As with any Union Budget, the expectations are running high for February 1, 2020 as well. As the finance minister rises to present the second budget of NDA 2.0 the market consensus is that the government could focus on – 1) tax sops to boost consumption and schemes to support farm incomes; 2) ease stress for MSMEs and the housing sector and lastly 3) outline policies to attract private/ foreign investments. The markets would also keep a keen eye on fiscal deficit numbers and await any hint of a relief in the long-term capital gains (LTCG) tax. In all, the government has a tough balancing act at hand.

Hopes many, but fiscal room limited

Relief on the personal income tax front tops all expectations as regards the upcoming budget. While wider tax slabs will boost urban consumption, the government could focus on infrastructure development to stimulate GDP growth rather than cut income tax/ GST, as tax sops may not immediately spur growth. Despite a rise in GST collections in the last two months of 2019, year-do-date numbers are not impressive, thus affording the government little scope to raise resources. A shortfall in the divestment target also tightens the government’s purse-strings.

Need to eye unusual revenue streams

The markets thus expect the government to eye innovative revenue sources such as privatisation of public-sector enterprises, transfer of surplus from the RBI, etc. Overall, markets would watch out for moves that would help raise required resources without crowding out the private sector. The government’s intent to fund part of its gross borrowings in foreign currencies, sovereign ratings and financial markets become important. We believe that the government may ease its strict fiscal-deficit-management and hence a marginal divergence in fiscal deficit may be expected that could generate job opportunities and spur growth.

Key focus areas

Alleviating agricultural and rural stress: To ease rural stress and boost farm incomes, the government may widen the scope of the PM Kisan Samman Yojana and Ayushmaan Bharat schemes; this is likely to double public health expenditure as a percentage of GDP to 2.5 per cent by 2025.

Piped water supply and river linking project: The mission to provide safe drinking water to all households through a pipe network is expected to be a key priority. The river-linking project aimed at addressing drought and flooding issues could be part of the larger mission.

Infrastructure creation to aid employment: Various schemes such as Bharatmala, Skill India, Ayushmaan Bharat and MUDRA, etc, have helped create jobs. As higher employment increases the multiplier effect on GDP growth, hence infrastructure creation is likely to be a key thrust area.

Better credit delivery in housing sector: We expect the government to provide more incentives for the real estate sector to boost the housing finance sector.

Improving tax collections: Better compliance measures, as well as efforts to kick-start GDP growth are likely to be announced.

Deepening last-mile credit delivery: Priority-sector lending status to MSMEs and SMEs and deep entrenchment of Jan Dhan accounts may be leveraged upon to boost last-mile delivery of rural/ consumer/ SME credit.

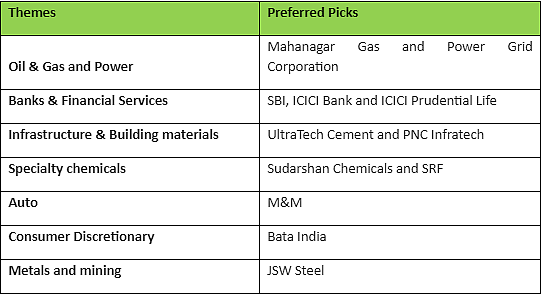

Preferred pre-budget picks