Franklin India Prima Plus is one such multi-cap scheme that has been delivering sound performance since its inception nearly two decades ago. While it underperformed for nearly a year, it has started regaining momentum, outstripping its benchmark as well as peers in the last one month.

This fund follows a growth-oriented, bottom-up approach stock picking where individual stock picks and, not top-down views, determine sectoral allocations. The scheme’s aim is to invest in ‘wealth-creating’ companies with competitive advantage that can result in superior returns on capital. “Our research focuses not only on the track record of companies, but also on their future strategies and their ability to continue to generate wealth on a sustained basis in a competitive business environment,” says Anand Radhakrishnan, chief investment officer – Franklin Equity, Franklin Templeton Investments–India. “This strategy has helped the fund deliver superior risk–adjusted returns over the last two decades through various market cycles.”

The fund managers look to keep the focus on fundamentals and valuations across all market conditions. “We emphasise on bottom up stock selection. The value-add that we provide stems from the superior stock selection…All our active decisions are made at individual stock level, with sector weightings a residual of this process,” adds Radhakrishnan. While the fund does take macro parameters into account, they do not play an active role in selecting stocks for the portfolio, with the fund managers relying on quantitative and qualitative factors for stock selection. While quantitative factors include capitalisation and stock liquidity indictors (shareholding pattern and free float, average daily turnover), qualitative factors encompass quality of governance, medium-term industry growth prospects, sustainability of the business model and potential for corporate action.

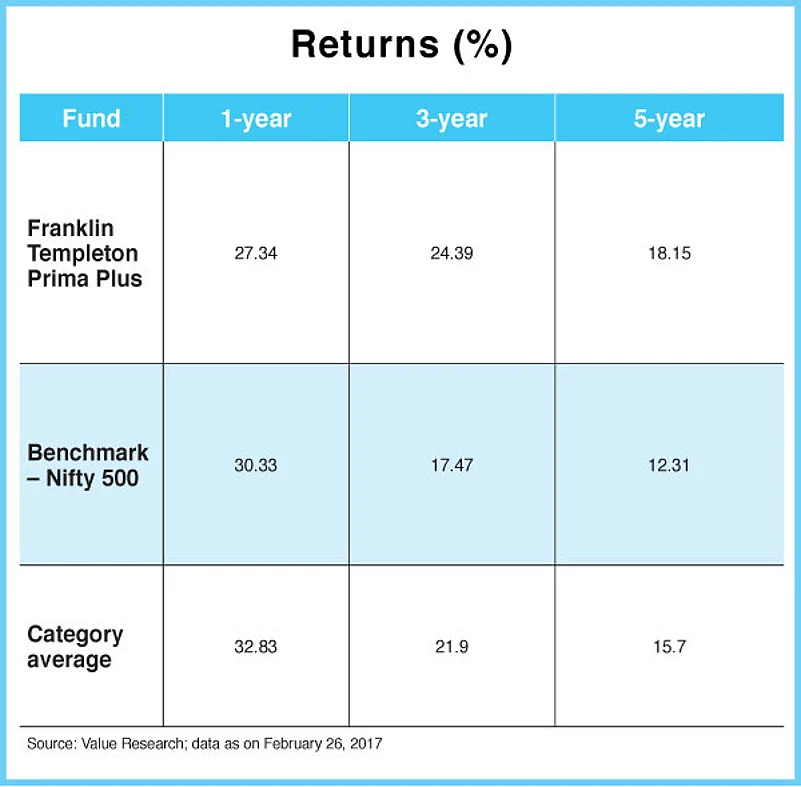

The fund has a track record of delivering attractive returns over the long-term – that is, three- and five-year periods – comfortably beating its benchmark Nifty 500 as well as the category average, though it lagged behind the top performers during the period. The multi-cap scheme’s performance, however, has slipped during the last one year, as both the benchmark and the category average raced ahead of it. The fund managers seem to have got their act together in the last month, when it has surpassed Nifty 500 and its peers. Given its stable performance over the long-term as also the recent resurgence, it remains a strong contender for the diversified mutual fund slot in your portfolio.