No one plans to get sick, yet chances are at some point between age 25 and 50, you would have made a trip to the hospital costing you upwards of Rs 50,000. If you contract dengue or anything that leads you to hospitalisation for a few days, add few more thousands to the aforementioned amount. Owning a health insurance policy is not only a must, it is also your ticket to financial cushioning without which you could find your savings being depleted. Increasing healthcare costs and complications means you need more than a single policy to manage the financial implications of hospitalisation.

At 28, Mumbai-based Roshan Bhagat has made sure that he has a health insurance that covers his wife and 18-month-old son for Rs 3 lakh. "It is a floater for all three of us for which I pay Rs 16,000 annual premium, which is sufficient at the moment. I will increase the cover later," he says. Most people who understand the need for health insurance and fidget over the premium end up paying more. Health insurance is more than just paying the premium; it also means knowing what the policy covers should you experience a crisis.

Selecting a plan

If you explore the available health insurance policies, you are likely to come across individual health insurances, top-up plans, critical illness, floater, senior citizen plans and more. Making a choice can be an arduous task unless you know the basic features of each of these options (See: Healthcare menu). Taken in right doses, chances are you will have a rock solid protection to financially fight any health related issues. Despite all the options, there are more people who have no health insurance or have a wafer thin health insurance policy.

"About 38 per cent of the population in the age group of 18-35 years and 60 per cent of the population above 45 years of age are underinsured," says G Srinivasan, CMD, New India Assurance. The pet peeve for most is the premium that one pays for health insurance as many feel it costs a lot. "Premium is a factor of age of the individual, people to be covered under a policy, city in which treatment is to be taken and the kind of hospital they plan to choose in the event of a claim," explains Srinivasan. A tradeoff between the cost of insurance and the type of facilities one is aiming at needs to be made.

"Purchase health insurance at early age when health risks are low. The policyholder will be rewarded with cumulative bonus on no claims each passing year, which adds to the initial sum insured, going up as high as up to 50 per cent of the sum insured," says Rajiv Kumar, managing director and CEO, Universal Sompo General Insurance. Moreover, with time, certain conditions like the waiting period exclusions are over and the policyholder is completely protected at a stage when he is more vulnerable to health risks.

Unlike life insurance, where a ballpark ten times annual income or expenses is a good start point on the quantum of cover one needs, health insurance does not have any such indications. "Every individual's needs vary. Start by listing out the important features that you would look for like disease-wise limits, cost sharing arrangement and waiting periods before looking at the premium," advises V. Jagannathan, CMD, Star Health and Allied Insurance. He goes on to detail why choosing the right insurer is even more important than the policy.

"The past track record of the insurer, especially with claim settlement is crucial," he stresses."Although different families have different healthcare needs, it is advisable for a young nuclear family living in a metro city to consider a family floater policy of at least Rs 10-15 lakh sum insured, as it provides adequate coverage for two adults and two young children," feels Antony Jacob, MD and CEO, Apollo Munich Health Insurance. At a very basic level, most employers provide a health insurance policy that is linked to the employee's hierarchy in the organisation and the salary they draw. This is a good start, and for many it is perhaps their first brush with health insurance in any form.

Although other forms of insurance may lose relevance with time, health insurance is a must for you throughout your lifetime. Whether you are young or old, ill health can hit you at any stage, which is why adequate health insurance is a must at every stage in life. In fact, you should assess your existing health insurance cover every passing year. "We are both in our 40s now and I think the family floater of Rs 5 lakh which also covers our two daughters is insufficient," says Vinay Singh Chaupal. The Mumbaikar is planning to double the cover after having experienced colleagues dip into their savings to tide over hospitalisation expenses.

For those who have missed taking a health insurance early in life, there are dedicated plans for senior citizens too. Yes, the premiums on such policies are high and there are exclusions that come with these policies; yet, if you do not have one, you should go for it. Increasing longevity and high healthcare costs necessitate such plans. "Medical inflation, as on 2015, was as high as 15 per cent, outpacing the average inflation rate. Lifestyle-related diseases are also on the rise, which makes health insurance a must," feels Sandeep Patel, MD and CEO, Cigna TTK Health Insurance. People with elderly parents can buy this policy for their parents.

Smart strategy

As you grow older, the probability of health risks goes up and so does the premium on such policies. While Rs 2 lakh health policy is a good start to fund small hospitalisation costs, it is not sufficient to cover for a serious case such as a heart attack. Not to worry if you have low cover as you can add on covers to enhance the scope of your health insurance policy. You could take a top-up health insurance plan in addition to your existing basic health insurance policy.

