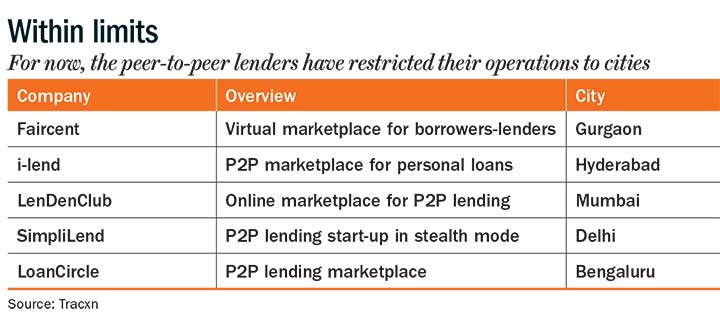

What’s common to Faircent, i-lend, LenDenClub, SimpliLend and LoanCircle? All of them operate as peer-to-peer (P2P) lenders, a global phenomenon that is slowly gaining traction in India. P2P platforms digitally connect borrowers with lenders — the former can be individuals or legal persons, while the latter are individuals — while charging both a commission on the loan amount.

Globally, lending through P2P platforms has increased meteorically from $3 million in 2012 to over $6 billion in 2015. According to start-up research agency Tracxn, there are 38 start-ups operating in this space in India, with total funding of $8.2 million being made available. Around 20 of these platforms — which have lent a collective Rs.18 crore-20 crore so far, industry sources say — opened shop in 2015 alone. Faircent, which has raised $6.75 million from JM Financial and others, claims to have 30,000 borrowers and 6,000 lenders on its platform.

Reportedly, Rs.5 crore worth of loans have been disbursed via the company, with Rs.1.2 crore being disbursed each month presently. i-lend, which has raised $117,000 from Angaros Group, claims to have 3,500 lenders and 4,500 borrowers, with Rs.1.25 crore worth of loans disbursed.P2P platforms register borrowers and lenders after conducting an authentication process using Aadhaar cards, utilities bill payments, bank statements and other KYC norms specified by RBI. Based on these details, a risk profile of each borrower is constructed and an appropriate interest rate — varying between 12-30% — recommended. However, this rate is only used as a reference range and lenders are free to charge independent interest rates acceptable to the borrowers.

i-lend, however, caps the interest rate at 24% to weed out professional moneylenders. Faircent charges borrowers between 2% and 5% based on their risk profiles and lenders 1% of the loan amount. i-lend charges borrowers flat 3% and lenders 1%. Newer entrants like Lendbox are choosing not to charge a fee from lenders as an incentive. Faircent also follows a reverse auctioning process, where lenders bid for loans to borrowers. “We follow open reverse auctioning [where borrowers list their requirements and all are welcome to supply the loan], so lenders can see the loans the borrowers have rejected. So, if a borrower has rejected a loan at 19% interest rate, lenders will know to offer a loan at 18%,” says Rajat Gandhi, CEO, Faircent.

However, lenders and borrowers have to meet certain criteria to qualify, which vary depending on the platform. “The lender criteria on Faircent is: annual income of Rs.10 lakh, trading in stocks and shares, possessing immovable property and being an Indian above 25 years of age,” says Gandhi, VVSSB Shankar, founder, i-lend, says most lenders on the platform are mid-level and senior executives earning between Rs.18 lakh-45 lakh. Meanwhile, borrowers are required to have an annual income of Rs.6 lakh for Faircent, and Rs.3 lakh for i-lend. Borrowers usually avail credit for purposes such as medical expenses, family functions and credit card debt reconsolidation. Since outstanding credit card debt incurs an interest rate of over 36%, borrowers choose to borrow from P2P platforms at lower interest rates (18-20%) and pay off credit card loans. But why not go to a bank or NBFC instead?

Explains Shankar, “Anybody who doesn’t work for a blue-chip company finds it difficult to get personal loans from banks. The latter give out unsecured personal loans at 17-19% to category 1 customers, but the loan amount is usually not below Rs.3 lakh. NBFCs charge 22-28% but don’t give personal loans below Rs.10 lakh.” It is this category of professionals — with a steady income stream and looking for relatively low-ticket loans — that P2P platforms target. With an average ticket size of Rs.1.5 lakh, 30% of borrowers on Faircent are MSMEs, while i-lend focuses on consumer retail unsecured loans.

However, P2P platforms provide no assurance of return and the risks are entirely borne by lenders. So, why do they choose to participate? Firstly, it is an attractive investment class, generating an average yield of 18-19%, which is much higher compared with savings accounts (4%) and rental yields (2-3%). Also, both Gandhi and Shankar say that no other investment product starts generating cash flows in the next month itself. Faircent has seen a default rate of just 1.5% so far. Shankar says that only about 10% of the applicants made to i-lend are approved for registration, which has helped keep default rates at 0.16%.

Playing it safe

With P2P lending platforms becoming popular, RBI has come out with a discussion paper for their regulation. Globally, P2P lending platforms are either exempt from regulation (China, South Korea), regulated as intermediaries (the UK, Australia), regulated as banks (France, Germany), or prohibited from functioning (Israel, Japan).

The RBI seems to favour regulating P2P platforms as intermediaries while registering them as NBFCs. It has stated that P2P platforms in India will be required to regularly report their financial position, loans arranged and complaints. However, both Gandhi and Shankar, while agreeing broadly with RBI’s policy, express reservations about some aspects. RBI says ‘leverage ratio may be prescribed so that the platforms do not expand with indiscriminate leverage’. However, Shankar says, “We are not going to carry loans on our balance sheet. Hence, the concept of leverage does not come in the picture. We’ve already communicated our issues to the RBI.”

Another issue concerns RBI’s prescription that ‘funds will have to necessarily move directly from the lender’s bank account to the borrower’s bank account’. “While we agree platforms should not handle the money, all information concerning transactions should be available to us. It is our fiduciary responsibility that the loans are being monitored regularly,” says Shankar.

These quibbles aside, RBI coming out with a regulatory framework will lend credibility to these platforms and might lead to an increase in funding. Already, Faircent has announced an undisclosed amount of series A funding from JM Financial after RBI released its discussion paper. The future seems bright for such platforms, considering the paucity of institutional sources for personal loans and the exorbitant rates charged by informal sources.