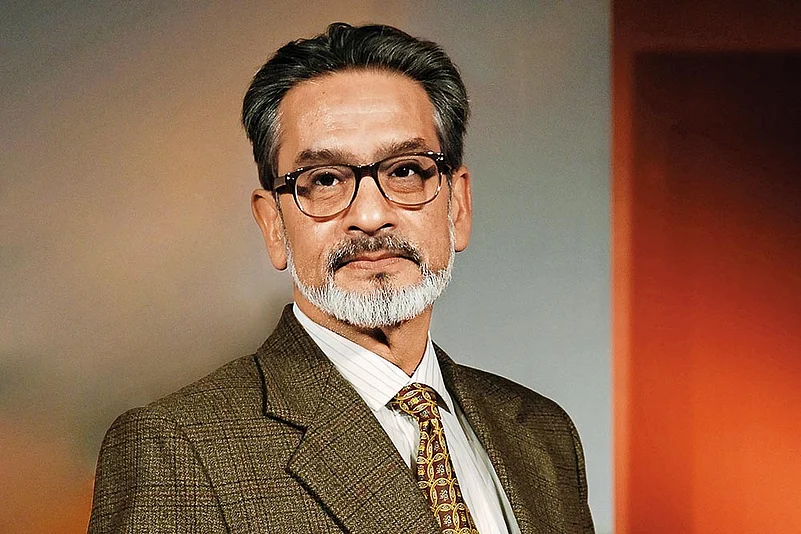

The readings of India’s macroeconomic indicators Consumer Price Index (CPI) and Gross Domestic Product (GDP), crucial in the country’s policy making, are far from the actual data due to their base year not revised on time, said Pronab Sen, Chairman of Standing Committee on Statistics and former Chief Statistician of India.

“Let me be very clear, the further you go from the base, the less accurate. This is pure statistics; there is no rocket science in that,” Sen told Outlook Business in an exclusive interview. He said the base was supposed to be revised in at least 5 years and since that has not happened; the current readings are way off the real data.

For food inflation, which majorly troubled India this year, the economist said the government’s ability to intervene has now become limited with the basket shifting to commodities over which it has less control. “Our ability to handle the current food basket probably is much less than what we had earlier, when our consumption was more green-dominated,” he added.

Following are edited excerpts from the interview:

Q The current year certainly didn’t go well for the US. From the Silicon Valley Bank crisis, to the credit downgrade by Fitch Ratings, and to the yields breaching the 5% mark. So, if we go by the saying, “When the US sneezes, the whole world catches a cold”, how much India should be worried at the moment?

A: At present, not very much. Firstly, as far as the US is concerned, it is seeing much stronger growth than anybody had expected, with the tightest labour market in the last 6 years. They are facing inflation build pressures, which is why interest rates have been pushed up and may get pushed up further. Now what this means in effect is that it would affect to some extent the flow of portfolio investments in India. But that also would be more for the portfolio investments that are into debt funds, and not into equities. Because the equity market in India is doing very well, so it should not make a difference.

Q Has India arrived on the stage where it can completely focus on the internal factors and achieve its targets amid the current global challenges?

A: Well, the global challenges are important. Unfortunately, the kind of global challenges that are coming up are not something we can necessarily take care of just by focusing internally. It is going to be things like energy prices, for example. And we frankly have very little levee at the moment to do anything about it. So we simply will have to make the necessary adjustments to minimise the impact.

Q A recent paper by economists Rishabh Kumar and Maitreesh Ghatak has challenged those published by the IMF and World Bank, who claim that poverty declined sharply in India in last 10 years. The argument is the use of “synthetic methods” in absence of the consumer expenditure survey. What are your views on it?

A: I think they have a point. In the absence of consumer expenditure data, they have taken 2011-12 data and then used other proxy variables to project that outcome. There is nothing intrinsically wrong with that. The problem of course there is that it assumes a certain degree of continuity in the two relationships. That is not necessarily a good assumption, simply because there had been some traumatic events during the time, which could actually breakdown the relationship between the proxy variables and the consumption variable. So, they do have a point.

Q Unemployment in India reached to a two-year high in October, according to the CMIE. Considering that we are now the most populous country in the world, which sectors have the potential to change the figures in India’s favor by 2030?

A: Basically, it is not so much a question of the product sector. The real issue out here relates to the balance between the corporate and non-corporate for the same product. Typically, corporate tends to employ far less people and far more capital than the MSMEs. And what has happened over the last several years is that the MSME sector has gotten periodically hit. Demonetisation and lock-down affected the MSME sector much more negatively than they affected corporate. So, for any given growth rate, we now have a situation where the bulk of the growth is coming from the corporate sector, which means the employment that has been generated would have been more if it was otherwise. It is much more of a concern of what we do about the MSMEs, because without them it would be very difficult to tackle the unemployment.

Q Despite the PLI schemes and reductions in corporate tax, private sector is still holding back from sharing the same optimism with the government when it comes to investing in India. What are the reasons for it?

A: That is very difficult to say. If you look at any of the objectives with economic parameters, they look fairly reasonable. But you are absolutely right, corporate investments have not responded and why that is happening is something that should be asked to the corporate. I mean, it is there mindset. That is a psychological issue. But the other problem is that the investments in MSMEs have gone down. That is the problem.

