It was absurd. In May 2021, when India was battling for its breath, retail investors were rushing in to buy anything with an ‘oxygen’ association. Even tiny stocks such as Bombay Oxygen, which has transformed into a financial company and no longer even produces the gas, surged.

Around this time, Linde India’s stock shot up by 70 per cent. Now, that was well deserved. After all, within a short span, the Kolkata-based industrial gases firm moved nuts and bolts around to pump out ten times more oxygen than before, catering to about a third of the country’s medical oxygen needs.

But, there are multiple reasons behind this rally and not just an unprecedented rise in demand for one of its products. In fact, Linde India saw its biggest gain in the month of February. (See: A stellar rise)

Then, what is going on at this recently famous company?

Breathing steady

Though healthcare makes just 15 per cent of the total revenue contribution for the company, oxygen did play a big role in the positive sentiment, analysts say. Otherwise the company’s mainstay has been production and distribution of gases, including nitrogen and argon, which forms 80 per cent of its revenue, and project engineering services. (See: Gases lead the way)

Abhijit Banerjee, the company’s managing director, says the company had seen an overall oxygen demand in the healthcare sector in the range of 850-900 tonnes per day on a pan-India basis before the pandemic. As the number of cases inched higher, the demand reached a peak of 3,000 tonnes per day around September-October. Linde gradually increased its capacity from 350 tonnes per day to 1,000 tonnes per day. From September to December, the stock climbed each month, adding about 30% in the period. Then, the second wave hit and demand skyrocketed to about 9,000 tonnes per day and Linde increased its capacity to about 3,000 tonnes per day.

That is 10x its regular capacity in a year.

It was heroic, considering the tragedy that was unfolding. But, to Banerjee, it felt more like “walking a tightrope”. As oxygen supply was diverted to address urgent medical needs, the company’s industrial customers were forced to either shut shop or reduce oxygen consumption. “A lot of the liquid oxygen sales in the medical world happened at the cost of industrial oxygen, liquid nitrogen and liquid argon sales to companies,” Banerjee says. The higher demand for medical oxygen also meant a reduction in the volumes of higher-margin products.

In the financial year 2020, Linde clocked a total revenue of Rs 14.71 billion from operations, recording a decline of 16.5 per cent as compared to 2019. Revenues from its gases division declined by 9.2 per cent, while the project engineering business saw a plunge of about 38 per cent. The performance of the latter was hit due to lockdowns which disrupted the project execution at almost all the sites, resulting in deferment of revenues. Onsite revenues also declined due to lower revenues from key customers such as SAIL and Tata Steel. On the other hand, the packaged gases business suffered with a decline in argon volumes as the automobile industry was hit hard. In the gases business, the decline in revenue was mainly due to loss of revenue arising from divestment of certain units and plants. However, higher revenue earned from medical oxygen and helium helped soften the blow. As a result, the company achieved Ebitda of Rs 4.07 billion during the year, a 6.7 per cent fall as compared to Rs 4.36 billion in 2019. (See: A solid show over the years)

Linde was by no means alone. On the global scale, a Fortune Business Insights report cited that the impact of Covid-19 has been “staggering” and “unprecedented”, with the industrial gases market witnessing a negative growth rate of 8.7 per cent last year as compared to average growth during 2017-19.

It must be added that Linde delivered better results than domestic peers. The company even paid a total dividend of Rs 10.5 per share to its shareholders in 2020, higher than the Rs 10 paid the year before. (See: A solid show over the years)

2020 was also the year that Linde India’s topline benefited by Rs 780 million from a 2018 merger of its German parent Linde AG with US firm Praxair Inc. In India, the overlapping merchant air gas business of the two has been geographically divided, and the on-site air gas business is divided based on incumbency, merchant priority and respective parties’ ability to offer competitive solutions. The project engineering business is unique to Linde, while the CO2 and hydrogen business is unique to Praxair India. Through this arrangement, Linde India is expecting Rs 3.5 billion of cost savings over the next three to four years.

