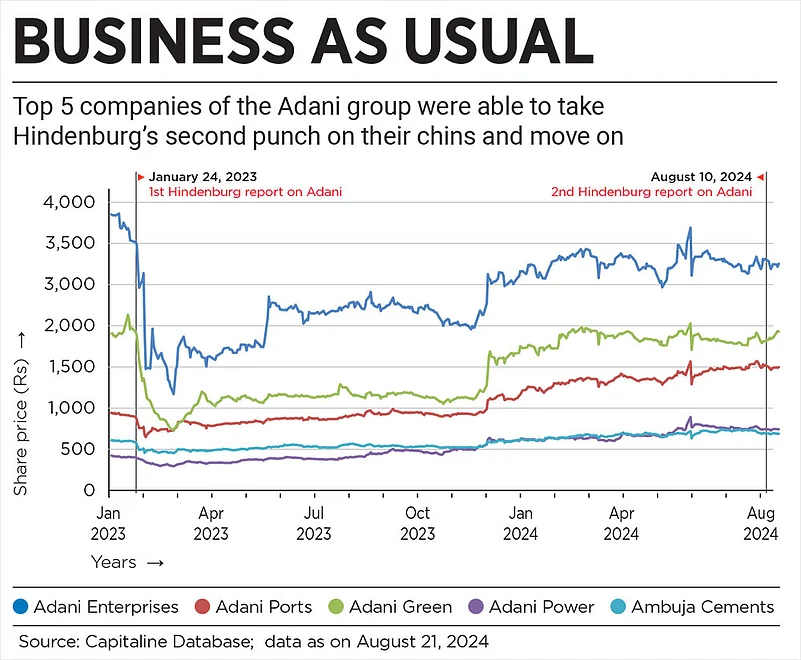

In January 2023, the Adani group was hit hard by a report from Hindenburg Research, a US-based short seller, accusing the conglomerate led by billionaire Gautam Adani of orchestrating “the largest con in corporate history”. The fallout was swift and severe: the group’s stocks plummeted by 50%, erasing $100bn in market value within just 10 days, and forcing the company to withdraw its Rs 20,000-crore follow-on public offer.

Fast forward 18 months, and Hindenburg released a second report, this time questioning the integrity of the ongoing investigation into Adani’s operations. Anticipation was high that the new allegations would once again send the group’s stocks into a tailspin. But reality has defied expectations. Ten days after the report’s release, Adani Enterprises' stocks dipped only about 3%. Unlike the first Hindenburg report, which disrupted the company’s financial plans, the second has so far failed to derail Adani’s fundraising efforts.

Minor Turbulence

In May 2024, Adani Enterprises’ board approved a Rs 16,600-crore qualified institutional placement (QIP), with media reports suggesting the QIP could hit the markets by September. The company is in the process of raising Rs 600 crore through public non-convertible debentures (NCDs), reports say. Despite the latest Hindenburg report, market analysts believe these fundraising plans are unlikely to be affected. Independent market analyst Ambareesh Baliga notes that the Adani group has likely reassured investors about regulatory concerns during prior discussions.

Data shows Fiis have reduced their stakes in Adani’s major companies since the first quarter of 2023

The Adani group is raising funds to support capital expenditure in various projects and to reduce its debt burden. As of the end of fiscal 2024, the gross debt of Adani Enterprises stood at Rs 50,124 crore, with a planned capex of Rs 80,000 crore for fiscal 2025, focused on new energy initiatives and airports. WealthMills Securities’ Kranthi Bathini suggests that both foreign and domestic investors are eager to participate in Adani’s expansion, driven by the government’s focus on infrastructure development. “The fundraising plans of Adani should sail through. The allegations in the Hindenburg report this time would not act as a major hurdle,” according to Bathini.

Adani’s recent fundraising success, including a $1bn QIP by Adani Energy Solutions, supports this view. Adani Green’s $409mn bond issue, which was oversubscribed with nearly $3bn in demand, further underscores investor interest. While the Hindenburg report may impact institutional trust, experts are divided on how it will influence Adani’s performance in the markets.

Cautious Optimism

Institutional investors have remained cautious about Adani group stocks over the past year. Sagar Adani, executive director of Adani Green Energy, acknowledged in a recent interview that the company is working to build trust among analysts and long-term investors. “Our target investors are those that look at a 10-year horizon, or 20-year horizon,” he told Bloomberg.

However, gaining that trust has been challenging. Data shows that foreign institutional investors (FIIs) have consistently reduced their stakes in Adani’s major companies since the first quarter of 2023. FII holdings in Adani Enterprises have fallen from 17.8% to 11.7%, while Adani Ports has seen a reduction from 18% to 15.2%. In contrast, domestic institutions have cautiously increased or maintained their stakes.

Baliga suggests that reports like those from Hindenburg can have a negative impact on institutional sentiment. “They [institutional investors] are not going to rush to the markets to buy their [Adani] shares or change their cautious stance for now,” he says.

Yet, despite the overhang of the Hindenburg allegations, Adani group companies have performed well in the stock market this year. Adani Ports surged 40%, while Adani Green outpaced the benchmark market with a 13% rise. The group’s strong earnings in the first quarter of fiscal 2025 have further bolstered investor confidence.

Can Things Change?

The latest Hindenburg report raised concerns about potential conflicts of interest in the investigation into Adani, alleging that Securities and Exchange Board of India (Sebi) chairperson Madhabi Puri Buch invested in offshore funds linked to Vinod Adani, Gautam Adani’s brother. This claim gained traction given that a Supreme Court-appointed panel had previously highlighted Sebi’s difficulties in tracing offshore funds connected to the Adani group.

In response to these allegations, former finance secretary Subhash Garg has called for Buch’s resignation and a comprehensive investigation into the Adani group. Garg proposes: “A commission of inquiry comprising judges, securities market experts and a previous chairperson of Sebi under the broad supervision of the Supreme Court” to take up the probe. The Opposition in Parliament has also called for a joint parliamentary committee (JPC) to investigate the matter.

However, Shriram Subramanian, founder and managing director of corporate governance research firm InGovern Research Services, believes the allegations lack substance. “The Sebi chair would have made all required disclosures internally on shareholdings and directorships with no conflict of interest. It is not possible for the probe to be compromised in such a blatant manner,” he says.

Investors will be closely watching to see whether these allegations lead to any changes in the ongoing investigation. As Adani group embarks on its aggressive capital expenditure plans, the company will be hoping that the latest Hindenburg episode soon fades from memory. Whether the group's efforts to build institutional trust will bear fruit remains to be seen.