The consumption of luxury goods in India has seen a significant rise in the last few years, according to a recently released report by global investment bank Goldman Sachs. The report supports this observation with figures of growth of premium brands versus mass brands in the past few years. For example, the volume of Royal Enfield sales has grown in the positive territory while mass brands have seen a shrinkage of close to 20 per cent compared to pre-Covid levels. Similarly, SUV sales have been higher than overall car sales.

Analysts call it the premiumisation of the Indian economy. The Goldman Sachs report states that between FY19 and FY23, the sales of Bata, an affordable footwear brand, grew close to 20 per cent while Metro, which focusses on the premium segment, saw its sales jump by over 70 per cent in the same period. Brands such as Titan in jewellery, Apollo Hospitals in healthcare, MakeMyTrip in travel and Phoenix Mills in retail, which cater to the top-end of consumer pyramid, recorded strong compound annual growth rate—between 12 per cent and 18 per cent—in revenue between financial years 2019 and 2023.

However, while the growth of such consumption might indicate a growing class of thriving Indians, a closer look at the scenario indicates a gloomier picture which gives more reason to worry rather than celebrate.

The report notes that that approximately only 4 per cent of the working age population in India has a per capita income of more than $10,000, or Rs 8.3 lakh at the current exchange rate. However, nearly 50 per cent of the total working age population earns less than $1,500 per annum and another 20 per cent earns between $2,500 and $1,500. The premiumisation of the economy appears ironical when juxtaposed with the low wages of the majority.

Weak Growth at the Bottom

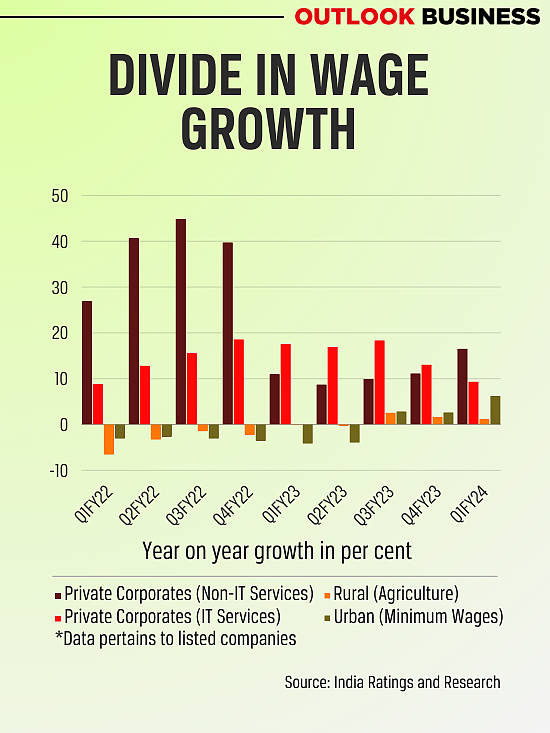

As the country began to recover from the Covid-19 shock, wages in the formal sectors like IT and non-IT services bounced back significantly while those in the agricultural and non-agricultural sectors in rural areas remained under considerable stress. Income data compiled by India Ratings and Research shows that in FY22, rural agricultural wages declined by 3.42 per cent and non-agricultural wages by 2.55 per cent. On the other hand, the wages of private corporates in the IT sector rose by 14 per cent while those in non-IT services grew by 38 per cent.

