Certain key sectors earmarked to stimulate domestic manufacturing under the Central Government’s ambitious Production-Linked Incentive (PLI) scheme, have received a muted response in terms of investment, due to the stakeholders being in disapproval of the scheme’s design.

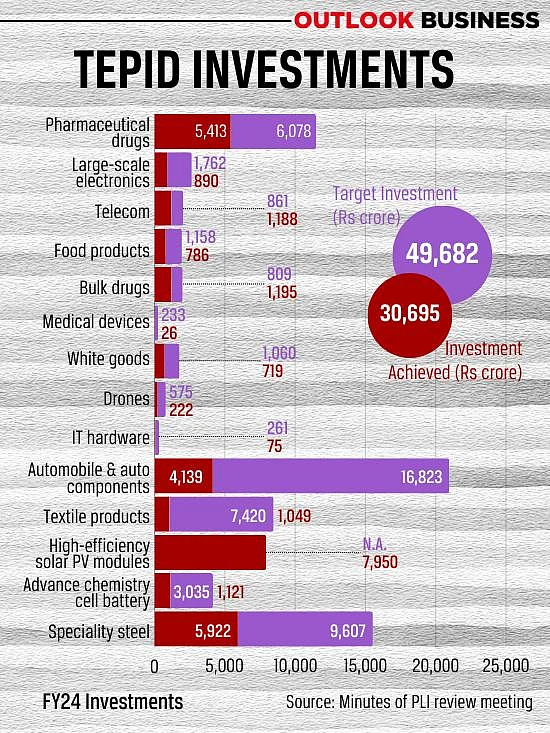

In the fiscal year 2023-24, the government had planned to attract investments totalling Rs 49,682 across all 14 target sectors. However, in the first nine months of the current fiscal, it has only been able to attract investments worth Rs 30,695, according to an official report.

“Wherever the PLI scheme has not attracted sufficient response, it is probably because the stakeholders are not happy with the scheme’s design or incentives,” a senior official at the ministry of commerce tells Outlook Business, requesting anonymity. “In some of the cases we have seen the concerned ministries coming back to the highest level and saying that we have to tweak our guidelines and change the basic parameters.”

2.0 Coming, Again?

Sectors that are currently laggards are automobile and auto components, textile products, ACC batteries, speciality steel, white goods and medical devices. Meanwhile, schemes for mobile phones, telecom, pharmaceuticals, drones and food processing are seen well on track in achieving their targets.

It was in the case of IT hardware where the government last year came up with a revised version only because the scheme had not met with sufficient response. Following a lukewarm reception outside the mobile phone segment and encountering criticism from numerous economists such as former RBI Governor Raghuram Rajan, the government had launched PLI 2.0 for IT hardware, whose response was deemed satisfactory by the IT ministry.

“In some cases like IT hardware, the original one did not take off well but the second version has got good response,” said the official, while adding that it will be up to the respective ministries to take the call on revising the under performing schemes.

Clearing the Fog

Among the laggards, the ones falling behind the most in attracting investments are the automobile and textile sectors. While auto has attracted investments worth Rs 4,139 crore against the target of Rs 16,823 crore, textile sector has severely under performed with just Rs 1,049 crore against Rs 7,420, in the first nine months of the current fiscal.

Apart from scheme designs, experts also attribute the lag to insufficient clarity among the stakeholders. “As of now, the lag in investments can be attributed to a lack of clarity around the scheme among the investors in the Auto sector. However, with the recent amendments done by the government, we might see an increase in the investments and India’s auto exports actually take off from 2024,” says Gaurav Vangaal, Associate at S&P Global.

At the beginning of this calendar year, the ministry of Heavy Industries announced an extension to the tenure of the PLI scheme for auto, and made partial amendments to provide clarity and flexibility to the stakeholders. The changes helped the investors to have a clear view on the applicability of the scheme, schedule for disbursement of incentives and eligibility. “The administration of the application process was not robust. The government should provide ample time and clarity to the industry to evaluate and make applications, with clear guidelines, since in some cases, major clarifications were issued after the announcement of schemes and it is better to engage in pre-consultation with the industry, to the extent possible and feasible,” says Karthik Mani, partner, indirect tax at BDO India.

Experts also suggest that instead of such small tweaks, a more holistic review of the scheme might be in need here.

Why Everyone cannot Make in India

Where the scheme aims to enhance manufacturing by providing incentives to manufacturers, it is not uniform in its objectives. According to the official, the implementation and support provided can vary depending on the sector and specific circumstances. Factors such as the levels of investment required, technological advancements, market demand, and competitive landscape can influence how the government supports manufacturing under the PLI scheme in different sectors.

Akshay Jain, partner at Saraf and Partners, says this to be one of the major reasons for the different levels of progress seen across the sectors. “The PLI schemes for various sectors are not uniform on terms relating to state support for setting up green-filed manufacturing activity such as the support offered for manufacturing of ACC batteries. With time bound criteria for making investment and generating value addition/incremental sales, a uniform approach on time bound state support for setting up the project can be looked into.”

Many textile manufacturers in India, at present, face infrastructure and technology constraints, such as outdated machinery and inefficient production process, which makes the sector a major laggard in availing the benefits of the PLI scheme. Additionally, the global textile industry is highly competitive with countries like China, Bangladesh, and Vietnam dominating the market, thus, creating further challenges for India.

Aaron Solomon, managing partner, Solomon & Co, Advocates and Solicitors, also echoes a similar believe for the under performing sectors, when he says, “Setting up of a new manufacturing facility takes time and resources, involves acquisition of technologies and land, discussions with strategic and technology partners and market research.”

Up to this point, the scheme has facilitated investments totalling Rs 1.03 trillion and contributing to exports surpassing Rs 3.20 trillion since its inception in 2020-21, with varied progress seen each year.