Established in 1979, AIA Engineering is the second largest producer of high chrome mill internals (HCMI) in the world. The company manufactures grinding media, liners and diaphragms, collectively known as mill internals. Mill internals are used for crushing and grinding in cement manufacturing, mining and thermal power sector. These are the core sectors from an economic standpoint and, therefore, market prospects are linked to the requirement of these industries.

The company enjoys global presence with sales and services support in more than 95 countries. AIA primarily operates in only one segment—manufacturing HCMI. The advantage for AIA lies in its technical expertise along with limited competition and customer stickiness. Although mill internals contribute just 1.5-2 per cent to the production costs in cement manufacturing and around 10 per cent in mining, they are higly significant as product failure could result in hampered production.

Favourable indicators

AIA’s effective capacity towards the end of 2013-14 stood at 260,000 metric tonnes, the company having successfully completed the brown-field expansion project at its Moraiya plant. AIA aims to expand its capacity to keep up with the increasing demand and is on course to implement its capex plans for FY15 and FY16 in order to effectively augment the total available capacity from the exiting 2.60 lakh TPA as on March 31, 2014 to 4.40 lakh TPA by March 31, 2016.

The company’s total revenue clocked compound annual growth rate (CAGR) of 21.3 per cent from FY11 to FY14. The resultant profit after tax

(PAT) recorded a CAGR of 21.1 per cent over the same period. For the quarter ended December 2014, the consolidated net profit rose by 74 per cent to Rs.115.04 crore as against Rs.66.23 crore during the same quarter in 2013.

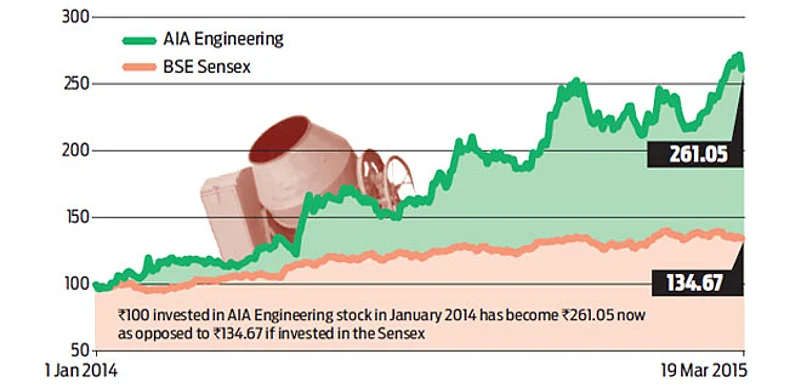

As of FY14, the company has a low debt-equity ratio of 0.07 per cent. India accounts for 25.15 per cent of its total sales. Starting January 2014, AIA has given 158 per cent returns till date. Further, the company’s plan for capex along with sound technical expertise and a strong debt-free balance sheet suggests good prospects for investors with a long-term horizon.

This story first appeared in Outlook Money April, 2015 issue.