India Post that functions under the Department of Posts, Ministry of Communications offers a slew of services to customers through a vast network of post offices. There are over 1.5 lakh post office branches spread across the country. Apart from running postal services, India Post offers banking, saving and investment platforms as well.

As a part of the government’s digital India push, India Post started internet banking for its customers in December 2018. Besides, it is working on mobile banking app, which is at the testing stage and will be soon released for the general public. It may be said the launch of digital banking was too late, but given the vast network of post office branches, the launch caught the attention of large number of customers.

Savings bank account

India Post savings account has been quite a hit among the populace, especially for those living in the rural parts of the country. It has helped government fulfill its goal of financial inclusion in letter and spirit, because anyone can get a savings account opened at any of the Post Office branches near them for an amount as low as Rs 20. According to the India Post website, “At least one transaction of deposit or withdrawal in three financial years is necessary to keep the account active.”

MAB and interest rate

The minimum average balance (MAB) needed to be maintained in an India Post savings account is Rs 50, which is meagre in comparison to other banks. You can also receive a cheque book by depositing Rs 500 in your account. For a cheque book account, Rs 500 is MAB required. It offers 4% interest rate, while country’s largest PSU bank State Bank of India offers 3.5% interest for savings bank account. SBI also requires customers to maintain Rs 3,000 MAB in metro cities and Rs 2,000 and Rs 1,000 in semi-urban and non-urban branches respectively. The return on post office savings is determined based on return on government’s small savings schemes. The good part is that through India Post savings account, you can avail all the benefits of many central savings schemes. Interest earned is tax free up to Rs 10,000.

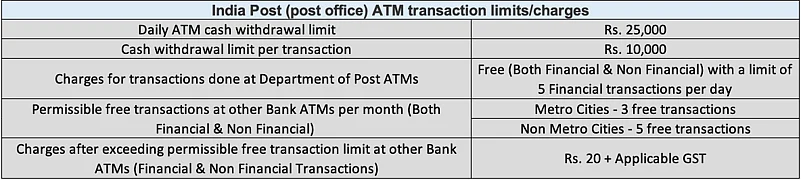

ATM cum debit card charges

The department of post also offers debit cum ATM card for savings bank account holders. A customer can withdraw Rs 25,000 per day using India Post ATM cum debit card. There is a ceiling of Rs 10,000 per transaction. A total of five financial transactions per day is allowed using ATM card. Besides, five transactions in other bank’s ATMs are allowed in non-metro cities. After five transactions, India Post ATM card holders.