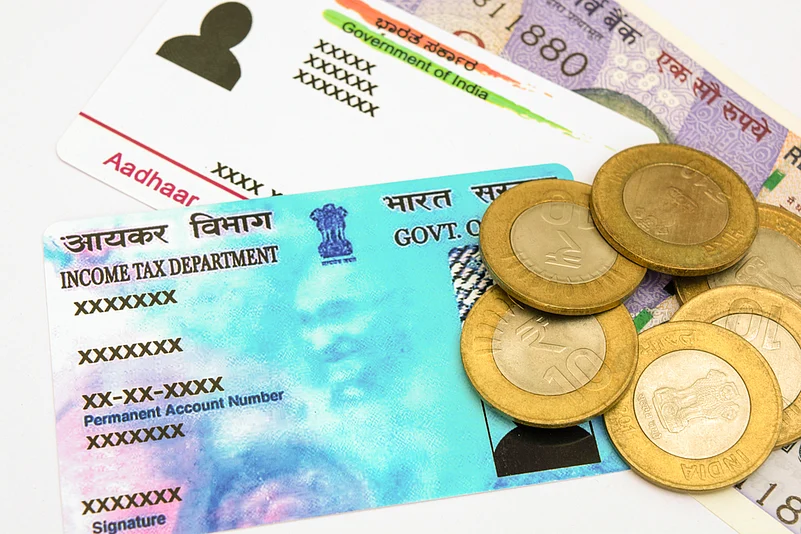

The process of linking your PAN with Aadhaar must be completed by June 30, 2021, according to the deadline set by the government. This is a crucial step since it allows for the processing of your tax returns. Unless expressly exempted, it is now necessary to cite and link an Aadhaar number while submitting income tax returns and an individual cannot submit an ITR without first connecting the two.

If so, then how to go about it? Here’s how.

Registered user at income tax e-filing portal

If you have previously specified your PAN while submitting ITR in past assessment years, it is likely that your PAN has been connected with Aadhaar. If the information of both is known, it is done by the income tax department. Visit the income tax e-filing website to see if your Aadhaar has been connected to your PAN.

The message ‘Your PAN is linked to Aadhaar number XXXX1234’ will appear on the screen. If your PAN is not connected to Aadhaar, you will be prompted to fill out a form with your name, date of birth, and gender as they appear on your PAN records. After that, enter your Aadhaar number. After entering the captcha code that appears on the screen, click submit. A success message will appear on your screen once you’ve submitted the form.

Non-registered user at e-filing portal

If you don’t want to register on the e-filing website, there is another alternative to link your PAN and Aadhaar numbers. A link has been added to the e-filing website’s homepage, as well as the income tax website’s http://incometaxindia.gov.in/Pages/default.aspx.

Simply go to the e-filing page and click on ‘Link Aadhaar’. A new form will display, prompting you to input your PAN, Aadhaar number, and name as per Aadhaar. If your Aadhaar card only shows your year of birth, you must also choose the ‘I have the only year of birth in Aadhaar card’ option. Click submit after entering the captcha code. A notice indicating that your PAN has been successfully connected to Aadhaar will appear on your screen once it has been submitted successfully.

Linking by sending SMS

If you are unable to link your PAN and Aadhaar through the department’s e-filing system, there are additional options for doing so. The Central Board of Direct Taxes (CBDT) has announced other techniques to connect PAN and Aadhaar in its announcement.

By sending a simple SMS, you may link your PAN and Aadhaar. You can send an SMS to either NSDL e-Governance Infrastructure Limited or UTI Infrastructure Technology and Services Limited, which are both PAN service providers (UTIITL). You may just send an SMS in a specified format to either 567678 or 56161 using a keyword.

The format is: UIDPAN<12 digit Aadhaar><10 digit PAN>

For example, if your Aadhaar number is 111122223333 and PAN is AAAPA9999Q. Then you are required to send SMS to 567678 or 56161 as - UIDPAN 111122223333 AAAPA9999Q.

NSDL and UTI won’t charge you for this. However, SMS charges as levied by the mobile operator will be applicable.

Manual link by filing a form

The Central Board of Direct Taxes has also included a manual approach to help taxpayers if they are unable to resolve the issue of data mismatch between their PAN and Aadhaar using other techniques.

You can go to a PAN service provider, NSDL, or UTIITSL service centre. You’ll need to fill out the ‘Annexure-I’ form and attach the supporting papers, such as a copy of your PAN card and an Aadhaar card.

This service is not free, unlike many internet services. Individuals are compelled to pay a certain price to them. The price is determined by whether or not the PAN or Aadhaar information is corrected during the connection process.

Visiting local PAN centre

If you are unable to link your PAN with Aadhaar, you must visit your local PAN centre and submit a signed Aadhaar seeding form. You must provide all essential papers, including your PAN and Aadhaar, along with the Aadhaar seeding form.

There is a new capability provided to solve the problem of a name mismatch. In the event of a name mismatch owing to the usage of initials, the two papers can still be linked using a shared date of birth and a common cellphone number. The department issues an OTP code for confirmation, and the Aadhar and PAN can then be connected.