The market entered 2015 with great enthusiasm of improved policy momentum and expectation of economic revival through the year. The government has opted for delayed gratification to invest in structural reforms. India has shifted to fiscal tightening and higher real rates when the rest of the world is happy to prop up asset prices. The economic template has improved, with clearer policies on resource allocation, ease-to-do business, inflation control and incentivising financialisation of assets. The RBI, too, participated with 125 bps cuts through the year and a defined policy mechanism.

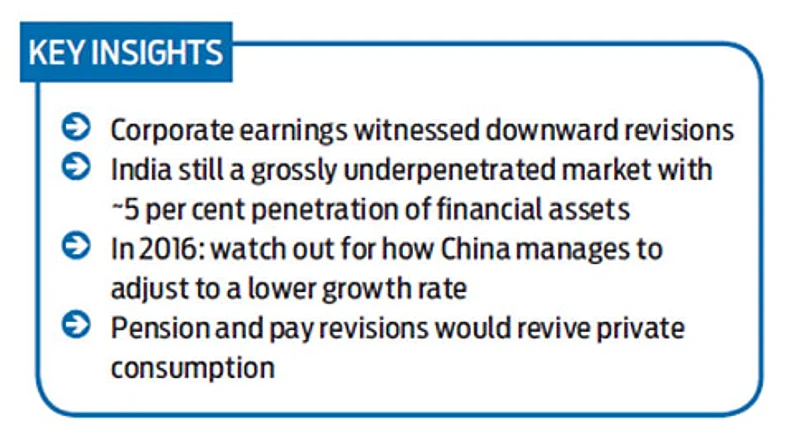

The global markets continued to witness volatility through the year, on the back of falling commodity prices, concerns on emerging markets, particularly China, and commodity producers, and the uncertainty on Fed rate hike. Poor monsoon and the policy reset on ground towards a cleaner operational framework postponed the expected domestic recovery. We are entering a long period of policy divergence among global central banks actions. While the US Fed is commencing normalisation of policy, central banks in Europe, Japan and China remain in an expansionary policy mode. We expect the volatility in global markets to subside as the event (Fed rate hike) is behind us. Two other things to watch would be how China manages to adjust to a lower growth rate, and the maturity of the key constituents in handling geo-political tensions.

The RBI decision to peg policy rates to consumer inflation has created a base reference rate for returns from a liquid financial asset. Concurrent sluggishness in physical assets, recessionary effect of equity as an asset class and structural move towards financialisation of assets make the right brew for increased domestic flows into the equity markets. After a long hiatus, there was a sustained shift to equities, once average yearly returns from equity turned positive against the physical options, such as gold, last year. The inflows have accelerated since the new government has come in. One expects this momentum to continue. The flows have remained strong due to falling returns on other asset classes, and relative tax efficiency for long-term equity investing.

For a country of 1.3 billion people, at $1,500 GDP per capita, with ~5 per cent penetration of financial assets, India is an underpenetrated financial market. The sheer shift of incremental savings to financial assets provides an outstanding opportunity of extended compounding for early entrants. We feel the trek has just begun.

As we enter the next stage of economic cycle, we expect the government and its execution engine to step on the accelerator for investments in key sectors like roads, railways, irrigation, power T&D, renewable energy, and ports. The government has smartly pushed the envelope through states to address tricky issues on land acquisition and labour laws. With several states competing for the pole position of investment destination, the ease-to-do-business template is fast permeating to the ground level. New cities like Amaravati (Andhra Pradesh) and Naina (Maharashtra) have been announced. The large FDI commitments during the current fiscal endorse the same.

The corporate earnings have seen downward revisions so far. Having said this, we enter the next year on a much cleaner slate with better base in terms of operating leverage, positioning in relative peers and restrained earnings expectation. Several high frequency indicators like indirect tax collections, power generation, coal production, petrol consumptions, passenger car sales, new job initiations and aviation passenger traffic are looking postive. A close look at the quarterly results suggests ~70 per cent of the last full-year capex has already been expended in the current year so far, thanks to tax incentives for investments in capex or R&D. Concurrently, the rural economy is in mild stress. Despite facing the worst two successive years of drought, lower MSP hikes and cut down in government rural spending, the rural economy has actually showed resilience. We expect the base effect to come in place in the next fiscal while government spending on infrastructure and irrigation has a positive effect. Impact of pension and pay revisions for military personnel and government employees will also help in reviving private consumption.

Some of the themes that drive India today are digitisation, globalisation, emerging demography and enforced governance. Each of these variables can challenge the current market structure creating new businesses, new brands, new categories and new winners. These forces would create multiple opportunities in the next economic cycle driven by new winners of ‘Next India’ while questioning the business model of some of the existing players. As the rules of the game change, businesses with operating mindset of ‘yesterday’ may face the heat, while extraordinary opportunities will arise for those who have the vision, integrity and execution capability to win in this new environment—‘Next India’.

Navneet Munot Chief Investment Officer, SBI Mutual Fund

The writer’s views are personal and do not represent those of the company