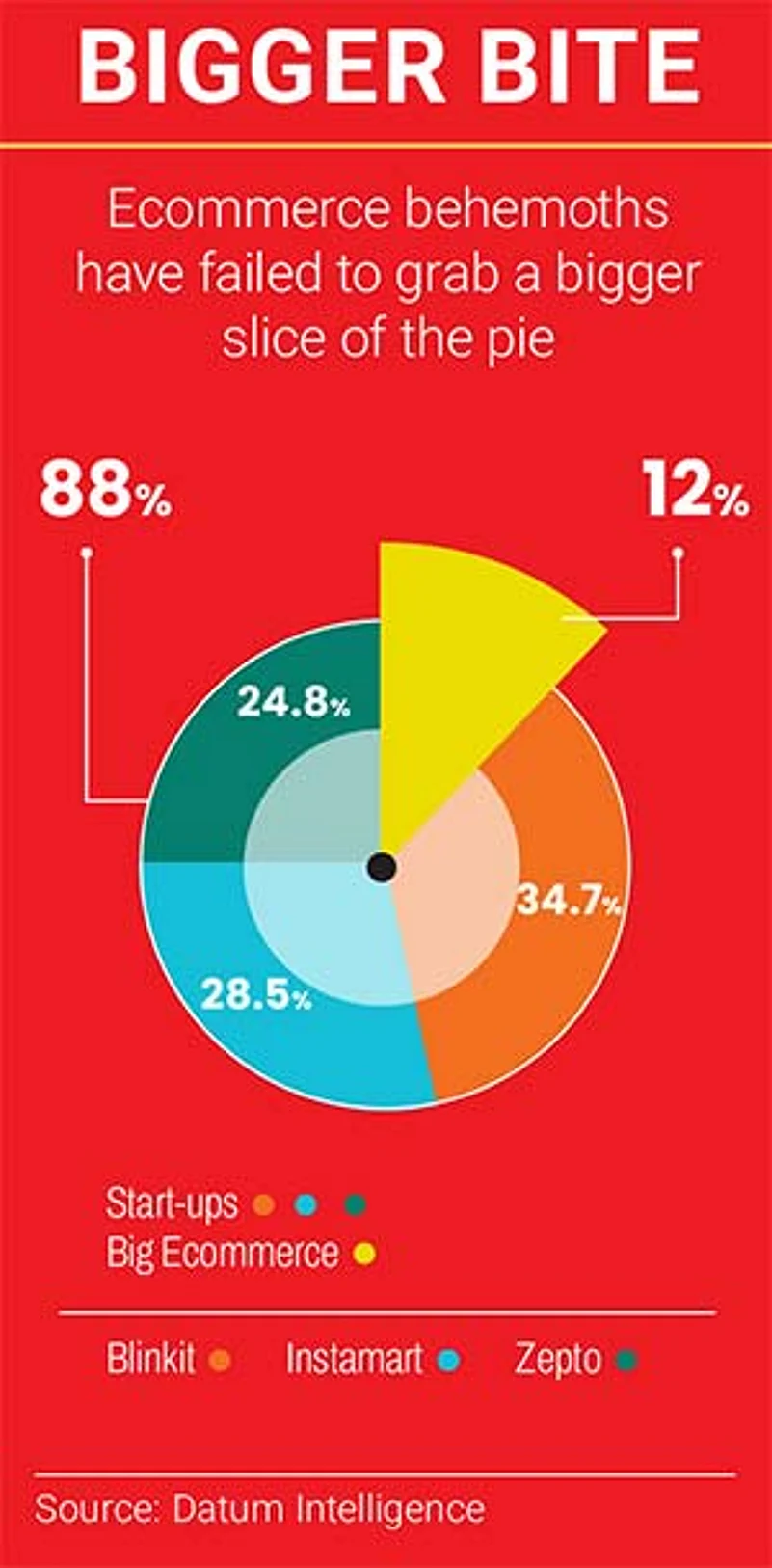

The quick-commerce pie is getting bigger, but ecommerce giants are failing to grab a slice. Retail behemoths such as Amazon, Walmart, Reliance and Tata are used to eating up big shares of the market. But in quick commerce, these companies have managed to take control of just about 12%.

The remaining 88% of the market rests with new age start-ups. Zomato-owned Blinkit holds 34.7% of the market share, Swiggy’s Instamart 28.5% and Zepto 24.8%, according to Datum Intelligence, a market intelligence company.

And it is not as if the big players are not keen on the contest. While it is true that many of them had initially called quick commerce unsustainable and the business model doomed to failure, the success of start-ups in the space has made bigger companies want to make a mark. But such attempts have had little success.

Take, for example, Flipkart, the Walmart-backed e-commerce giant. Flipkart is gearing up to launch a system to deliver orders in 10–15 minutes in around 10 cities. This is going to be the company’s third attempt at quick commerce. Its earlier efforts, Flipkart SuperMart and Flipkart Quick, were shut down abruptly.