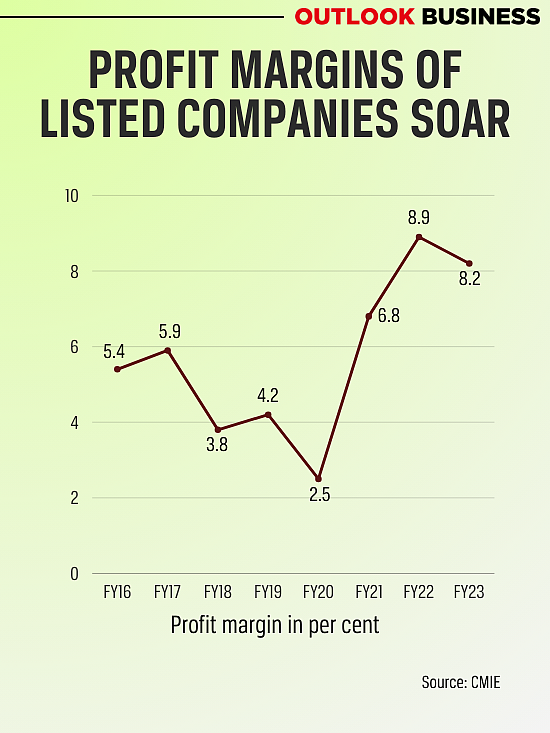

The net profit margins of listed companies in India went from 2.5 per cent in FY20 to 8.2 per cent in FY23, according to the data from the Centre for Monitoring Indian Economy (CMIE). On the other hand, the agricultural sector, which accounts for a larger part of India’s workforce, has not seen a strong growth.

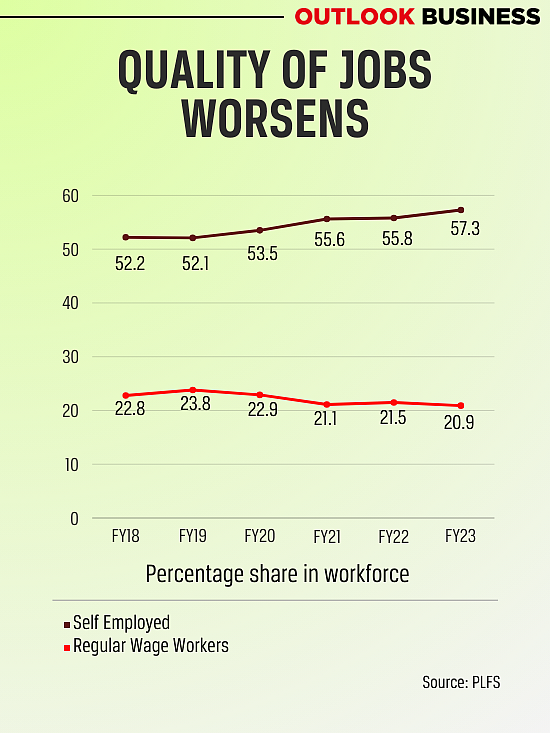

The employment data continues to throw up a worrying trend. The latest Periodic Labour Force Survey (PLFS) Annual Report shows that self-employment’s share in total workforce has gone up consistently in the last five years from 52.1 per cent in 2018–19 to 57.3 per cent in 2022–23.

The divergence in wages is visible in the trend of consumption, where mass brands are not performing as well as companies catering to the luxury space. Mass brands depend on higher sales numbers while premium brands thrive on earn huge profits on per unit sales.

Ritesh Kumar Singh, founder and chief economist at Indonomics Consulting, says that the key to understanding the premiumisation trend is to look at who is exposed to corporations which have benefitted in the last few years from measures such as corporate tax cuts. “This section includes promoters, investors including equity market investors and the salaried class. But the larger mass of Indians is left out,” he says.

Amit Basole, professor of economics at Azim Premji University, suggests that the combination of Covid-19 and the slowdown in economy which was visible just before the pandemic contributed to the rising divergence visible in the economy and rise of self-employment. He adds, “Earnings growth has been very weak in several areas. The upper part of labour workforce performed reasonably better because few jobs were lost due to the Covid-19 shock, but the blue-collar jobs suffered a big hit. The recovery in the latter is still not clear. Putting it all together, a picture of K-shaped recovery comes out.”

But to understand the premiumisation story of Indian economy, there is another trend which has been noted by several observers: the massive credit boom.

Premiumisation To Whose Credit?

While a part of the increased demand has come from the improved health of the corporate sector and the subsequent wage growth, the pickup in demand for premium goods can also be attributed to easy access to credit.

