As per the latest AMFI's data, there are 107 Thematic and Sector funds with Rs 1.09 Lac Crore of Asset under management (AuM) ie, 10 per cent of total Equity AuM at present is in thematic and sectoral funds

Thematic funds invest in industries and sectors about a particular theme eg, Infrastructure, Consumption. Energy, etc. At the same time, sectoral funds invest in companies belonging to a particular sector eg, Pharma, IT, Banking, etc. Thematic funds compared to sectoral funds are supposed to have a broader range of companies and sectors as it is based on a theme. Some of these funds have done well over the last year as the market correction in 2020 due to pandemic and the lockdown helped some sectors to perform better compared to the overall market. Over the last one to one and a half years, some of these funds have outperformed other funds. Hence, we continue to see the constant interest of investors in thematic and sectoral funds based on this near-term performance. There are funds based on Pharma, IT, Banking and Consumer Discretionary which constantly draw the attention of investors at present as well. While performance is one aspect of investing, understanding these funds from a risk and behavior perspective is equally important.

Cyclical Nature

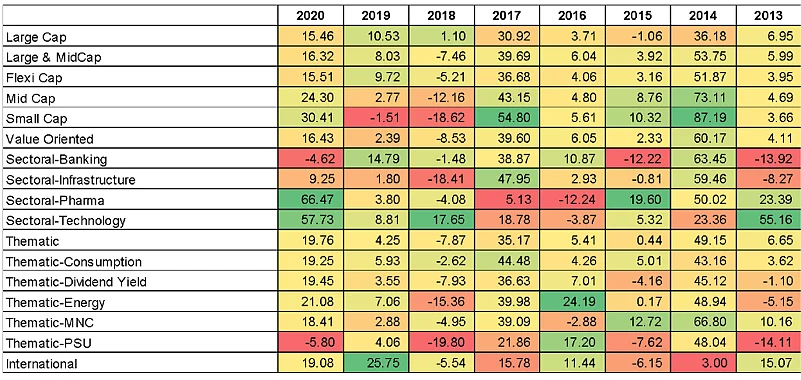

These funds allow you to invest in a particular story or theme that is anticipated to do well over a period. At different points of time, some themes appear to have potential because of various reasons like the current environment, favorable changes in government policies, etc. Sometimes it could be Infrastructure or Consumption or Energy or Healthcare that seems to have the potential of doing well depending on different scenarios. Similarly, if any change impacts the growth prospect of the theme or sector it has its repercussions on these funds and can affect its performance. Hence, these funds are cyclical and can go through multiple cycles of ups and downs. One way to understand this cyclic nature of thematic and sectoral funds is to refer to their calendar year-wise return before investing in it.

From the above table, it is clear how cyclical thematic and sectoral funds can be across different years. The swing in yearly returns (dark red and dark green shades) shows a lack of consistency when compared with diversified funds like Large Cap, Large & Mid Cap, Flexicap, etc.

Limited Companies to Invest

As these funds are based on a particular theme or sector, the universe of companies and industries they can invest in is limited at any point in time. Their portfolio can be concentrated, and it is quite likely that the allocation in top holding companies can be much higher than usual. Both these aspects result in higher risk and volatility for thematic and sectoral funds. Along with it, these funds have a clear mandate to always follow the theme or sector irrespective of right or wrong time to be invested in some of these industries and sectors. Here, equity diversified funds are more flexible and can invest across sectors and industries as per the available opportunities. These diversified funds can also have higher allocation in certain sectors if the fund manager expects them to do well in the future as well.

Should You Invest in Thematic and Sectoral Funds?

Investing is about both risk and return, hence knowing the risk factors along with performance is equally important at the time of investing in thematic and sectoral funds. One should restrict allocation in thematic and sectoral funds as they carry more risk compared to equity diversified funds. A lot depends on which theme or sector you are invested in and which one is expected to do well in the future. The performance is subjective, and it cannot be generalized that all thematic or sectoral funds have equal growth opportunities. Investors who are at the beginning of their investment journey or those who have low and moderate risk appetites should try to avoid thematic and sectoral funds. Even though you may have a higher risk appetite, you should restrict your allocation of these funds.

The author is Co-Founder, MyWealthGrowth.Com

DISCLAIMER: Views expressed are the author's own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organization directly or indirectly.