence start-ups do not have a future-looking business plan. “VCs want to invest in a good business plan,” he says.

Even Arun Kumar, managing director of Celesta Capital, whose company has made major investments in ideaForge—India’s first listed defence start-up—agrees. He says funding remains a challenge for the sector because of the time and resources necessary for complex and groundbreaking innovation.

In the bleak sector, ideaForge is a rare success story. Founded in 2007, industry experts say the company had been working hard for years but tasted its first success only when it received an emergency procurement order from the government. Now, the company is India’s leading drone-maker, and has investments from groups such as Qualcomm, Infosys and Flointree Capital Partners.

Government’s Job

Industry experts say the government must help start-ups if it wants to succeed in its pursuit of indigenisation. The Ministry of Defence (MoD) has issued five indigenisation lists comprising equipment that needs to be sourced locally or have at least 50% local content. More than Rs 450 crore has been given in grants to the over 500 winners of the Defence India Startup Challenges. But the funds are not enough, the experts say.

Each start-up just gets around Rs 10–25 crore and then has to match with the same amount. Credit is difficult to obtain because of a lack of collateral, unproven business models, complicated application processes and pressure to pay back within strict timelines.

Moreover, the pursuit of indigenisation does not directly benefit start-ups and micro-, small- and medium-enterprises (MSMEs) in defence. This is because when orders come, bigger companies with more resources can meet the demand better. And thus, the order book of Hindustan Aeronautics stands at Rs 94,000 crore while that of rare success ideaForge stands at only Rs 175.8 crore.

Start-up founders and industry experts say the government needs to hand-hold the little guys by providing them equal opportunity instead of obtaining most things from established players. An industry source associated with policymaking for drones’ manufacturers says, on condition of anonymity, that start-ups only have a chance when there is emergency procurement, and the government’s needs have to be immediately fulfilled.

“But it is quite possible that a new entrant may not be able to fulfil such an order. This is an unfortunate reality. This is where established players or mature-stage start-ups go on to bag the deal,” the source adds.

Need of the Hour

Indigenising defence is a priority for governments worldwide. And several countries are now counting on start-ups to provide the next layer of innovation to power their arsenals. China and Canada have specific mandates to procure defence equipment from start-ups. In the US, where defence manufacturing giants such as Lockheed Martin and Boeing dominate the market, start-ups like Anduril, which integrates artificial intelligence (AI) into military operations, are being given an opportunity to thrive.

Nikunj Parashar, chief executive of Sagar Defence Engineering, says, “The need of the hour is to set up an alternate investment fund (AIF) for defence start-ups so the challenge of funding can be tackled, and start-ups are able to innovate.”

Former defence secretary Ajay Kumar, who was instrumental in the framing of iDEX, agrees with the call for a separate fund for defence start-ups. “I have always felt that there is a huge need for a focused fund which can be available for start-ups which are genuinely doing good work and creating value for themselves,” Kumar told Times Of India.

Dr. Abhishek (who goes by only his first name), the co-founder and director of drone solutions start-up EndureAir Systems, says the Indian government needs to focus on research and development and have a long-term vision for future requirements. “It is not just that the credit line needs to be extended for the start-ups, the production-linked incentive corpus should also be extended and should be easily accessible to new entrants,” he adds.

He shares that during his PhD in the US, his research and that of several of his colleagues on unmanned aerial vehicles (UAVs) was funded by the United States’ Army. Abhishek thinks the Indian government should adopt the approach. “The government should focus on academia and establish a separate research and development fund in this field,” he says.

Running a defence start-up in India is a messy affair. Companies must adhere to multiple layers of compliance and standards like getting intellectual property rights, industrial licensing, and dealing with export controls and security clearances. Industry experts say the labyrinth of regulation is what often keeps capital away.

VCs say that the rise in global conflicts—the tensions in West Asia and the war in Europe—underscores the need for a robust, AI-infused military, and that can be an opportunity for start-ups. India’s new deep tech policy might also solve some of the problems facing defence start-ups.

A senior government official who refused to be named tells Outlook Business that the government is doing its part to push India’s defence tech ecosystem ahead. “Initiatives like iDEX and ADITI [a Rs 750-crore start-up funding scheme] have been introduced with a positive approach seeing the potential of our start-ups. For the small loopholes that exist, we need to give all parties time,” he adds.

As global tensions rise, the demand for advanced military technology will rise in tandem. By establishing dedicated funds, simplifying regulations, and fostering a culture of research and development, India can transform its defence sector and truly become a self-reliant powerhouse. The path to indigenisation is not easy, but with a concerted effort, India’s defence start-ups can rise to the challenge.