Data compiled by Goldman Sachs shows that the number of credit cards in the country rose from 47 million in FY19 to 95 million at present. The share of unsecured loans in the total retail loans of the country’s banks also increased from 20.6 per cent in FY19 to 25.2 per cent in FY23. Unsecured loans are those which do not have any collateral against the total borrowed money.

Within this segment, the dominance of small ticket loans of less than Rs 50,000 became a worry for the Reserve Bank of India. TransUnion Cibil data showed that in Q2 2023, 51 per cent of the consumers who availed a small ticket loan already had more than four active loans. CRIF Highmark data shows the phenomenal rise in such credit products. Loans of less than Rs 10,000 individually and totalling Rs 20,000 crore were disbursed in FY23, up from Rs 10,000 crore in FY20. For a loan amount of Rs 10,000 to Rs 50,000, disbursals rose from Rs 14,000 crore in FY20 to Rs 48,000 crore in FY23.

But such products also started to see more stress. The delinquencies rose from 4.71 per cent in June 2022 to 5.4 per cent in June 2023, CIBIL data showed. Spooked by the trend, the RBI moved in quickly to curb such lending and increased the risk weights on unsecured credit in November last year.

Paras Jasrai, senior analyst at India Ratings and Research, says that the credit boom has a direct link with the premiumisation trend. “Households have been using credit to fuel their demand for premium goods. In fact, they have been also dipping into their savings to finance their consumption,” he adds.

The health of Indian households’ balance sheet has emerged as a matter of concern. Where, on one hand, the debt taken by Indians is hitting record highs, the net financial savings of households fell to a five-decade low of 5.1 per cent of GDP in FY23.

Unsustainable Growth Path

While Goldman Sachs predicts a rise in number of affluent Indians, there are no visible signs of a recovery of mass markets in India. The latest quarterly earnings of FMCG major Hindustan Unilever (HUL) suggest that volume growth is still elusive. Its income from operations fell by 0.3 per cent in the final quarter, despite it being the festive season.

CMIE data shows that the net sales of the non-financial entities declined in the first two quarters of the financial year 2024 by 2.26 per cent and 1.33 per cent respectively. In the broader corporate landscape, which also looks at the unlisted segment, the divergence in the growth becomes clearer.

Analysis by Motilal Oswal Financial Services found that the share of profit after tax of unlisted companies declined from 6.5 per cent of GDP in FY20 to 4.3 per cent in FY23. While the post-Covid phase has seen the profit after tax of listed companies grow at 23.8 per cent CAGR, the pace of growth in unlisted space is much slower at 2.3 per cent.

Dhananjay Sinha, Co-Head of Equity & Research at Systematix Group, says that the current growth path should certainly worry policymakers. “What you have is a situation where income growth has fallen dramatically and the dependence on subsistence sector has risen over the last few years. While the disparity between the good growth in organised urban sector and subdued environment in other segment can coexist, what we also need to keep in mind is that there are signs of slowdown in the organised sector as well.” He adds that topline growth of India Inc. has started to decline, with non-finance listed companies seeing a year-on-year decline of 1.5 per cent in their total revenue for the first half of this financial year.

If a consistent slowdown in the revenue of lndia Inc. continues, experts worry that the compensation growth visible at the top end might also slow down, which will hurt India’s already fragile consumption story. The government’s latest estimates suggest that India’s private final consumption expenditure (PFCE) is expected to grow at 4.4 per cent, the slowest in last two decades barring the pandemic year.

While the Indian economy has posted strong growth in the last few quarters premiumisation of the Indian economy has propped up the rise of affluent Indians, what it also highlights are the lopsided recovery in demand post the covid-19 pandemic and the dangerous rise of unsecured credit.

Rising leverage of households and lack of broad-based recovery in incomes has raised questions on the nature of India’s growth story in the past few years. Without a pickup in sectors responsible for incomes of most of the Indians, many wonder whether it is a sustainable recovery in the long run.