Q Do you think that investing in these PLI schemes is a better use of India’s limited budget?

A: I would say wrong timing. The PLI scheme would have worked very well had we been in a booming global economy. We are not there. So, the effectiveness of the PLI scheme comes weaker. We are already seeing a lot of sectors where companies who have come on to the PLI have been forced to get out of it, then having to repay the government’s money. This does not speak well of the effectiveness of the PLI scheme.

Q The freebie culture in India is often seen putting a strain on the government’s expenditure. Don’t you think this holds the economy back?

A: It depends upon what happens with the freebies. If you are giving freebies, all you are saying is that the government is spending money on a particular kind of expenditure. The question is would you be better off or worse off if the government spends the same amount of money on some other forms of expenditure. We are already investing a lot and the government’s capacity to invest is pretty much strain now. So there is a strong argument for saying that the government has two jobs. One job is to promote growth which the government is doing with its investment. The second is to handle the distributional problem, where some people are not getting what they deserve. That is sort of a welfare argument in government expenditure. So freebies are really like welfare. Now you may discuss and debate the kind of freebie, like is this freebie better than that freebie, that is a political call.

Q We are long-pending on revising the base for CPI and GDP, which are considered crucial in our policy making. How much accuracy you see in the current readings?

A: Let me be very clear, the further you go from the base, the less accurate. This is pure statistics; there is no rocket science in that. Now the problem with this is we can’t change the CPI until we have the consumer expenditure data. That is already 12 years old. We are already way off as it should be revised at least in 5 years. Now, the GDP is even more complex. You need the consumer expenditure data but then you need a whole bunch of other survey data to be able to do a GDP based conditioning. So that is more problematic, but let us just get the consumer part of it, because that is needed for both.

Q When the revisions happens, and if say the weight of core increases over 60% in the CPI Index as it is being said by some experts, do you think that the pass-through from WPI to CPI will increase?

A: That is difficult to say because we still don’t have a very clear idea as to how the structure of the CPI should be changed. And the pass through really depends on the kind of commodities. Now, typically what would happen is that the weight of food would go down and the weight of manufactures in the CPI would go up. And in a situation of that kind, it is likely that the pass through will become more.

Q Why despite all the measures India has not been able to control its food inflation?

A: That is for various reasons. One, is our improvements in the food distribution chain has not been up to the mark. We are very high in losses, particularly transport and freight losses in food products. We had storage losses. That dimension continues to exist. It is better than it was in the past but not great. Second reason is we are now in a situation where the government’s ability to intervene is limited. I mean it can do so only in rice, wheat, some pulses and some oil, and that is it. And in this situation where your food basket has shifted to things like vegetables, meats, dairy products, and so on, the government has no ability to intervene. It cannot do open market sales, so our ability to handle the current food basket probably is much less than what we had earlier, when our consumption was more green-dominated.

Q Our current monetary policy is juggling between inflation and growth. Which side should get more weight according to you?

A: Monetary policy has to be nuanced. The view is that monetary policy can focus on only one. I do not believe that to be honest. Monetary policy is a number of instruments, and you can play around with those instruments to be able to influence both. Now, the real question is that if inflation is essentially being triggered by excess demand, then of course the monetary policy has a problem as that way it can only hold down inflation by curbing demand, which could affect your growth story. But if the problem is essentially being driven by supply side factors, the shortage is coming out of supply rather than excess demand then there is no inherent conflict in supporting both.

Q The Reserve Bank of India has clearly said the target is to bring CPI to 4% on a durable basis. What are the main risks to this ambitious target and does it look achievable with the current scenario?

A: For that, a lot of things will have to happen. Every economic system has a built-in inflation in it, which comes from expectation about how much more I should earn this year compared to last year. And this is not just among employees; this is to a farmer, to businesses, and to everywhere. If those expectations are relatively higher, then the inflationary pressure is going to be higher. So, you will have to bring down the overall level of inflation, and if you think about it, in India, the standard expectation is that your annual increment would be three and a half per cent. If that is your standard, you are actually almost setting a flaw and inflation cannot go below three and a half per cent. But the expectations are actually higher than that.

Q The current scenario indicates that we would not be getting the census before 2025. Is it true?

A: Yes, I guess. Because, first you have the house-listing operations, about which we have not even heard of yet, and we make census only 7-8 months after that. So yes, you are probable talking about 2025.

Q You are currently chairing the Standing Committee on Statistics. Has it made any progress?

A: The main work of that committee really depends upon the kinds of demands that are being placed, which come from the user community. Now what kind of data do they need that they are not getting and how do we make it available, is the main purpose. Every ministry actually collates some kind of information that they need for their policy making, so we have to see if can generate that data.

Q The household expenditure survey will be repeated for another year. What would be the alternate measure if it does not yield the required result?

A: We will have to then re-look at the questionnaire. There are three things that are involved around here. One is that this particular methodology invokes three results in each household with three different questionnaires. So, we have to look at both whether if these three visits is causing us any troubles, and are we getting into a situation where in the three visits you are not correcting the data which adds up to the actual annual expenditure of that household. That is the objective. And then we have to re-look at the questionnaire.