It’s been seven years since the 2008 financial crisis, which changed several things forever in its wake. Delhi-based Surinder Khanna was 62 then, and already working in his retirement because he felt he will be able to better utilise his time and experience. It was a blessing in disguise for this senior citizen because he was able to maintain fresh cash-flows, which definitely helped in times of financial uncertainty. “I had been planning for long and had a roadmap to manage my finances in retirement. It all fell in place because of the discipline that I imbibed with money very early in my life,” he says.

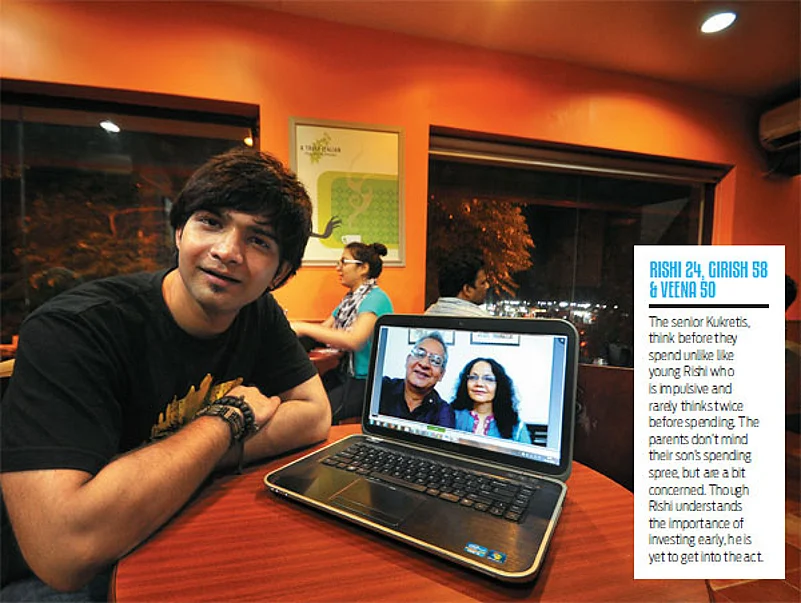

Khanna is from a generation which toiled for everything— education, jobs and owning a house. In contrast, 24-year-old Rishi Kukreti is living alone in Chennai and works with a technology major, while his parents live in New Delhi. “I spend on everything that I want or feel I should. I guess it comes from the fact that I don’t have any liabilities as of now,” he says, nonchalantly. His fast-paced life revolves around the latest in technology, films and outdoor activities. A true, live-for-today youngster; though he does have plans to start saving for a secure financial future.

FIRST STEPS

Achieving lifelong financial success can sometimes seem like an overwhelming task. However, when developed step by step, you can gain long-term control of your finances. “Time and inflation are the core factors that tend to eat into our current savings and pose a serious threat to our long-term goals in life,” says Sarojini Dikhale, CEO, LIC Nomura Mutual Fund. Add to this the fact that life expectancy of Indians is going up; it has necessitated the need to start early to achieve financial freedom. Most importantly, financial freedom means that you are not dependent on your job for your regular expenses, but don’t confuse it with retirement.

Explains Dr Vikas Gupta, EVPTraded Markets and Investment Research, Arthveda Fund, “The condition for financial freedom is that you should be able to maintain and grow your capital in line with inflation even after paying out the income required for your regular expenses.” Naturally, financial freedom is all about taking control of your finances. Take the case of 39-year-old Mumbai-based Amol Pitale who lives with his parents in their house and has surplus to invest in other avenues. “Unlike my parents who focused on owning a house, for which they sacrificed a lot of other comforts, I did not have the compulsion and have my money spread into other financial instruments,” he says.

Before you embark on any new adventure, it is important to determine the starting point. A thorough evaluation of your current financial picture is a major step going forward. Take a look at your personal financial situation and assess how it looks like (Read: Road to financial freedom). The first step to financial freedom is to have a strong foundation, which is built on financial protection.

