Since its inception in 1993, the scheme has witnessed several high and low phases in the markets. It has largely managed to stay ahead of its benchmark – S&P SENSEX 100 by focussing on quality companies that exhibit strong management and corporate governance standards, in addition to robust business models. “Within that particular set, the fund now has a value bias where we look for companies that offer more margin of safety in terms of valuations. To further narrow down the company list, the fund looks for companies where there is positive change at the margin in terms of business fundamentals,” says Dinesh Balachandran, fund manager, SBI Magnum TaxGain.

The emphasis on safety factor makes it large-cap-heavy, with mid-caps making up 25 per cent of the portfolio. “The fund is primarily has a bottom-up orientation and does not take big sector bets. The top positive active weight holdings are SBI, CESC, Mahindra Finance while top active underweight positions are TCS, HDFC, ITC,” adds Balachandran.

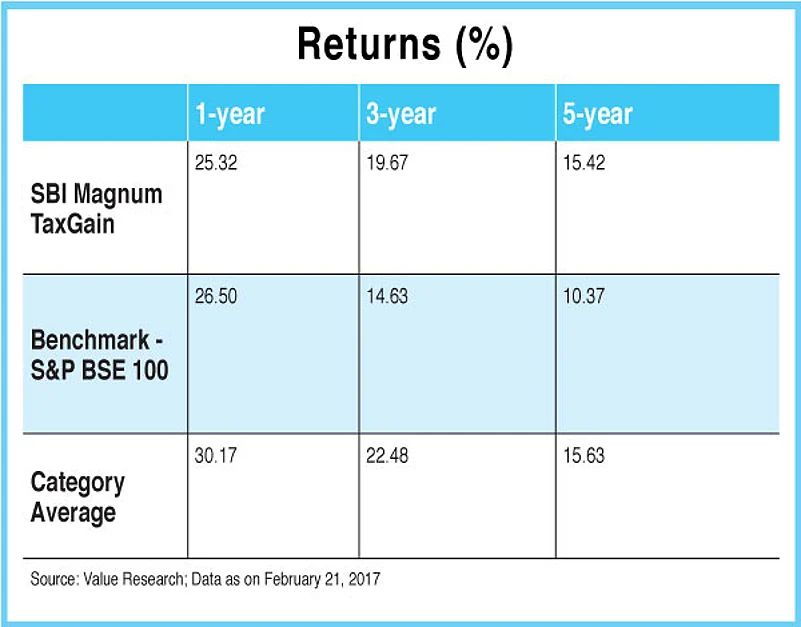

While the fund has managed to beat its benchmark S&P BSE 100 consistently over the years, the performance has slipped in the last one-year period, when the gap between returns of the funds and that of the benchmark has been widening constantly. It fares better in the longer-term return periods of three and five years, delivering returns of 19.67 per cent and 15.42 per cent respectively, compared to corresponding benchmark returns of 14.63 per cent and 10.37 per cent.

However, its peers have performed even better throughout the period, yielding three- and five-year returns of 30.17 per cent, 22.48 per cent and 15.63 per cent respectively. It hit a rough patch in the last year, as it lagged behind even its benchmark. SBI Magnum TaxGain’s fund manager Dinesh Balachandran attributes the performance to stocks that have underperformed the broader market over the last year on the back of expensive valuations.

He believes the stocks in the fund’s portfolio are of high quality and the current performance is a short-term phase that the fund will recover from over the long-term. “While these stocks are still expensive, the extent has significantly diminished on the back of correction in price/time. We are confident that the same strategy that has been employed till now will result in the fund outperforming its benchmark going forward,” he explains.

The fund maybe on a sticky wicket for now, but its long track record of weathering storms could bring in it back into the top league in the days to come.