The brand name Sintex is ubiquitous with Indian rooftops. Wherever you go, you are greeted with the sight of Sintex storage tanks mounted on independent houses, highrise buildings and offices. Sintex started off as a textile player but, in 1975, moved to plastics business. The company’s prime business is segregated into building products (BP), custom mouldings (CM) and textile. Sintex’s 78 per cent revenue is derived from different segments of plastic. The BP business includes prefabs, monoliths, storage tanks and containers.

The CM division caters to industries such as automotives, electrical appliances and power, including wind turbine and defence. Under the textile division, it specialises in men’s structured shirting.

Number crunching

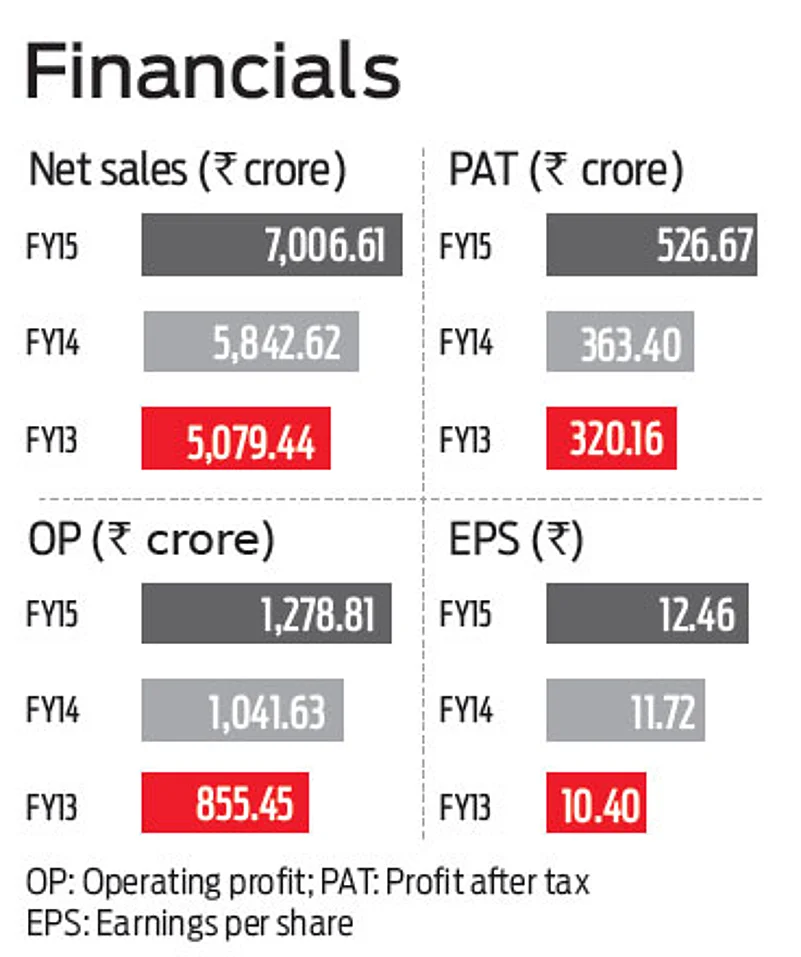

Sintex’s topline has grown at a compound annual growth rate (CAGR) of 16.5 per cent over FY 2012-15, while it delivered a net profit CAGR of 19.9 per cent during the same period. Its consolidated profit witnessed a growth of 35.7 per cent y-o-y in the quarter ended September 2015, driven by strong revenue growth in plastics as well as textiles businesses. Revenue grew by 13.7 per cent to Rs.1, 912 crore in the said quarter against Rs.1, 681 crore in the same quarter last year.

The plastics business, which adds 75 per cent to the total revenue, gave a good performance during the said quarter, with revenue rising 22 per cent to Rs.1, 632 crore. The textile segment, which accounts for 10-12 per cent of the revenue, saw a 35 per cent growth at Rs.233 crore.

Going forward

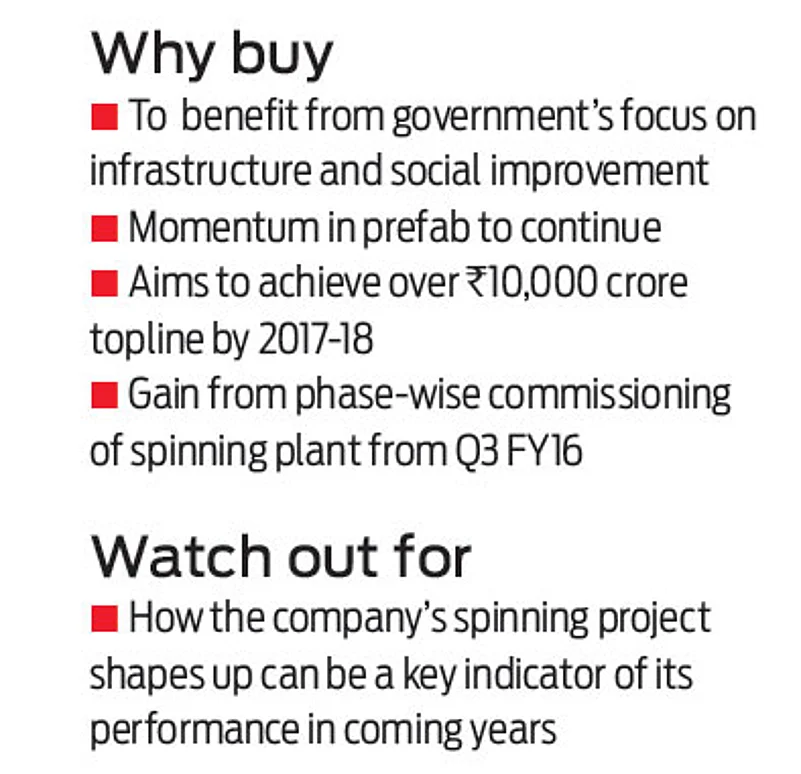

The company aims to be a global market leader across its product range and is striving to achieve over Rs.10,000 crore topline by 2017-18. The company’s business model is strongly related to the macro outlook and boost in government spending. Going ahead, Sintex is expected to grow in the value-added segments by focusing on innovative products relevant to the domestic market, and increasing its penetration by providing solutions across global and diverse technology footprints.

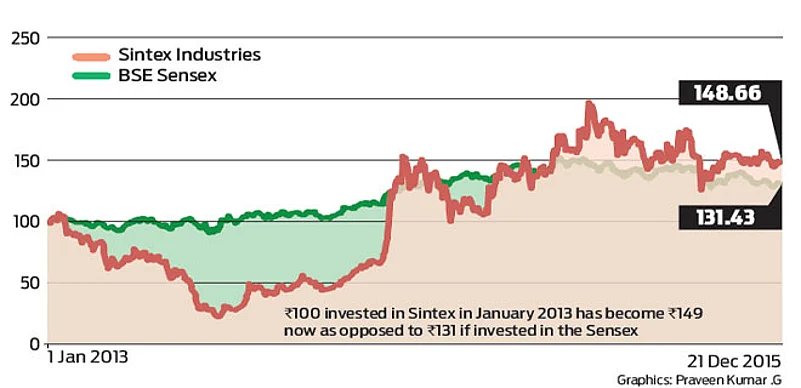

The stock has witnessed a return of 49 per cent since January 2013. Earning per share (EPS) for the quarter ended September 30 stood at Rs.2.88. Investors with a medium-to long-term outlook should view the scrip favourably.

The article first appeared in Outlook Money January 2016 issue.