2024 is a crucial year for the world as more than 50 countries—close to half the global population—elect their next governments, which will have consequences for many years to come

- COVER STORY

2024 is a crucial year for the world as more than 50 countries—close to half the global population—elect their next governments, which will have consequences for many years to come

Market regulator SEBI says there is “froth” in the mid-and small-cap stocks; banker Uday Kotak says there is no bubble. Caught in this cross-current are traders in small towns who are betting heavily in risky derivatives. What is next for the turbocharged Indian markets and what of the retail investors rallying behind it?

While retail investors rushed to make hay as small- and mid-cap stocks shone at the bourses, institutional investors stayed away, guided by traditional wisdom that warned them against the exuberance in the stock market. The mid-March crash, dominated by the smaller segments, proved their point

In her address at the fifth SEBI-NISM research conference on March 12, 2024, Securities and Exchange Board of India (SEBI) chief Madhabi Puri Buch expressed her concerns about the valuation froth in the mid- and small-cap space.

As more investors enter the markets, the palette of investing style becomes more colourful. Each investor brings in their own biases, impulsive actions and assumptions to the markets

Sunil Koul, executive director (Asia Pacific portfolio strategy, global macro research) at Goldman Sachs, in an exclusive interview with Ayaan Kartik and Neeraj Thakur, talks about the valuation situation in India and how foreign investors are looking at increasing their bets in the equity markets

At 8.4%, India’s GDP surpassed the expectations of analysts of almost all dispositions. But are GDP numbers hiding a bleaker story? It is not just the missing private money, there are more devils in the story

In the David and Goliath battle for quick-commerce supremacy, underdogs like Blinkit and Zepto are winning against giants Walmart and Amazon. Instant shopping is not only heralding in a new era of convenience but is also rewriting the rules of the game

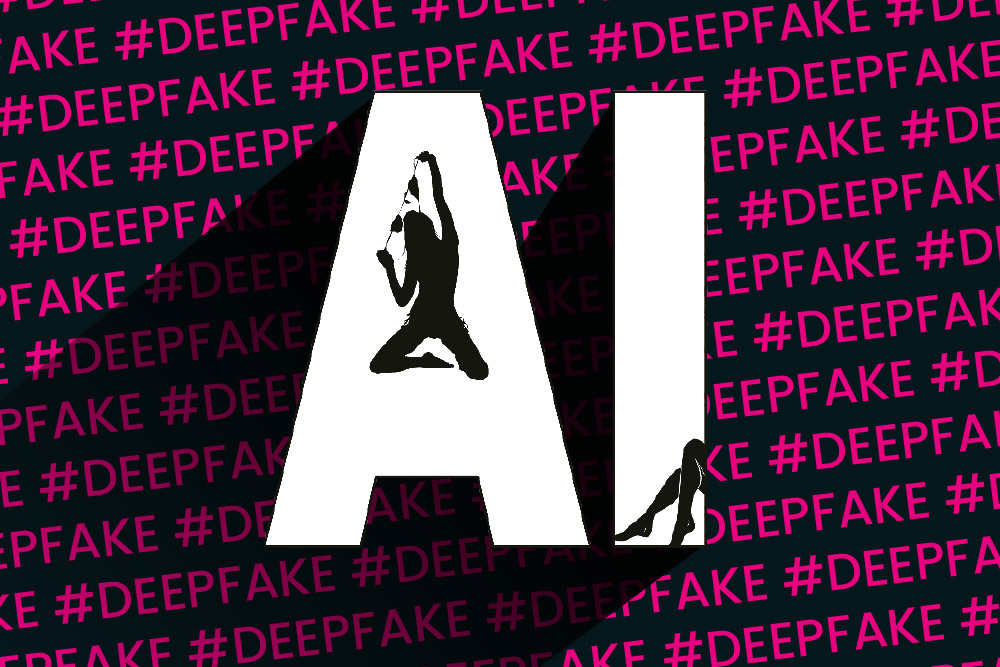

Deepfakes and artificial intelligence-generated images have breathed new life into the porn industry. Celebrities have become the latest victims and revenge porn is on the rise

Firms are popping up to help people and companies plant saplings. Reasons for this green consciousness range from earning carbon credits to a desire to fight deforestation

That is how Anil Bhatt, global CIO of Elevance Health, gets his way in the boardroom and brings about techquity—his coinage for combining technology and equity for the benefit of customers

Partha DeSarkar, executive director and CEO of Hinduja Global Solutions, not only advocates making small adjustments but also taking oneself less seriously to remain happy

2024 is a crucial year for the world as more than 50 countries—close to half the global population—elect their next governments, which will have consequences for many years to come

Market regulator SEBI says there is “froth” in the mid-and small-cap stocks; banker Uday Kotak says there is no bubble. Caught in this cross-current are traders in small towns who are betting heavily in risky derivatives. What is next for the turbocharged Indian markets and what of the retail investors rallying behind it?

While retail investors rushed to make hay as small- and mid-cap stocks shone at the bourses, institutional investors stayed away, guided by traditional wisdom that warned them against the exuberance in the stock market. The mid-March crash, dominated by the smaller segments, proved their point

In her address at the fifth SEBI-NISM research conference on March 12, 2024, Securities and Exchange Board of India (SEBI) chief Madhabi Puri Buch expressed her concerns about the valuation froth in the mid- and small-cap space.

As more investors enter the markets, the palette of investing style becomes more colourful. Each investor brings in their own biases, impulsive actions and assumptions to the markets

Sunil Koul, executive director (Asia Pacific portfolio strategy, global macro research) at Goldman Sachs, in an exclusive interview with Ayaan Kartik and Neeraj Thakur, talks about the valuation situation in India and how foreign investors are looking at increasing their bets in the equity markets

At 8.4%, India’s GDP surpassed the expectations of analysts of almost all dispositions. But are GDP numbers hiding a bleaker story? It is not just the missing private money, there are more devils in the story

In the David and Goliath battle for quick-commerce supremacy, underdogs like Blinkit and Zepto are winning against giants Walmart and Amazon. Instant shopping is not only heralding in a new era of convenience but is also rewriting the rules of the game

Deepfakes and artificial intelligence-generated images have breathed new life into the porn industry. Celebrities have become the latest victims and revenge porn is on the rise

Firms are popping up to help people and companies plant saplings. Reasons for this green consciousness range from earning carbon credits to a desire to fight deforestation

That is how Anil Bhatt, global CIO of Elevance Health, gets his way in the boardroom and brings about techquity—his coinage for combining technology and equity for the benefit of customers

Partha DeSarkar, executive director and CEO of Hinduja Global Solutions, not only advocates making small adjustments but also taking oneself less seriously to remain happy