Mid-cap stocks belong to companies that fall within the range of mid-sized capitalisation as defined by the Securities Exchange Board of India (Sebi). These companies rank between 100 and 250 of the Sebi’s list of classification with their market capitalisation falling in the range of Rs 500 crore to Rs 10,000 crore. Mid-cap mutual funds are a class of equity mutual funds that primarily invest in the stocks of mid-cap companies. When it comes to making investment decisions, the size of a company can play a crucial role. This is because the size of a company can have a large impact on the risk and the opportunities present in a company. Mid-cap companies are usually those that are still in the mid-phase of their growth cycle. This means that while they have already tested their product or service in the market, their true value is yet to be realised. Consequently, these stocks offer the potential for relatively higher returns. At the same time, due to the uncertainty related to their future performance, these stocks also carry a higher level of risk.

Hence, it is preferable that you consider investing in mid-cap funds only if you have a high risk tolerance and a minimum investment horizon of around 3-5 years.

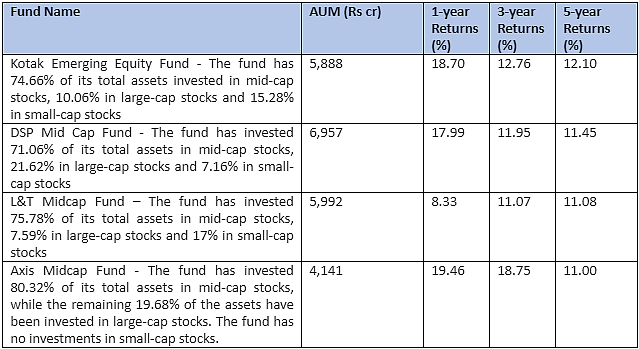

Top Mid-cap funds to invest in this year

Data as on January 23, 2020; Source: Value Research