The inclusion of India in the JPMorgan Bond Index couple of weeks back came as a key milestone in India’s pursuit of attracting foreign capital inflow into the country. The global financial firm’s move has sparked hope that the country would see an inflow of billions of dollars in the next few years. A direct result of these inflows will be felt by the Indian currency in the coming years, which tends to appreciate when more dollars flow into the country.

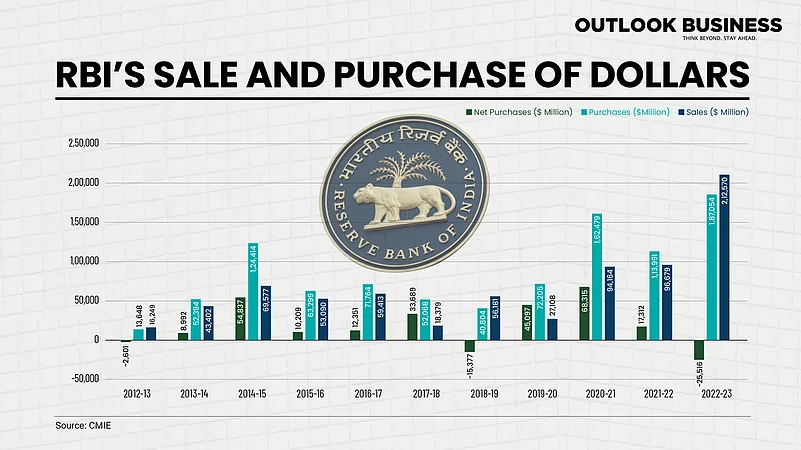

However, JPMorgan’s head of emerging markets economics Jahangir Aziz had a word of advice for those tracking the development. In an interview to Reuters, Aziz said, “Investors assuming that the inflows will lead to an appreciation in the rupee and a decline in yields seem to have forgotten that they live in a country which has one of the most activist central banks.” He added that the central bank would likely buy dollars from the spot market and sell bonds to counter the excess rupee liquidity. In January this year, the news agency had reported that RBI had intervened through public sector banks to prevent rupee appreciation above 81 level after the currency reached 80.89 during day trade.

Also Read | Impact of inclusion in JPMorgan Bond Index

According to the central bank’s stated policy, it has opted for managed float regime where it intervenes time and again to reduce volatility in the Indian currency’s price. While the RBI maintains its “activist stance” and defends the rupee in the currency market to maintain stability, an old question has come into the spotlight once again: Is it picking the right battle to fight?

Let Markets Decide

The RBI usually has to deal with a policy trilemma. No central bank can allow free flow of capital in and out of the country, maintain a stable exchange rate and have an independent monetary policy all at the same time. If the central bank counters the appreciation of the rupee by buying dollars in the market, it releases a supply of rupee which increases liquidity in the system. To counter the excess liquidity, the bank has to deploy available tools at its disposal such as increasing reserve ratio or sell bonds. By reacting to the fluctuation in the exchange rate, the central bank looses control of the monetary polic

Co-founder of XKDR Forum Ajay Shah, a former consultant at Ministry of Finance and professor at National Institute for Public Finance and Policy, argues that RBI shouldn't pursue the defence of rupee. “In its efforts to counter the price fluctuations, the RBI loses its control over domestic monetary policy which hinders its ability to control inflation,” Shah says.

According to Shah, the rate of rupee should be entirely market determined and the policymakers need to accept its spillover effects. “We need to understand that it is incorrect to assume the government knows the correct price of rupee. The markets should be deciding the real rate.”

In his recently published book The Eight Per Cent Solution, Motilal Oswal Chief Economist Nikhil Gupta agreed with Shah over letting rupee completely free float. He suggested, “RBI must explore how to distance itself as much as possible from the currency market, allowing the Indian rupee to be market determined and reducing the need to accumulate forex reserves.”

The economist argued that doing this would allow RBI to focus more on government securities which will allow better control over domestic fundamentals. Shah says that RBI needs to be held accountable for inflation targets. “It can’t be case that RBI says it was not able to meet the inflation target because it was managing the currency level.”

Gupta noted in his book that the RBI’s intervention in the forex market has a cost. He cited the example of capital outflows which led to depreciation of rupee during 2013 taper tantrum and inflows during federal reserve’s Quantitative Easing (QE) drive in Covid-19 pandemic.

