In his over two-decade racing career, Formula 1 legend Michael Schumacher was never involved in an accident that would have forced him off the circuit. However, last year when skiing in the French Alps, Schumacher met with an accident that left him in coma, from which he is still recovering. That, in a nutshell, is the unexpected nature of accidents. Many a times, the impact of the accident could leave one in a state much worse than death.

Most people tend to have life or health insurance of some form, but they forget to anticipate the risks associated with accidents. While health and life policies do address the risk of illness and death, even they do not take into account the situation that one may land in with an accident. A simple ligament tear can make one immobile for anything between a few days to some weeks. In worst cases, one could face permanent disability. It is here that a little-known insurance policy comes into play—the personal accident insurance plan (PAIP).

Guard against accidents

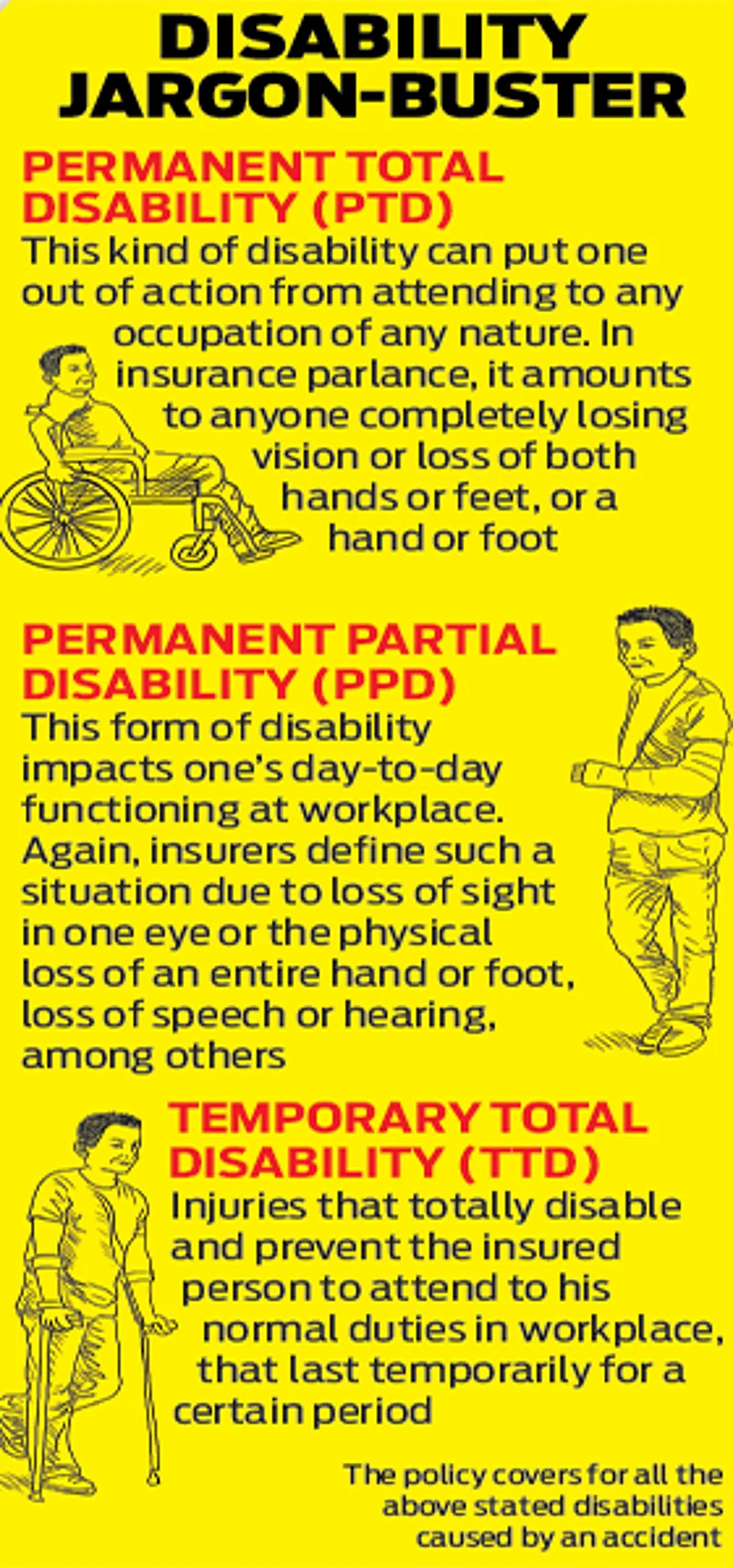

The outcome of an accident could result in death or even lead to a state of total or partial disability. There are different degrees of disabilities that one could face. For instance, one could lose a limb, damage an organ, lose hearing in one or both ears or lose sight in one or both eyes. No need to sound more morbid, but it’s presumably understood the extent to which an accident could affect one’s life. Now, coming back to the insurance aspect, PAIP covers four situations —accidental death, permanent total disability (PTD), permanent partial disability (PPD) and temporary total disability (TTD). As you can see, there is a reverse hierarchy in the degree of complexity with the ac-cident that the policy covers.

