The year 2015 has not been exciting for the common man even though at the macro level, there have been achievements in terms of policies being implemented and pure economic numbers. That is because households normally do not look beyond their own homes to judge whether the year has been good or not. This also becomes critical when elections are held and micro issues tend to gain in precedence.

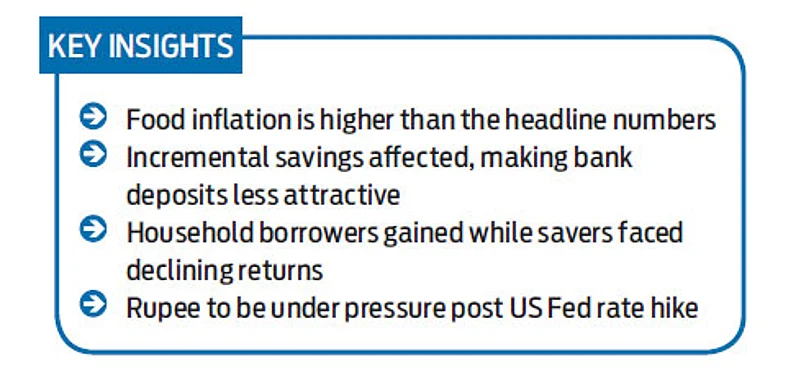

If looked at from this perspective, households have gone through another rough patch with regard to inflation. While the headline numbers have been within the policy range of 5-6 per cent for most of the time, food inflation has been higher. Further, specific price shocks like those in pulses or vegetables, including onions, have upset household budgets quite significantly. This holds true for the lower-income groups as well as the middle class, where food is a significant part of the house budget. A consequence of relentless high food inflation is that higher food expenditure necessarily means lower allocations for other consumer goods. This, in turn, affects demand for consumer goods, which was the case in 2013 and 2014. Hence, real income has not been increasing at the required pace and has in fact fallen for some households, thus impacting consumption.

Another fall out of high food inflation is that with lower real disposable income, savings have been affected. The amount left after providing for food expenses has diminished, which has a dual impact on consumption of non-food items as well as savings. To top it all, the RBI lowered the repo rate by 125 bps in 2015 and the reaction of banks has been to lower the deposit rates almost immediately. Hence, incremental savings tend to get affected adversely, with bank deposits becoming less attractive. With limited options of financial savings, it may be expected that even at the economy level, savings would be subdued, given that substantial part of domestic savings come from households, which account for 60 per cent of the total.

Presently, small savings provide better returns with certificates, post office accounts and PPF offering relatively higher rates. While some migration has taken place, in general, there is less mobility, given the limits placed on such savings and limited flexibility in withdrawal. Therefore, on the savings side, there has not been much advantage for households in 2015. In fact, the government is speaking in terms of aligning the interest rate on small savings with those of bank deposits.

The general pointer is that the RBI would now focus on lowering rates rather than increasing them while simultaneously targeting CPI inflation. Hence, there may not be too much hope of better returns even in 2016. The Fed rate hike, hence, would also not have much impact from the point of view of individuals, as interest rate decisions would be contingent on domestic conditions. On the other hand, the Fed hike also means that the rupee will be under pressure and would probably decline vis-à-vis the dollar. This, in turn, will make foreign exchange costlier for a holiday or tutions overseas.

The investment picture has been mixed. While households have preferred to substitute gold in the past, the demand has been lower this year. This is notwithstanding the fact that the price of gold has come down. However, with the higher taxes being paid as well as the falling rupee, regional demand has come down. The gold bond and deposit schemes too were not very successful.

Those looking at the stock market would not be too pleased. While experts did talk of the Sensex skyrocketing to levels above 30,000 by Diwali time, one did not quite see such a picture emerging. On a point-to-point basis, the Sensex declined by almost 2,000 points this year.

Household savings in mutual funds would have drawn some benefits on equity, as the market did better than 2014 and old schemes would have had an older export folio. However, the government’s action to treat capital gains from debt instruments at par with short-term gains, unless kept for more than a year, has made this avenue also quite redundant. Besides, with falling interest rates, the returns that one gets have been lower on debt schemes.

The only area where the households would benefit would be is when borrowing money, especially for housing. With prices dipping marginally, a major advantage has come in the form of mortgage rates of banks, which have come down. Here, there are tangible benefits for households who are planning to buy homes. The same would hold for other consumer loans like education, though the net benefits may be minimised due to the rupee depreciation, which would affect servicing of all forex loans.

In short, 2015 has been relatively better for household borrowers while it has been a negative for savers. Investors in capital markets have had a mixed impact. One may hope that markets would be better in 2016, though conventional savings will continue to be at a disadvantage. Inflation, especially food inflation, will continue to hold the clue in the future.

Madan Sabnavis Chief Economist, CARE Ratings

The writer’s views are personal and do not represent those of the company.