He wrote that the monetary tightening to prevent the outflow of capital, which included restrictions and interest rate hikes, hurt the domestic economy. The short-term treasury bills’ rates surged during this period. The 91-day treasury bill rate increased from 7.5 per cent to 12 per cent, increasing the cost of borrowing for the government. Gupta added in his book that even if the central bank did not intervene, the rupee would have depreciated in a similar manner but the effect on domestic economy could have been limited.

Similarly, the economist argued that the massive federal reserve QE exercise post the pandemic led to an appreciation in Rupee, which the central bank countered by expanding its balance sheet to accumulate dollars. This hindered the ability of the central bank to buy government securities, which according to Gupta, was the need of the time. He added, “As a stronger currency would have led to deterioration in India’s external balance and made foreign investors more wary of rupee depreciation, market forces would have led to the rupee weakening, which is exactly what happened in 2022.”

2022 was one of the worst years for Rupee since 2013. The currency fell 11 per cent from 74.29 to 82.61 within one year. India’s current account balance worsened from surplus of 0.9 per cent of GDP in FY21 to deficit of 2 per cent in FY23.

Shah says that price fluctuations are one of the most natural things in economics. “Instead of targeting the price, you should focus on market failures and resolve them. There has always been this instinct to protect the status quo and fear market behaviour. However, as India becomes more global and attracts capital, there is no need to be wary of investors.”

Over fears that rapid depreciation could spike India’s import bill and hurt domestic economy, Shah opines, “Imports becoming costly would promote domestic capacity building. Moreover, exporters would also gain in the process. Besides that, any rationale currency speculator will know that rapid depreciation will reverse over time which could prompt them to buy government securities to make massive gains.”

While some economists argue in favour of the markets, others point to the nature of Indian economy to say that the approach of central bank is correct.

The Right Approach

In the first half of financial year 2024, rupee was one of the best performing Asian currencies. Between April and September, the currency depreciated by 1.04 per cent against the US dollar. In the same period, Japanese yen declined by over 10 per cent while Thai Baht and Chinese renminbi fell by 6.49 and 5.81 per cent respectively.

One of the reasons for rupee’s better performance against the bullish dollar is RBI’s interventions. As per a recent Reuters report, the central bank has been intervening in the non-deliverable forward (NDF) market to reduce volatility in the Rupee.

Sakshi Gupta, Principal Economist at HDFC Bank, says that the RBI’s approach to manage currency volatility is the right one for an emerging market. “India runs a current account deficit and high volatility in the currency won’t be ideal. RBI’s intervention time and again instills confidence in investors.” India’s CAD stood at 2 per cent of GDP in FY23, rising from 1.2 per cent in FY22.

Commenting on whether the interventions affect RBI’s focus on other fundamentals, she opines, “I think supporting the currency in an environment where global markets are facing headwinds is the right approach. Through its interventions, the central bank is actually helping the macroeconomic conditions.”

Sujan Hajra, a former RBI official and currently the chief economist of Anand Rathi Shares and Stockbrokers, argues that managed float is the right approach for India. He said that there was a lot of chatter during the 1990s for exchange rates to be entirely market oriented. “However, the Asian crisis occurred in this period. Unrestricted foreign currency flows had a significant influence in the process.”

The 1997-98 Asian financial crisis refers to the time when Thailand unpegged its currency from US Dollar which led to devaluations and capital flight in many Asian countries. Value of South Korean currency fell by nearly 50 per cent, Indonesian rupiah declined by 80 per cent and Malaysian ringgit fell by 45 per cent. The crisis had led to high unemployment and billions of dollars of losses for several Asian countries. Interestingly, this crisis had led to the formation of Group of 20 (G20).

Hajra adds that the role of the market in determining Rupee’s price has increased over time. “For the Reserve Bank of India, increasing the level of currency convertibility or making the rupee's external value more market-oriented are processes rather than events,” he says.

Over argument that depreciation of rupee can help incentivise domestic capacity building and lead to good gains for exporters, Sahana Roy Chowdhury, Associate Professor of Economics at International Management Institute, says, “I think it’s a myopic view. Due to a lot of our exports being import intensive, I don’t think rapid depreciation would be ideal. Given the fact that components used for manufacturing products for exports are imported in the country, the cost for the country would actually increase.”

