De Beers taught us diamonds are forever. In India, we know that holds true for gold.

Gold is an intrinsic part of Indian culture. Indians grow up listening to the tales from Panchatantra where goodness is rewarded with pots of gold. When Indian women were not allowed to be part of the formal economy due to the pressures of patriarchy, they had but one asset to fall back on—gold.

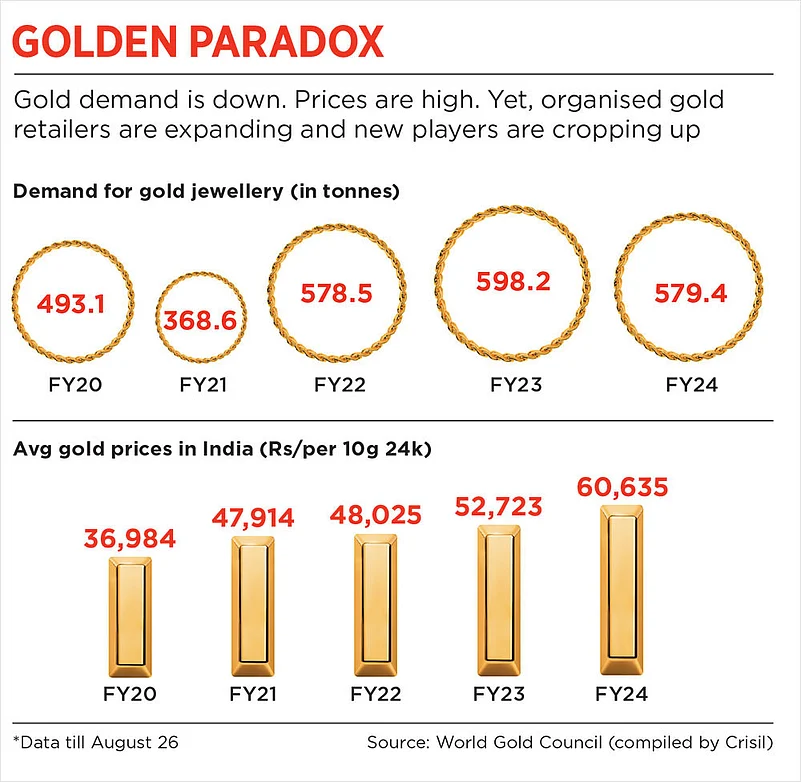

Yet fewer Indians are buying gold right now. Gold demand fell nearly 17% last quarter and gold prices surged 18% year-on-year in June, according to the World Gold Council. The same month, the Aditya Birla Group—one of India’s largest conglomerates—announced its own jewellery brand: Indriya. The group is the most recent addition to a market seeing increasing formalisation at a time when Indians’ household savings are at a historic low and millions of people are taking out whatever little money they have to pour into stocks and mutual funds.

What explains this rising formalisation in a market that is visibly bleeding? One word: trust. Indian retail jewellery brands trust their countrymen to return to stores just as the festival season hits and then the wedding season kicks in. And Indians are willing to pay a premium to trust that the gold they are buying is genuine, pure and hallmarked, the designs they are getting are in line with the latest trends, and that there is assured return on resale.

Experts and branded jewellers seem steadfast in their belief that the stagnating demand for gold is temporary and people will queue up at stores again soon.

Golden Goose

India’s gems and jewellery market currently accounts for nearly 7% of its gross domestic product (GDP). Between 2019 and 2024, the total jewellery market saw a compound annual growth rate (CAGR) of 8% in revenue, according to a report by financial services firm Motilal Oswal. The report projects the market will grow from $75bn in 2023 to nearly $90bn in 2025. The top 10 players in the organised jewellery sector currently control over 30% of the overall demand and nearly 90% of the demand in the organised market.

And this is what is making groups like Aditya Birla foray into gold jewellery retail. “The Indian jewellery market is valued at approximately Rs 6 lakh crore and is projected to grow at 10% CAGR by 2030,” says Sandeep Kohli, chief executive of Novel Jewels—the business that houses the Indriya brand. Kohli adds, “The share of organised retail in this market is expanding more rapidly than the industry average. While the organised segment currently accounts for less than 50% of the market, it is growing at a significantly fast rate.”

Surendra Mehta, national secretary of the India Bullion and Jewellers Association (IBJA), says, “The past few years have seen sustainability standards and hallmarking put in place. Gold is the only product that does not need aggressive marketing in India. All these factors have caught the attention of big brands and created a conducive environment for them to enter the [gold jewellery retail] business.”

Organised gold jewellery retailers are expected to clock year-on-year revenue growth in the range of 17–19% in 2024–25, according to a report by ratings agency Crisil published in May. “It is the value that migrating from the informal to the formal sector has to offer. The consumer preference for trusted brands and the wedding market demand presents excellent opportunities for growth of branded jewellery retailers,” says Praveen Govindu, partner at Deloitte India, a consultancy.