“Life insurance as a tool has the ability to protect against exigencies and build financial stability over time. It gives your family the ‘much needed financial support’ in an event of unfortunate death or disability. Life insurance has more to do with peace of mind than anything else,” says K.S. Gopalakrishnan, MD and CEO, AEGON Religare Life Insurance.

Although life insurance is also available as a savings and investment tool, understand the pay-off before going in for one. What is essential is that you have adequate life and health cover in its undiluted form by way of a term plan and basic health cover. “A term plan is essentially a replacement of the loss of income due to the death of the breadwinner. A cover of at least 10 times the annual income is needed just to protect the current expenditure, excluding inflation,” says Sandeep Batra, executive director, ICICI Prudential Life Insurance Keep some money stashed for emergencies and your financial base is ready. All you need is to maintain it throughout your life.

MAKING THE INVESTMENT CHOICE

With your emergency savings taken care of, you should begin to diversify your savings through other types of investments. A plethora of investment options are available to you. You can invest directly in stocks and bonds. You can also keep your money in cash or invest in mutual funds. “When you start investing, you should clearly know the product mix you are investing in. So clearly, when one is young, they can take higher risk and they should be investing a larger portion into the equity market,” advises Abhishake Mathur, Senior Vice-President, Financial Planning and Customer Service, ICICI Securities.

There are a wide variety of investment vehicles available to the individual investor. You could invest in many different assets. However, investing is often about owning publicly traded securities like stocks, bonds, money market instruments, or mutual funds that hold such investments. “Mutual funds are a good option for investors to invest in—both debt and equity markets. It is fit for investors who lack expertise to track the markets or trade individually,” says Dhikale. For all those who see merit in borrowing because repaying is in manageable installments, it is a small and regular commitment through systematic investment plans (SIPs), which will go a long way in building wealth and achieving financial freedom.

So, at a young age, a higher exposure to equities is what you need. “Saving and returns are more on my mind, though I believe in bigger gains, which will accrue by taking higher risks,” spells out Kukreti. In contrast, his 50-year-old mother understands the risks associated with investing and is invested in instruments that have a low-risk profile like fixed return investments. “At my age, I just cannot take wild swings on my investments,” says Veena Kukreti.

Going purely by proven data and facts, there is merit in putting away money into equities for the long run when one is young, more specifically towards retirement. “If a youngster earning Rs.25, 000 a month invests Rs.5, 000 a month, it is 20 per cent of his take-home salary. At this stage, equity as a product mix is very suitable as it gains from the power of compounding and longterm averaging,” iterates Mathur.

TO EACH HIS OWN

While there is no one rule that is applicable to all, what you as a reader need to understand is that financial nirvana can be achieved as long as you clearly know the end point. “I burnt my fingers when I tried investing in the markets. I now put my money in real estate because I see value in it, just the way I see the value in the investment made by my parents,” says Amol Pitale. The younger Pitales have actually gone a step ahead and clearly earmarked their financial goals—daughter’s education and their own retirement, and are working towards it.

There is a lesson to draw from Veena Kukreti too, who says, “The mere fact that I am financially independent doesn’t let me get carried away to do what I desire. I make sure to invest at least 40 per cent of my income in low-risk products, which give me a stable return.”

What is important is to note that each of these people realise their preferences to handling money and are working towards achieve financial freedom in their own ways.

Basically, financial freedom should allow you to pursue your passion and interests, without being tethered to working to earn a living. For instance, older people who are financially-free need not depend on their children. “In my view, it is not a huge bank balance, but having peace of mind, a healthy life, and above all, a secure feeling is what is important,” stresses Khanna.

In the race to have money to be financially free, do not forget that financial freedom is much more than just having money. It’s the freedom to be who you really are and do what you really want in life. “There is a need to understand the difference between wealth and income. Income enables you to meet dayto- day expenses whereas wealth is an outcome of the accumulated income, which will help you sustain in the future, one that is highly uncertain in today’s world,” explains Dhikale. Accept this reality in order to be on top of your finances and become financially free.