While initiating coverage on the stock in March this year, Antique Broking Limited’s Amit Shah and Dhirendra Tiwari said the merger “couldn’t have happened at a better time”. The industrial gases market is projected to grow from $91.29 billion in 2021 to $148.16 billion in 2028 at a CAGR of 7.2 per cent, with oxygen generating the biggest share of revenue. Meanwhile, the Indian healthcare sector is expected to record a three-fold rise, growing at a CAGR of 22 per cent during 2016-2022 to reach $372 billion in 2022 from $110 billion in 2016. Against this promise of growth, Shah and Tiwari believe the combined entity will command over 50 per cent market share across major industrial gases. Therefore, they expect the Ebitda margin of Linde India to improve to 29 per cent by CY23, resulting in earnings growing by 2.8x by that year.

The merger has also allowed Linde to shore up its balance sheet via cash raised through divestments. Following an investigation, the Competition Commission of India said that the Linde-Praxair merger deal showed it is likely to have an appreciable adverse effect on competition in some markets in India. Therefore, the watchdog mandated the sale of certain assets of Linde and Praxair as a precondition to the merger. The proceeds from sale of the South Region Divestment Business—which came up to Rs 13.8 billion—allowed Linde to fully repay a Rs 1 billion loan in May last year to Citicorp Finance. By 2020, the company was free of debt.

This February, the stock saw a massive rally also because of Linde’s selling of land and buildings of its closed Kolkata factory to Mindstone Mall Developers for Rs 3 billion. That month, the last installment was paid. The sale strengthened its balance sheet and boosted its bottomline, with consolidated profit for the March quarter at Rs 3.03 billion, up a whopping 675 per cent from last year. Even keeping the proceeds aside, the profit before tax and exceptional income during the quarter was Rs 903.9 million, which compares well with Rs 565.9 million last year.

As the pandemic situation eased this year, the Indian government slowly started easing the availability of oxygen for industrial purposes. On June 1, India’s Ministry of Commerce issued a directive permitting oxygen supplies to continuous process industries such as furnaces, refineries, steel, aluminium and copper processing plants subject to ensuring sufficient supplies for medical purposes. As a result, Linde is now doing about 650 tonnes per day.

Volatility scare

Unlike the run-up in several other stocks, Linde’s rise has not been driven by retail investors. The reason is simple: there’s very little they can do. Only 22.5 per cent of the company’s shares are in free float. As per Linde’s latest filing, 75 per cent of its shares is held by the promoter group BOC Group.

