The IT sector has been facing the heat ever since Donald Trump took oath as the President of America. Unclear visa norms, muted spending and slow takeoff of spend in the financial services industry is a factor impacting the sectors. According to Kotak Institutional Equities report on the technology sector, IT companies indicate downside risk to revenue growth estimates. The IT services market has witnessed slowdown in growth rates in the past two quarters, due to factors that are unique to each sector and the vertical within.

No signs of uptick: Although at the beginning of the year, there were indications favouring an environment that expected an increase in interest rate and easing of certain regulations, for acceleration in banking spends. And, though some of the conditions have been met, but it has not translated into increase in spending. Indian IT is possibly pinning its hopes of conversion of optimism into spending from Sep 2017 quarter though hopes of a back-ended recovery carry significant risks of going wrong.

Shift to client captives: Over the past 12-18 months, the use of captive centres and in-source has been of concern. This is due to various reasons such as in-house built digital capabilities; belief that economies of scale are driven by large budget sizes and it is perceived that the level of automation and cost savings offered by the Indian IT isn’t up to the mark.

Capturing digital opportunities: Digital opportunities are large and undisputable; many opportunities and spending allocations are still in digital strategy and consulting heavy phase. Such a scenario leads to lower participation rate in discretionary spending. The report expects size and magnitude of opportunities to increase as digital moves to integration phase even as the timing of the transition remains unclear.

Redefined partnerships: The big-3 consulting firms and big-4 accounting firms are playing roles of influencers in digital initiatives and have flourishing digital consulting practices. The size and scale of digital practice of these players is not known, but it is reasonable to say that many new players are participating in digital opportunities and clients are comfortable and getting used to working with a number of players/specialists in digital projects.

Stocks impacted?

The report does not expect a rebound in growth rates, but hopes few companies will benefit, especially those that have invested in digital capabilities and are well positioned to defend their share of business in traditional areas. TCS, Infosys and Mindtree appear well positioned in this journey.

What does this translate to?

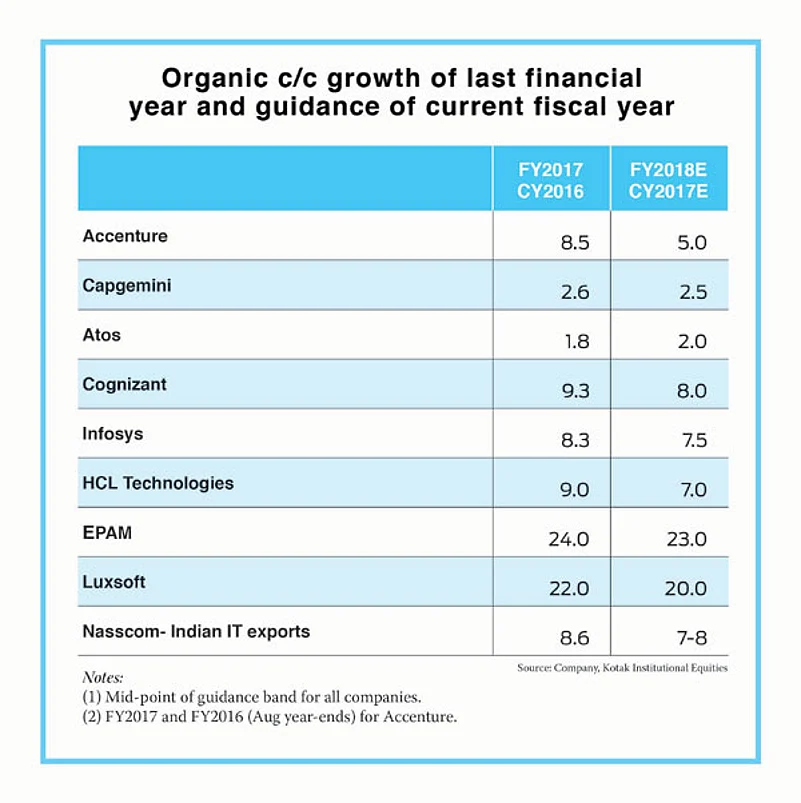

The report forecasts organic constant currency revenue growth rate between 4 and 8.5% for Tier 1 companies in our coverage universe. Growth is likely to remain modest till such time as IT spending increase materializes across a broader set of verticals or contribution from digital

increases to a reasonable portion of overall revenues. Nasscom indicates that digital revenues will be between 15 and 20% of industry export revenues. Recovery in any case will be uneven, with companies which invested in digital services the only ones that will have revival in growth rates in future.