Typically, PAIP is sold by general insurance firms. There is, however, a variant that is available from life insurers, which can be added to the policy at the time of buying it. Says Sunil Sharma, chief actuary, Kotak Mahindra Old Mutual Life Insurance, “Life insurers do offer all such riders, and policyholders can pick and choose the combination of riders that meets their needs.”

Both variants come with their sets of pros and cons. For instance, in the case of the general insurer’s accident policies, one has to renew the policy annually, but with a life insurer, it is generally a long-term contract and could be for a minimum of five years.

General insurers offer a robust accident cover, which has a standard cost irrespective of one’s age, but it varies depending on the individual’s risk profile. For instance, a commercial car driver or a courier company delivery boy will find the premiums to be higher compared to a mid-level executive in a bank. This policy is not for everyone. It is most suited for people who have a higher exposure to risk from accidents.

Varying costs

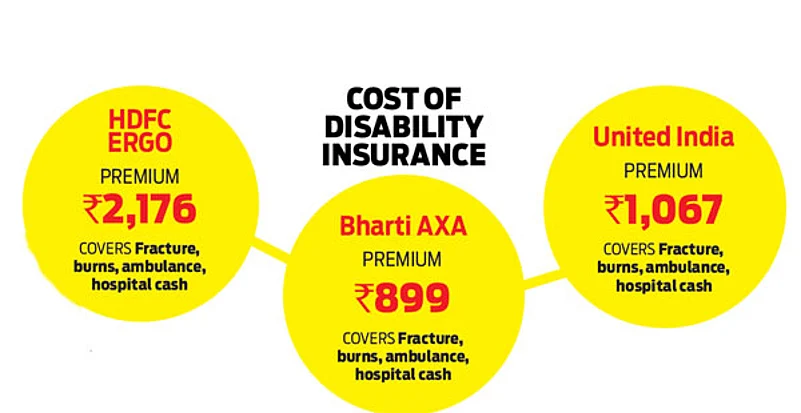

As always, the premium varies from one insurer to another as well as on the scope of the coverage. For instance, the premium would range between Rs 900 and Rs 2,100, depending on the insurer, for an individual taking a Rs 10-lakh coverage under all the four heads. In contrast, the rider option with life insurance plans works differently.

In these plans, for instance, someone aged 30 years, buying a term plan for 30 years at Rs 10 lakh, would pay an annual premium of about Rs 3,000 on the life cover and an additional Rs 650 on accident cover, which covers for only death due to accident. Says Sharma, “Premiums under life insurance are usually guaranteed, but the accident rider from non-life is usually cheap.”

The maximum cover on a PAIP is typically determined by the income of the insured person and ranges between five and six year’s annual income.

Making a selection

While it is important to choose the right cover against the hazards of accident, it is another thing to make the right choice. Says Rajeev Kumar, chief and appointed actuary, Bharti AXA Life Insurance: “Accidentbenefit riders will differ, depending on the benefit and the product attached. There will also be a price difference between any or all of these conditions being covered.”

While premiums on standalone PAIP covers from general insurers are low, one should look for a comprehensive cover that encompasses all the four disability risks. Says Mukesh Kumar, executive director, HDFC ERGO General Insurance, “One should consider parameters such as coverage and payout conditions before buying a personal accident coverage, either as a standalone cover, or, a rider along with a life insurance policy.”

The most important aspect of PAIP is the temporary total disability cover. This is the one that covers instances like immobility due to a fracture. In such cases, the policy covers for a weekly compensation to be paid to the policyholder, subject to medical certification. What it means is that if one is temporarily but totally disabled, the policy would pay a weekly compensation for up to two years, with 1 per cent of the sum assured being the limit for the specified period.

Given the fact that India accounts for about 10 per cent of road accident fatalities worldwide, as per the World Health Organization (WHO), this is the only policy that is a must for a cross-section of people.

Taken for a ride

It is common for insurance agents to sing the virtues of an accident rider to go with your life insurance. While the intent is right, the scope of the cover is pretty restrictive. First, you can add such a cover only at the time of signing the policy. Second, you cannot exit anytime before the end of the policy tenure. So, unlike a standalone PAIP where you have the freedom to decide when you need the cover and drop it when you don’t, there is no such window with the riders. Moreover, in case of riders with life insurers, the maximum accident coverage is 30 per cent of the sum assured.

What this means is that if you have a Rs10-lakh insurance cover, the accident rider cannot exceed Rs 3 lakh. Life insurers also cap the accidental cover to Rs 50 lakh on the outside, which means that even if you wish to add it to your life insurance policy, there is only so much that you can do with these riders.

Given the limitations, it is best to avoid considering adding an accident rider to one’s life insurance policy. Instead, one should go with a PAIP, which for all practical reasons, not only offers a wider coverage, but also gives flexibility to buy it as and when needed.