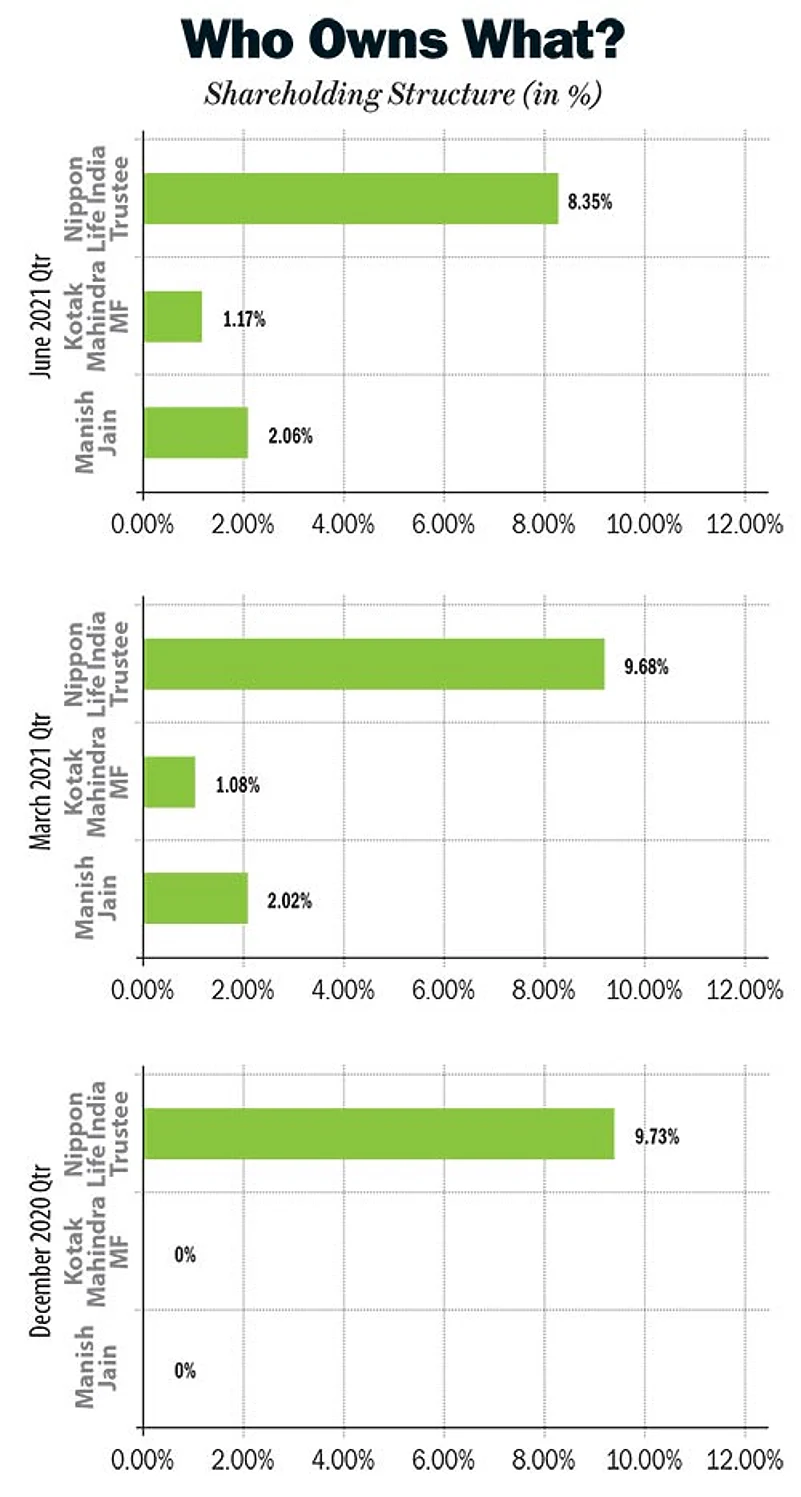

In the remaining shares available as free float, mutual funds and individual investors dominate. Nippon Life India Asset Management, which held 8.35 per cent at the end of June quarter—down from 9.7 per cent held at March end—is its second largest shareholder. An individual investor named Manish Jain holds 2.06% of the shares, making him the No. 3 shareholder. Curiously, his holding has gone up from 0% to 2% in the span of just seven months. Little is known about him except the fact that he hails from Mumbai. Despite repeated attempts to contact him, the reporter could not verify other details. Interestingly, Jain has picked up most of the holdings previously owned by Life Insurance Corporation. LIC was a prominent seller & has completely exited its legacy holding and missed the run-up post January.

The other key mutual fund is Kotak Mahindra Asset Management, which marginally increased its shareholding from 1.08% at March-end to 1.17 per cent in the June quarter. (See: Who owns what?)

The shareholding pattern makes the stock vulnerable to volatile spikes in trade, independent analyst Ambareesh Baliga says. “When the parent group holds such a large chunk of shares, the stock is more exposed to spikes. It also allowed it to benefit more from the broader bull run in the market.” It also gives players such as Nippon and Jain the role of kingmakers in processes such as delisting.

Linde’s promoter BOC has already lobbed an attempt at delisting the company, but failed. As part of the process, BOC opened the bidding in January 2019 at a floor price of Rs 428.50. After, when the bidding concluded, the price discovered during reverse bidding was at Rs 2,025, nearly 4.7x higher than the floor price offered. The promoter rejected the price, unwilling to buy back at such a high price. Nippon, which was Reliance Multi Cap Fund and Reliance Tax Saver (ELSS) Fund back then, played a key role as it held 9.85 per cent of the total stake. In the reverse bidding process, it is believed Reliance placed its bid above Rs 2,000, taking the discovery price to

Rs 2,025.

