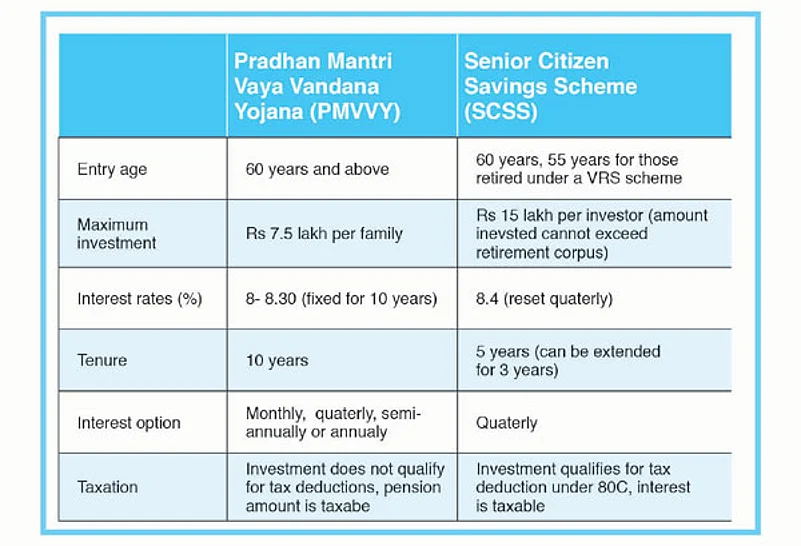

At a time when interest rates on small savings schemes are falling, the recently launched Pradhan Mantri Vaya Vandana Yojana (PMVVY), a pension scheme launched by the Life Insurance Corporation of India (LIC), comes as another option for senior citizens looking for a regular pension income. Here we take a look at the features of the scheme and whether you should invest in it.

What it offers

With interest rates heading south and expected to go down even further, the guaranteed 8- 8.3 per cent for 10 years is a plus point. This is how it works—on investing a single one time amount, also known as the purchase price, one can choose to receive pension over the next 10 years at a chosen frequency, which could either be monthly or quarterly or half-yearly, or yearly.

The interest rate depends on the mode of pension one chooses. Those choosing the annual pension option will get the highest returns at 8.29 per cent, while those choosing the monthly option will earn a return of 8 per cent. “The purchase price changes based on the option you choose. The interest rate varies because the compounding factor comes in due to the mode of payment chosen” says Amit Suri, CEO and Chief Financial Planner, Aum Wealth Management.

The total investment limit per family is Rs 7.5 lakh. This means with a maximum investment of Rs 7.5 lakh one will get a monthly pension of Rs 5,000 for 10 years at 8 per cent per annum. For an annual pension of Rs 60,000, the amount invested needs to be Rs 7.22 lakh at 8.29 per cent.

The pension will be payable through NEFT or Aadhaar enabled payment systems. In case the annuitant dies in the ten year period, the purchase price is paid to the nominee/legal heir.

There is also an option of early exit in the case of an emergency like critical/ terminal illness of self/spouse where the surrender value payable will be 98 per cent of the amount invested. One can also avail a loan of a maximum of 75 per cent of the invested amount, after completion of three years.

Should you invest?

Looking at alternate investment options, the Senior Citizens Savings Scheme (SCSS) with tenure of five years currently offers a return of 8.4 per cent per annum and the maximum amount that can be invested is Rs 15 lakh for each spouse. So the total amount invested can be Rs 30 lakh.

One needs to understand that the maximum pension one can earn from PMVVY is only Rs 5,000 per month, which is very little and will cover only a small fraction of post-retirement expenses. “Many people looking for an income in retirement have substantial investments in bank fixed deposits which offer a return of maximum of 7- 7.25 per cent. They should move a maximum of Rs 7.5 lakh to the PMVVY scheme to lock in the interest at 8 per cent over the next ten years,” says Suri. He adds that the requirement of every investor is different and one should have a portfolio with a mix of the PMVVY and SCSS and mutual funds. “To get inflation adjusted return over a longer time horizon one should also invest in Systematic Withdrawal Plans (SWPs) of debt and balanced funds which are likely to give a return of 7-8 per cent and also see a capital appreciation.”