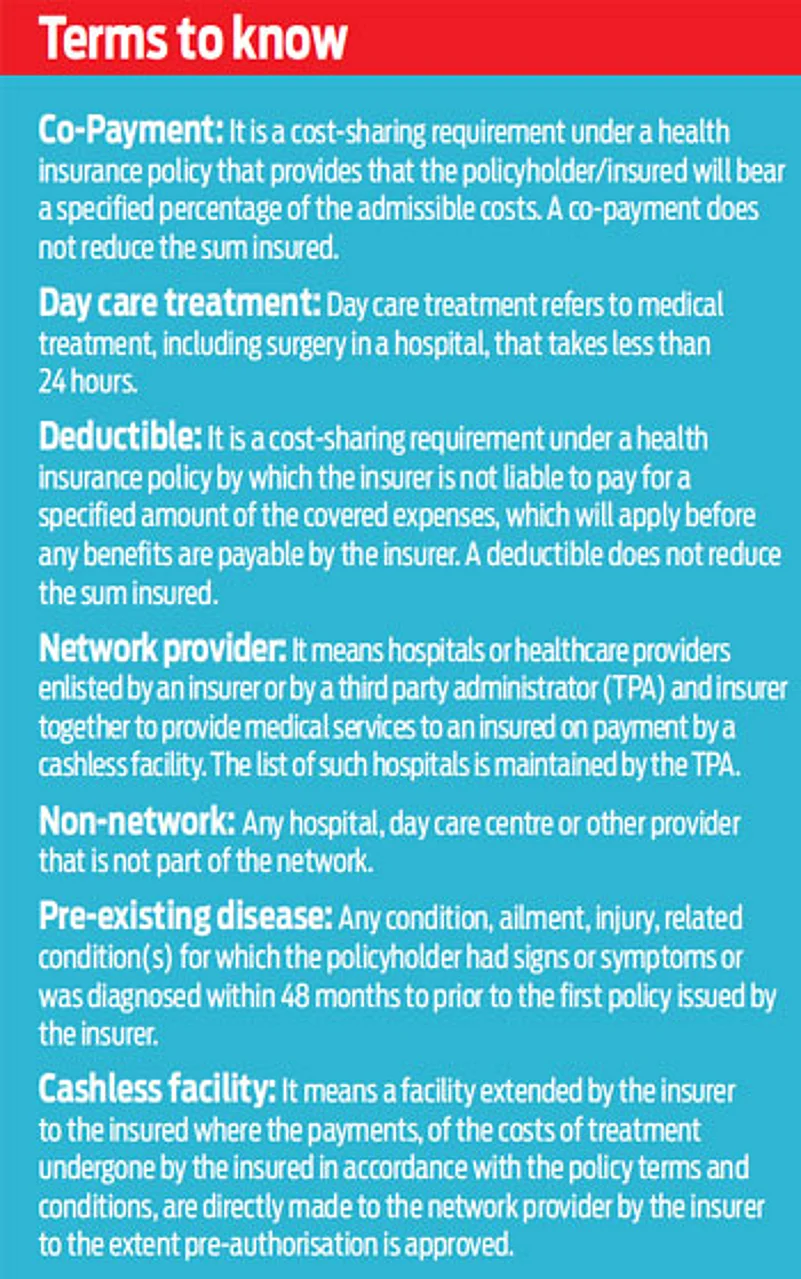

These policies come into action after a basic threshold is breached by your existing health insurance, popularly known as deductible in the insurance dialect. Deductible is the portion of the claim amount that is not covered by the insurer and which you, the policyholder, needs to pay before the benefits of the insurance policy can kick in (See: Essential terms). For instance if you opt for a top-up policy of Rs 5 lakh cover with a deductible of Rs 3 lakh, it means that the first Rs 3 lakh of the hospitalisation bill will have to be borne by you and the remainder by the insurer. What this means is that if you do run up a hospital bill of Rs 5 lakh, you can use your individual health insurance policy to pay Rs 3 lakh and then use a top-up cover to pay the remaining Rs 2 lakh. In similar vein there is the super top-up plan, which is a step ahead of the top-up plan. While top-up plans work on 'per claim' or 'per single hospitalisation' basis, super top-up is useful in case of multiple hospitalisations.

The increasing incidents of critical illness, especially chronic critical illness have also resulted in the launch of disease-specific insurance plans. Today, there are health policies available to address diabetes, cancer and heart-related health issues. With India being the diabetes capital of the world, insurers have come up with dedicated health insurance policies to address this disease. Typically, health insurance was either unavailable to diabetics or was available with stringent exclusions. The diabetes care policies offer insurance cover for diabetes-related complications, which is a boon for diabetic patients, who otherwise are denied health insurance when they need it the most.

Caveat emptor

Having adequate health insurance is one thing; being paid the claim is another. While the cashless claim with health insurance has been in vogue for over a decade, it comes with its share of rough edges. "I was hospitalised and the bill ran up to Rs 12,000 and despite the intimation and reminders, I was denied the claim," says an anguished Pankaj Adlakha. The Gurgaon resident needed hospitalisation in May 2015 and got himself admitted to a leading private hospital where he had no complaints of the treatment. As it was an emergency, it was not a planned admission. The insurer asked him to furnish documents and proof, which he did diligently. However, after a few follow ups, he gave up due to time constraints.

It is not enough to have adequate health insurance policy, make sure that you read the terms and conditions well. You should know whom to call at the time of the need than leave it till the last. Chances are you will have someone else take you to the hospital and get you treated and use the insurance policy; so make sure you maintain the policy-related documents in order and easily accessible for your near and dear ones. Yes, there are instances of claims being delayed and in some cases even denied. However, most such cases are due to mistakes committed by the insured. Do not be a victim of ignorance; know about your policy and its scope to benefit from it when you need it the most.