BigBasket is investing heavily in building its ultra-fast delivery arm BBNow. Launched in 2022, BBNow aims to deliver its orders within 18–20 minutes in over 20 cities.

Once one of India’s biggest e-grocers, BigBasket’s entry into the quick-commerce space came after it was acquired by Tata Digital in April 2021. In the two years since the launch of BBNow, the quick-commerce platform has managed to secure around 9% share of the market.

Reliance-owned JioMart also attempted to venture into quick commerce but shut it down within a year. Dunzo, also backed by Reliance, launched DunzoDaily—a quick-commerce platform, but even that failed to take off.

Path to Profitability

Quick commerce has not always been profitable. In the initial years, the start-ups were bleeding money. At the end of the third quarter of 2023–24, Blinkit clocked in a revenue of Rs 644 crore, up from Rs 505 crore the previous quarter, while its earnings before interest, taxes, depreciation and amortisation (EBITDA)-adjusted loss reduced from Rs 125 crore to Rs 89 crore. The company reported a revenue of Rs 1,533 crore till December and has set itself a target of becoming EBITDA-adjusted breakeven by the end of the first quarter of 2024–25.

Similarly, Zepto saw a huge reduction in its net loss margin from 277% to 63%. The start-up expects to turn profitable at an EBITDA-level in the next two-and-a-half quarters. Initial public offering (IPO)-bound Swiggy, which turned profitable in 2023–24, expects Instamart to turn profitable in upcoming quarters. Swiggy generated a revenue of Rs 3,221.40 crore selling fast-moving consumer goods (FMCG) via Instamart, an increase of 39.7% from Rs 2,035.6 crore in the previous fiscal year.

To turn profitable quickly, quick-commerce platforms are jumping into segments such as cosmetics and garments. Unveiling India’s Q-Commerce Revolution, a report by strategy consulting group Redseer, says: “Quick commerce has been able to sustain the momentum triggered by Covid-19 between 2019 and 2022 by registering a 77% growth in gross merchandise value (GMV) last year. This is despite 2023 being a slow consumption year.” The report goes on to say that quick-commerce platforms are not staying confined to fruits, vegetables, meat, staples and FMCG, but have ventured into the broader retail pie of beauty, electronics, home decor, wellness and other merchandise.

Turnaround Time

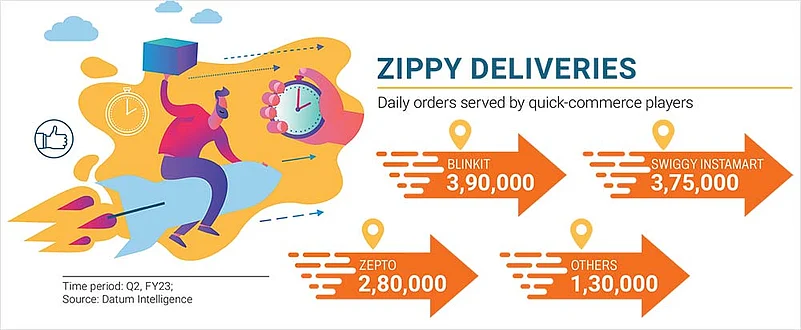

Blinkit says it takes around eight to 10 minutes to deliver an order. Zepto claims an average delivery time of 11.08 minutes with time taken to deliver an order ranging between 10 minutes and 25 minutes. Instamart delivers orders in 15–30 minutes, according to multiple data platforms. The 10-minute model of quick commerce stands on the shoulders of ‘dark stores’, storage units in urban areas that store and package products for quick delivery.

Quick-commerce businesses rely on their dark stores to manage an efficient supply chain by integrating technologies such as real-time demand sensing and dynamic pricing. The inventory in these dark stores shows up on the apps. The moment an order is placed, the nearest dark store gets a notification. Within two minutes, executives at the dark store pack the goods.

Simultaneously, a delivery partner, within a radius of 1–2 kilometres, gets an alert and reaches the store within a minute. The delivery partner then delivers the goods in another 4–5 minutes to locations typically within a 2-kilometre radius. The goal is to deliver the items to the customers before they pick up their phone again to track the order.

While quick-commerce start-ups count on dark stores, bigger players like Amazon and Flipkart depend on their big warehouses and fulfilment centres located in industrial zones to store inventory.

Quick-commerce businesses store nearly 6,000 stock-keeping units (SKUs) in their dark stores and 1,000–1,500 SKUs in local shops, a JM Financial report says. Warehouses of big companies, on the other hand, store lakhs of SKUs.

Thus, when an order is placed on Amazon, the availability of the item is checked at the nearest warehouse or fulfilment centre. Time is spent on scanning the barcode, labelling the product and packaging it for delivery. After that, a delivery executive picks up all orders for a particular locality and then delivers them. All of this takes at least a day and can even take up to a week.

