Over the last couple of years, the Indian Rupee has been depreciating against the US Dollar. This is one of the reasons why Investors want to explore the option of investing in International Funds. Additionally, International funds can also come into the picture when investors diversify their portfolio across geographies.

But first, let us understand what International Funds are and if they are the right choice for an investor.

International Funds are funds that invest in stocks of companies outside India. They basically allow us to invest in international markets and help in diversifying existing portfolio beyond the Indian Stock Market. If one wants exposure to the Global Bluechip companies like Amazon, Google, Facebook or Microsoft, international funds help in doing so. Investors also get to hedge against the depreciation of the domestic currency.

However, having said that, international funds carry their own set of risks like currency risk, geopolitical risk and economic risk that can impact the value of the investment.

The investments made in a foreign country are made in foreign currency. Therefore, there is a currency exchange risk. For example, in the case of the depreciating Indian rupee against the dollar, the depreciation in the rupee improves our returns in the international fund which is US Focused. But if we reverse the situation and consider the appreciation of Indian rupee against the dollar, we would end up making a loss. It is very difficult for laymen to predict the currency movements and it should be done by experts. Hence, if one is investing only to hedge against the depreciation of the Indian Rupee, it would not be a great reason to do it.

In addition to the risks associated with currency movements, international funds expose one’s investments to geopolitical risk. Such risks are country-specific and beyond anyone’s control. It may be worth taking both these risks (Currency risk & risk specific to a particular country) provided, investors are very well compensated.

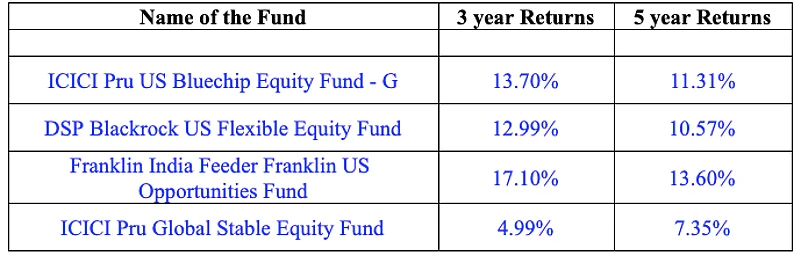

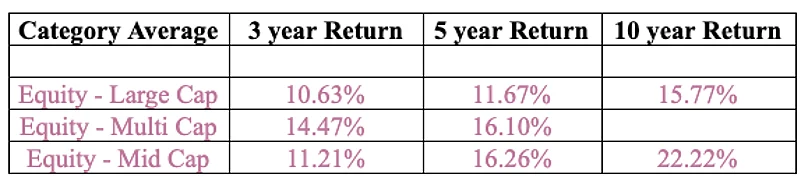

In order to understand this better, let us look at the returns of a few top performing International Funds Vs the Indian Mutual Fund category averages:

The above comparison clearly shows that investors are not well compensated for the risk they have taken by exposing money to other countries. Rather, diversification could have been achieved by spreading investments across different categories of Indian equities only.

Investments in developed economies can pay well only when we are expecting long term slowdown in the Indian economy. Till the time, the economy of an emerging market such as India is doing well, we will continue to see that our markets are performing well in comparison to the developed economies.

The author is Head, Product Development & Planning, Happiness Factory, a Wealth-Tech platform