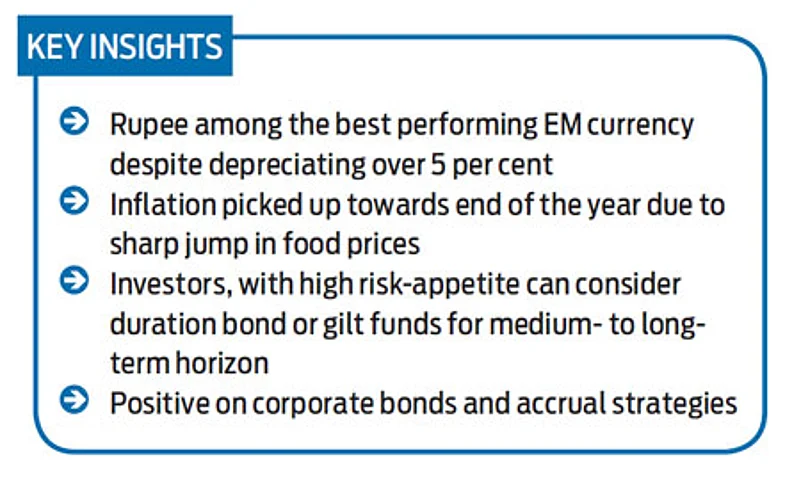

The year 2015 started on a good note for duration strategies, with RBI cutting the repo rate by a total 125 bps (during the year) leading to softening of bond yields. However, expectations of rate hike by the US Fed and subsequently with the Fed raising rates by 25 bps, a significant amount of these gains reversed towards the end of the year. Nevertheless, full transmission of the rate cuts by the RBI is yet to happen, which could augur well for duration strategies in the coming year. Meanwhile, there were credit concerns on individual companies during the year, which weighed a bit on the accrual strategies. However, improving credit ratio seems to indicate that we broadly appear to be in a credit upgrade cycle. Additionally, further transmission of policy rate cuts would help to bring down cost of capital for Indian companies, which in turn may bode well for the improvement of the credit environment and thus, benefit accrual strategies.

Inflation, which showed downward trend through most part of the year, picked up towards end of the year due to sharp jump in food prices on account of weak summer crop output and weak incoming data on winter crop sowing. However, we believe that the drivers of inflation viz. fiscal deficit, rural and urban wages, and international commodity prices continue to remain benign and hence supportive of a decelerating inflation trajectory in the medium term. Meanwhile, the RBI in its fifth bi-monthly monetary policy in December also maintained the inflation trajectory at previous policy levels and cited that there could be slight downside risk to the inflation trajectory, set out in the September policy (5.8 per cent in January 2016). Going ahead, any action on the interest rate front by the RBI would be a function of inflation trajectory and status of fiscal consolidation.

The rupee has depreciated over 5 per cent against the dollar. However, it was among the best performing emerging market currencies in 2015. While the impact of Fed rate hike has already been factored in, other external factors such as slowdown in Chinese markets and weakness in Asian markets may lead to the weakening of the rupee. Nonetheless, factors such as contained twin deficits, lower commodity prices and improving domestic macroeconomic indicators may provide some support. The upcoming FPI debt limit auction in January 2016 would be a crucial factor to watch out for, which may provide cues for FPI flows and its subsequent impact on forex and bond markets.

We believe that any further rate increase by the Fed, as hinted in December meeting, and demand-supply mismatch in G-Secs (given FPI outflows in recent past and concerns on elevated fiscal deficit) could lead to volatility in bond markets. The government may not be able to meet FY17 fiscal deficit target on account for higher wages and pensions while maintaining its spending on capex and infrastructure development. However, we believe that anticipated transmission of rate cuts, expectation of continued soft crude oil prices and elevated spreads between repo rate and yield curve could potentially benefit duration strategies. Hence, we recommend investors, who can withstand volatility to consider duration bond or gilt funds for medium- to long-term horizon. Also, with growth picking up albeit at a slower pace, and economy recovering—though in early stages—we believe that credit environment will continue to improve. Hence, we remain positive on corporate bonds and accrual strategies.

Santosh Kamath Managing Director, Local Asset Management-Fixed Income, Franklin Templeton Investments, India

The writer’s views are personal and do not represent those of the company