Former RBI governor Raghuram Rajan had pointed in one of his papers that combined data on imports of parts used to manufacture phones and the exports of finished products, show that the combined net exports fell from -$12.9 billion in FY17 to -$21.9 billion in FY23. This data indicates that the country is heavily dependent on imports for products which are exported.

Chowdhury says if exporters can reduce import dependence, then the exports can fully gain from such a scenario. However, at the moment, she says that it is far from reality.

Sarbartho Mukherjee, Senior Associate Economist at CareEdge Ratings, says, "Depreciation of the Rupee can swell energy import bills and reduce dollar returns for foreign investors. Petroleum, Oil, and Lubricants (POL) imports are largely inelastic in nature and constitute ~25% of total imports in value terms."

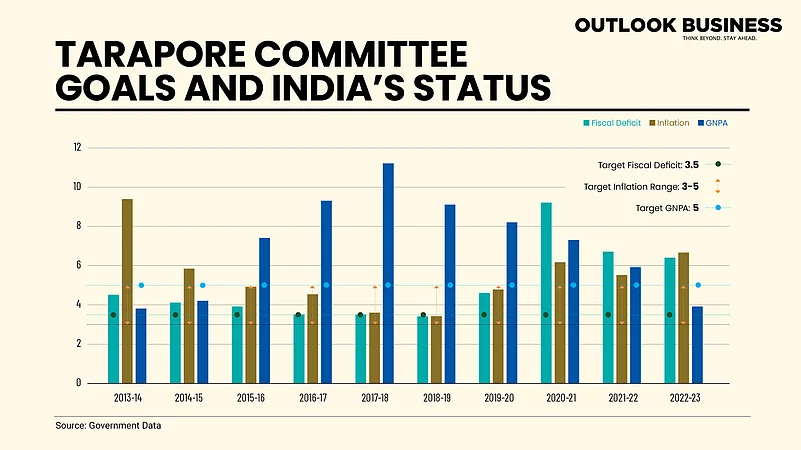

The deliberations over fully convertible capital account, which would make rupee purely market determined, have been going on since the 1990s. Two Tarapore committee reports in 1997 and 2006 give an insight into what India needs to do before taking the big step. According to the reports, India needs to have inflation rate in range of 3 to 5 per cent for three years, gross fiscal deficit of less than 3.5 per cent, effective cash reserve ratio of 3 per cent and gross NPAs less than 5 per cent.

Given the fact that India is yet to fulfill some of the above-mentioned criteria and the past instances of currency flows leading to crises, analysts say that RBI’s cautious approach is right. However, with the recent developments in global financial markets, there are some concerns over how RBI would continue to defend the rupee.

A Viable Strategy

With the RBI defending the rupee to ensure it does not depreciate, succeeding in making it one of the best performing currencies in Asia, there are concerns over how long the central bank can sustain the depreciation.

The Federal Reserve stance of ‘higher for longer’ and the rising US bond yields have made the country the safe bet of investors for now. Dollar’s bull run at the moment has put pressure on Rupees which is trading below the 83 level for some time now. Amidst the bull run of dollar in the global currency markets, the price of crude oil has also surged over $90 per barrel in the last few weeks due to cuts announced by OPEC countries.

With the central bank focused on ensuring the inflation inches back to its desired 4 per cent target, how long it can continue to defend the rupee against the dollar remains to be seen.

Kunal Sodhani, Vice President of Shinhan Bank, says, “While a lot of ammunition to intervene in the forex markets is still there, RBI will intervene till a point. RBI will keep in mind the factors like crude prices going above projection of $80-85 and dollar maintaining its strength.”

Gupta argued in his book that most of the successful Asian emerging markets had opted for managed float regime during their rise. However, he wrote that due to the effect of Federal Reserve’s QE-like measures changing the dynamic of global markets, there needs to be a rethink of the approach. Both Shah and Gupta argued that by managing INR against USD, the central bank is “importing” US monetary policy which isn’t fair for the domestic economy.

More movements in the Indian currency are expected as analysts predict the strength in US dollar to continue in the coming months. The lingering debate over whether the central bank should let rupee float completely is expected to continue for some time to come. With the chatter of de-dollarisation and internationalisation of rupee picking up pace in the last few months, it remains to be seen where the Indian currency goes from here.