In Brands We Trust

Fifty-year-old Shobha Roy is busy jewellery shopping for her daughter’s wedding. Having bought gold at local retailers earlier, Roy now wants to buy her daughter’s jewellery from big brands with a pan-India presence. Her go-to brands are Tanishq and Kalyan Jewellers. “They offer a great range of choice and pricing as well as hallmark,” she says. She believes that buying gold from these brands would ensure good resale and exchange value.

When Tata group’s Tanishq forayed into gold retail in 1994, it was only one brand amid a sea of local and regional jewellers. Even today, small jewellers make up 60–62% of players in this segment. Sneha Valmiki, a resident of Kolkata who is always on the lookout for new and interesting jewellery designs, says, “The trust we had in our neighbouring jewellery shop and the local goldsmith has now shifted to standardised, hallmarked gold because of the introduction of standardised parameters of quality.”

The success of Tanishq as one of the earliest pan-India players to enter jewellery retail was largely an outcome of this shift. Buyers have moved on to brands because they trust them better.

The lower making charge and competitive pricing of local jewellers have lost out to this. Inspired by Tanishq, many regional players have now taken the pan-India brand-building route.

Local Players Go National

Regional brands in jewellery retail have thus made their way into other parts of the country. Traditionally, jewellery retail has been dominated by regional design preferences as well as regional brands. And even though brands are moving towards a pan-India market, a good portion of the product assortment is curated as per regional design preferences, says Govindu of Deloitte India. But, he adds, geography is no longer a barrier in the sale of jewellery.

This, according to Govindu, is because of the possibility of omni- channel jewellery sale across stores and online. Ramesh Kalyanaraman, executive director, Kalyan Jewellers, says, “Last year, we achieved Rs 130 crore in revenue primarily through our digital channels. Our focus is now shifting to an omni-channel strategy integrating our digital capabilities with physical storefronts.”

The Kerala-headquartered jewellery chain is in expansion mode. In the 2024 fiscal, Kalyan Jewellers launched 58 showrooms under a franchise model. The brand is slated to open 130 new stores this fiscal—80 for Kalyan Jewellers and 50 for Candere, what until now used to be an online offering. “The aggressive rollout of new showrooms will be crucial in driving omni-channel revenue,” says Kalyanaraman.

He says millennials and Gen-Z consumers are now buying jewellery and the company is aligning its offerings through specific expansion in the product portfolio. “Moreover, men’s jewellery is a fast-evolving segment, we have launched Senhor to cater to them,” adds Kalyanaraman.

India's gems and jewellery market is projected to grow from $75bn in 2023 to $90bn in 2025

Similar plans are in the offing for the Kolkata-headquartered Senco Gold and Diamonds. “Senco has established a strong presence in eastern India and is now extending its reach into northern states and beyond, including Odisha, Assam, Bihar, Jharkhand and Delhi-NCR,” says Suvankar Sen, managing director and chief executive of the company. Experts say consumer preferences in gold and precious jewellery have undergone significant shifts, especially in response to soaring gold prices. As a result, there is growing demand for lightweight jewellery that offers value at competitive-making charges. To address this demand, brands have created tailored sub-brands such as Mia by Tanishq and Everlite by Senco.

Senco, Tanishq and Reliance Jewels have all decided to tap Tier-II and Tier-III markets this year, enthused by a positive response from customers in search of quality jewels. While a section of urban consumers buys gold bars and coins for investment, semi-urban and rural markets continue to see a demand for jewellery.

“Middle India’s towns are seeing benefits from better incomes, infrastructure growth and the rise of an aspirational class. This is the trend. Cities with populations below 10 lakh have seen a CAGR of 15%. The overall buyer pool has shifted. Tiers II, III and IV are showing faster growth,” says Ajoy Chawla, chief executive, jewellery division of Titan Company that houses Tanishq.

Lure of Pure Gold

The penchant for quality, price standardisation, transparency and responsible business practices among consumers have spelt gold for branded jewellers. For some, branded jewellery is also a sustainability issue. With a finger on the consumer pulse, branded retailers have been quick to showcase their business depth in responsible procurement and sustainability.

Vaishali Sharma, a sustainability professional based out of Delhi, says, “I want my gold to be procured without any damage to the environment. The procurement must not be done unethically, oppressing and underpaying miners and craftsmen. There are many like me who would be mindful of this.”

Brands are responding to this demand for sustainable procurement. MP Ahammed, chairman of the Malabar Gold & Diamonds, says transparency, sustainability and responsible business practices form core of his company’s operations. “In 2023 we partnered with Rand Refinery—accredited by the London Bullion Market Association (LBMA)—for procuring 100% traceable and ethically sourced RandPure gold," adds Ahammed.

Apart from rules around sustainability and ethical sourcing becoming stricter, the industry is expected to adopt new technologies such as blockchain to enhance transparency and security.

In a society where gold defines everything good, demand slumps are transitory. What sustains is the Indian love for the yellow metal. While the market faces fluctuating demand and rising prices, the commitment of branded jewellers to purity, transparency and innovation will define the industry’s values. As the festival and wedding seasons approach, the resilience of the jewellery market will be tested. But the enduring allure of gold—and the growing trust in branded jewellers—suggest India’s golden tradition is far from losing its lustre.