Investors today are faced with a plethora of options when it comes to investing in Mutual Funds. Picking funds is often a hard task as there is a sea of information available to investors and the sheer number of funds to pick from can make the task seem daunting. Many investors tend to rely purely on historical short term performance to make investment decisions, which to our mind can be misleading. For starters, historical performance may or may not be repeatable in the future. Secondly, it is important to ascertain the attribution of the performance—is it due to the fund being invested in specific segments of the market that have done really well? Or is the performance more broad-based across stocks and sectors? The latter would suggest a more repeatable performance going forward.

Founded in 1984 in the United States, Morningstar is an independent investment research firm with operations in 27 countries. Our mission is to create great products that help investors reach their financial goals. We are fiercely independent in our research and put investors at the center of everything. Morningstar has been in India since 2008 and produces two ratings on funds – Morningstar Ratings (Star Ratings), which are quantitative ratings based on historical performance and Morningstar Analyst Ratings, which are a qualitative forward-looking assessment of the fund manager and the strategy.

The Morningstar Ratings are based on the historical risk adjusted returns of fund versus their peer group.

These ratings capture the risk adjusted returns of the fund over longer time horizons and as well use proprietary metrics to penalise funds with large downsides. Star Ratings are based on a 5 point scale from 1-star to 5-star, with 5-star being the best. We believe these are a good starting point for investors to shortlist more consistent funds basis their historical performance.

While Star Ratings are a good starting point, the Morningstar Analyst Ratings help identify those funds which, we believe, have the ability to outperform their benchmark and/or peer group, within the context of the level of risk taken, over the longer term. Analyst Ratings use a globally consistent five pillar process to assess funds on “People”, “Process”, “Parent”, “Performance” and “Price”. Analysts carry out extensive research followed by fund manager interviews to assess funds on these criteria. The first three pillars (People, Process, and Parent) form the core of our assessment and believe these eventually translate into long term consistent performance going forward. Funds are rated again on a five point scale – Gold, Silver, Bronze, Neutral, and Negative.

These fund reviews are intended to help new investors looking to invest into mutual funds as well as help existing investors take a decision whether to stay invested in a particular fund.

We are glad to be associated with Outlook Money to bring our best investment ideas across to investors to help them make the right investment decisions. Happy investing!

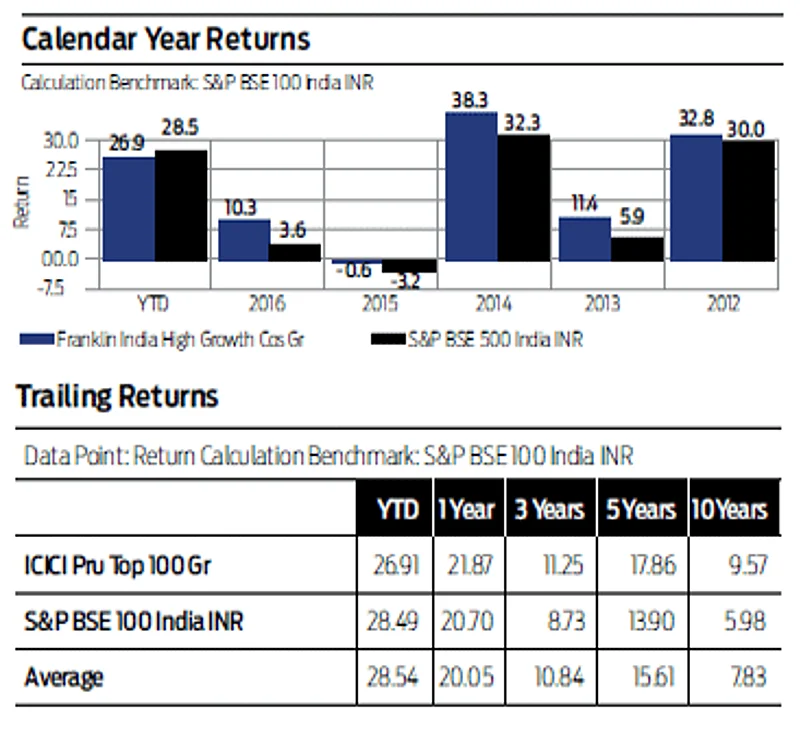

Franklin India High Growth Companies Fund

Manager Biography and Fund Strategy

Roshi Jain has 12+ years of experience in equity research and portfolio management. She has been a comanager of this fund since 2012 and the lead manager since 2014. The investment process is research intensive and relies heavily on a bottom-up approach. Only companies that have durable competitive advantages versus peers, sustainable business models, strong entry barriers, able management teams, and good corporate governance standards are included in the coverage list. The portfolio is currently positioned to benefit from a turnaround in the economic growth. Also, Jain has been investing in sectors and companies which are related to domestic growth recovery rather than export oriented. She is flexible in her investment approach while constructing the portfolio and invests in stocks from across market segments (large, mid, and small) without any bias. She does not shy away from taking significant sector and stock bets. Jain is cognizant of the underlying risk in this strategy and takes requisite measure to mitigate them. Hence, single stock weight in the portfolio is capped at 10 per cent. Also, while constructing the portfolio, she ensures that it doesn’t have significant exposures in two sectors which are fundamentally aligned. For instance, given she has high exposure to banking stocks, she has avoided investing in metal and mining companies. In our opinion, the process is sound and workable over the long term and it has been executed with skill by the manager so far, which results in long term sustainable performance.