Price to Pay

Quick deliveries, however, come at a steep cost. Zepto spends Rs 95–105 per order, according to a report in Moneycontrol.com, a business portal. Swiggy’s Instamart spends between Rs 140 and Rs 145 per order, while for Blinkit, the cost is around Rs 130–135, the same report says.

The costs had made players like Flipkart and BigBasket earlier say that 10-minute deliveries were loss-making and unsustainable. But now, even these companies are venturing into the dark-store model. Amazon Fresh, formed from the integration of Amazon's Pantry and Fresh in 2021, was able to process same-day deliveries. But even that platform takes at least two hours to deliver an order.

“The current demands are met with 25 Amazon Fresh fulfilment centres across 60 cities in 10 states,” says Srikant Sree Ram, director of Amazon Fresh India.

One Step at a Time

While brands like Amazon, BigBasket and JioMart are making forays into the quick-commerce space, they seem cautious in their approach. One of the major problems for big e-commerce platforms venturing into quick commerce is the risk of lower average order values (AOVs). Storing specific inventories in units like dark stores can lead to lower AOVs, while holding a broad inventory can lead to unsold stocks. For example, the AOV on Amazon in the second quarter of 2023–24 was Rs 1,000 while the same for Blinkit was Rs 635, according to Vumonics Datalabs, a consumer data analytics company.

The quick-delivery model often caters to smaller, more frequent purchases which may not align with the higher AOV model of bigger brands. Additionally, bigger brands do not want to go head-to-head with quick-commerce start-ups because they prioritise a comprehensive range of products and services.

A strategic and sharp focus on their primary business enables them to maintain a broad market presence, says Roshan S. Bisht, co-founder and chief executive officer of Asort, an ecommerce-enabling platform. “The big players like to co-exist in ecommerce and experiment with quick commerce, but do not specifically want to compete with players whose one and only focus is delivering within 10–15 minutes,” he says.

According to him, players like Zepto, Blinkit and Instamart are restricted to Tier I and II cities, but brands like JioMart and BigBasket have wider reach and are available even in remote locations. Start-ups like Zepto cannot open dark stores in Tier II and III cities because of low demand, but bigger brands can open warehouses at such locations and deliver orders as per their convenience, says Bisht.

According to Jeetu Bairathi, partner at business and management consulting firm BDO India, quick-commerce companies and ecommerce companies work on different goals. “While the focus at quick commerce is to generate a higher AOV at the hyperlocal level, especially in Tier I cities, the focus at an ecommerce platform is to grow by onboarding new internet users and shoppers in Tier II and III cities,” he says.

Moreover, bigger brands are hesitant to fully embrace the quick-commerce segment because they are aware of the advantage start-ups have when it comes to making quick decisions and pivot rapidly, according to Meher Patel, founder of Hector, an ad optimisation platform for ecommerce businesses. “The nimbleness required to execute decisions quickly are crucial factors that distinguish start-ups like Blinkit and Zepto from larger players such as Jio Mart and Amazon Fresh,” he says.

Future Perfect?

Since its advent, quick commerce has been seen as a challenging business model due to inherent issues of cash burn and dark-store management. Many start-ups in the business faced staggering losses at the end of the 2022–23. But industry experts predict that the Indian quick commerce market is on the brink of a revolution. They say the market will display a compound annual growth rate (CAGR) of 27.42% between 2023–24 and 2027–28, resulting in an estimated market size of $9 billion by 2027–28.

A Bank of America report states that the top quick-commerce players in India have the potential to reach an estimated 25 million households, who are likely to go on to spend an average of Rs 4,000–5,000 per month. The estimate bodes well for quick-commerce players. To stay ahead in the race, start-ups are innovating quickly and finding ways to turn profitable. For example, Zepto recently launched Zepto Pass, a paid membership programme. The Zepto Pass offers free deliveries and discounts to members. The company also introduced a platform fee of Rs 2 for select users. Some that do not charge a platform fee charge a nominal amount for deliveries, handling or convenience.

The real question for quick-commerce players is whether consumers are willing to pay for the convenience, says Vaibhav Arora, vice president of ecommerce at WOW Skin Science, a cosmetics brand. “Despite being a cost-sensitive market, India has adopted quick commerce. Consumers are ready to pay for it.”

A recent report from consultants PwC, titled How India Shops Online, states that India’s Gen Z prefers to make smaller-value purchases, prioritising quick delivery and is not particularly concerned about additional delivery charges. Nearly 50% of consumers in metros and Tier I cities value quick deliveries and the convenience they bring.

For now, quick-commerce start-ups need to keep up the momentum by expanding into higher-margin categories, increasing their AOV and enhancing unit economics through growth in dark stores in major cities. Ecommerce giants, on the other hand, will have to find ways to compete with start-ups in the quick-commerce space or risk losing out on business, especially in urban centres.