The delisting saga has kept investors on the edge with many holding on to the shares in hopes of a rally driven by another offer by BOC. Banerjee, when asked about the possibility of one, says only promoters can answer that. Analysts, however, seem to believe the promoters will wait for the price to go down a bit to make another bid.

“Open offer at current high valuation may not be ideal for the parent company and may not be justified”, Jigar Shah, CEO at Maybank Kim Eng Securities India, says. Till then, the wait goes on.

A double-edged sword

Going ahead, the pandemic might work negatively for Linde, warns Baliga. “What turned out to be a boon is a double-edged sword for the stock”. Explaining further, he says that the medical oxygen capacity built up by smaller players and government institutions is going to reduce demand for Linde’s products. On the other hand, the positive sentiment that drove Linde’s stock higher during the pandemic will withdraw, leading to a pullback in gains, even though the financial performance might be steady.

Echoing the sentiment, Shah also expects the stock price to cool off. “The one-off jump in hospital/home demand may cool off and diversion from industry may reduce due to normalisation of COVID-19 situation next year,” he says.

The pullback has begun. In May, profit taking drove the stock to shed nearly 13 per cent. For the June quarter, Linde slid 8.6 per cent, underperforming the Nifty 50, which rose 7.1 per cent.

The longer-term outlook remains solid though with the company sticking to a double-digit growth guidance for this year. Having fixed contracts with reliable customers such as Tata Steel, Steel Authority of India Limited, Jindal Stainless and ITC has also lent it a degree of stability. At the end of last year, it had a robust order book for its project engineering division of Rs 11 billion. Going ahead, it sees benefits from pent-up demand in the industrial sector.

Crucial to this optimism is the fate of the steel industry, which is a major driver of industrial gases growth. Commodity-centred analysis firm Argus estimates crude steel output to rise by 9-12 per cent in FY22. At its AGM, Linde India said the industry is witnessing an improvement in performance with rising prices and a broad-based pickup in volumes in most of the steel-consuming sectors such as automobile, construction, capital goods and consumer durables.

Another area of growth may come from the government’s increased focus on improving infrastructure across India, especially for healthcare. This will provide growth opportunities for the gases business, the company believes. Till now, its plants for medical oxygen are centred in eastern parts of the country. However, the management has said it has also been evaluating investment opportunities for installing new merchant capacity in north and west India to capture the growth of these markets.

A potential winner for the company going forward also lies in hydrogen, a gas that is central to discussions around the pivot to clean energy globally. The company has one hydrogen electrolysis plant in India at the moment. It has repeatedly said that it is looking for business opportunities and will look to invest in certain hydrogen projects going forward. Its parent company has already established itself as a key player in the production, processing, storage and distribution of hydrogen. It has installed over 200 hydrogen fueling stations and 80 hydrogen electrolysis plants worldwide.

“The expertise that Linde India already has in hydrogen sets it up to be among the leading players in its production in the country,” says Hemang Jani, group senior vice president at Motilal Oswal Financial Services.

Further, Jani adds that the announcement by billionaire Mukesh Ambani’s Reliance, of plans for two giga factories dedicated to green hydrogen in India, is likely to spur growth in the segment.

“That is likely to benefit Linde and we can see a lot more investments in the area,” he says.

The resilience in the stock is already visible. Tiwari and Shah have maintained a buy rating on the stock with target price of Rs 2,170 based on 45x CY23e earnings.

Looking at the fundamentals, the stock’s net margin stands at 10.27 per cent as compared to 9.73 per cent of the wider industry, according to Refinitiv data. It is currently trading at a price-to-earnings ratio of about 36x, which, analysts say, is a stamp of investors’ confidence in the company’s potential for further growth.