ICICI Prudential Top 100

Manager Biography and Fund Strategy

Naren has 25+ years of experience in research and fund management and has been associated with ICICI Mutual Fund for the last 13 years. Naren is known for being a contrarian and has a good understanding of “value” stocks.

Naren follows a disciplined investment process and an active portfolio management approach. The fund has a large cap bias with a focus on stocks which have significant long term growth potential. He aims to generate alpha by active sector rotation through a top-down approach. Within the chosen sectors, Naren makes use of relative valuation parameters to invest in large-cap stocks he believes are attractively priced relative to their growth prospects.

While picking stocks, he focuses on the financial strength of the company and knocks out stocks with high leverage. He favours companies with attractive fundamentals, shifting away from ones where he thinks valuations are stretched. He does not take cash calls and remains fully invested; cash levels are unlikely to exceed 5 per cent of assets. The strategy is complex, but we believe in Naren’s execution skill which makes the process robust.

The fund runs a concentrated portfolio based on the number of stocks in its portfolio than its peers. With Naren’s excellent stock picking skills we are comfortable of the concentrated portfolio, which could have the potential to fetch higher returns. The fund’s long term performance track record is good, but it can underperform its peers in the short run due to its valuation conscious approach.

Aditya BSL Short Term

Investment Strategy

Maneesh Dangi heads the fixed income team at Aditya Birla Sun Life AMC and is also the co-CIO at the AMC. He has 15+ years of experience in research and fund management and has been with Aditya BSL AMC since 2006. Dangi is an experienced portfolio manager and we view his in-depth understanding of the macro-economy as being an advantage. The fund house runs one of the largest teams on the Fixed Income side, consisting of a 12-member analyst team. This includes four portfolio managers who also double up as analysts. Analysts too take on dual/multiple roles based on their expertise. The fund typically invests in high quality debt papers and has not taken active credit bets in the past. The issuer-selection process on the corporate bond side is extremely detailed and based on a well defined set of processes. The team relies on their internal ratings and processes as opposed to external credit rating agencies. Given their focus on quality and liquidity, analysts tend to undertake an in-depth evaluation of the management, corporate governance practices, financial standing of the issuers, liquidity, and risk.

Overall, the investment process seems robust, given the manager’s focus on conducting competitor analysis, scenario analysis, and client profiling that form important aspects of the process. The core of the strategy lies in a combination of taking a duration view based on the interest rate directional movements and taking some credit bets in high quality corporate bonds at the shorter end of the yield curve. In line with its philosophy, the strategy allocates a portion of its assets to G-Secs and State Development Loans (SDL) in addition to investing in high quality debt papers. Dangi can vary his allocation towards these based on their valuations and relative spreads. The execution of the strategy is reflected in the fund’s noteworthy performance. The fund has remained a consistent performer over the years.

Disclaimer:

@2017. All rights reserved. The Morningstar name and logo are registered marks of Morningstar, Inc. This Investment Research (“Report”) is issued by MorningstarInvestment Adviser India Private Limited (“Morningstar”), which is registered with SEBI (Registration number INA000001357) and provides investment advice and research. Morningstar has not been the subject of any disciplinary action by SEBI or any other legal/regulatory body. Morningstar is a wholly owned subsidiary of Morningstar Investment Management LLC. In India, Morningstar has one associate, Morningstar India Private Limited, which provides data related services, financial data analysis and software development. The terms and conditions on which Morningstar offers Investment Research to clients varies from client to client, and are detailed in the respective client agreement. • The information, data, analyses and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and are not warranted to be correct, complete or accurate. • Redistribution is prohibited without prior written permission of Morningstar. • Except as otherwise required by law, Morningstar and its officers, directors, employees and associates shall not be responsible or liable for any trading decisions, damages or other losses resulting from the use of this Report. • The author/creator of this Investment Research (“Manager Research Analyst”) or his/her associates or relative may have (i) a financial interest, including a long or short position, in the mutual fund schemes that are the subject of the Report (“Subject Mutual Funds”), or (ii) an actual/beneficial ownership of one per cent or more of the Subject Mutual Funds, at the end of the month immediately preceding the date of publication of this Investment Research. • The Manager Research Analyst, his/her associates and relatives do not have any other material conflict of interest at the time of publication of this Investment Research. • The Manager Research Analyst has received no compensation or material benefits from the product issuers of the Subject Mutual Funds or from any third party in connection with this Report in the past twelve months. • The Manager Research Analyst has not engaged in market making activities in the Subject Mutual Funds. • The Manager Research Analyst has not served as an officer, director or employee of the relevant fund companies of the Subject Mutual Funds in the past twelve months. • Morningstar has no financial interest or actual or beneficial ownership in the Subject Mutual Funds. • Investments in securities are subject to market and other risks and there is no assurance or guarantee that the intended objectives of the Subject Mutual Funds will be achieved. • Past performance may or may not be sustained in future and is no indication of future performance. • As the price / value / interest rates of the securities in which the Subject Mutual Funds invest fluctuates, the value of investors' investments in the Subject Mutual Funds and in the income derived therefrom may go up or down.