What does Amul, Procter & Gamble, Hindustan Unilever, Asian Paints, Akzo Nobel, Kansai Nerolac, Shell, Castrol, Cadbury, Vadilal and London Dairy have in common? Apart from being blockbuster brands all of them are clients of the Hyderabad-based Mold-Tek Packaging.

A Rs.275 crore company today, the little-known company started its operations in 1986. The business began with a small project outlay of

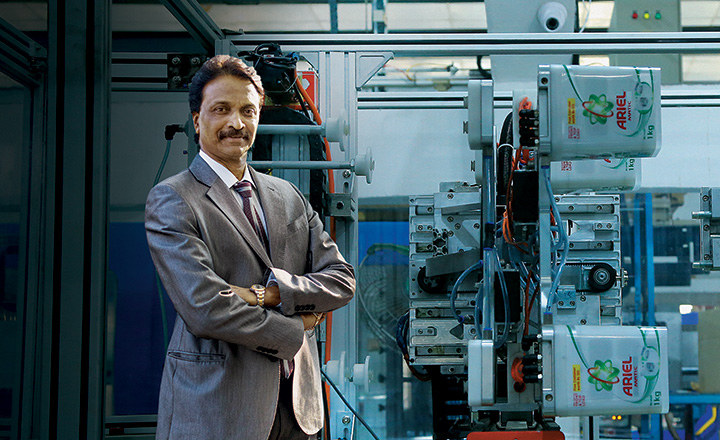

Rs.55 lakh. After passing out from IIM Bangalore in 1982, J Lakshmana Rao along with his uncle started a commercial tool room that manufactured moulds. However, Rao soon sensed there was a bigger opportunity in packaging products and set up Mold-Tek Packaging in 1986.

Finding its feet

In the ’90s, Mold-Tek started developing plastic pails for the paint industry which until then was using metal containers. It didn’t take much time for the paint industry to make the switch to plastic pails and Mold-Tek started raking in a lot of orders from the likes of Asian Paints, Kansai Nerolac and Berger Paints.

The surge in orders called for further investment and expansion, which led Mold-Tek to access the capital market in 1993. A Rs.4 crore public issue was floated to fund the expansion plan of Rs.6-7 crore.

After conquering the paints market, Mold-Tek started to address another lucrative market, lubricants, in 1998. It started supplying plastic pails to companies such as Castrol, Valvoline, Shell and Exxon Mobil which were using metal containers till then. The company came up with innovative features such as the “pull up spout”, locking system and tamper-proof seals. These product innovations were granted a patent in 2007.

A complete package

Rao, however, felt that the physical features in plastic packaging can only be innovated so much and it would be difficult for Mold-Tek to differentiate itself if it didn’t do something different.

So in 2011, Mold-Tek introduced packaging with in-mould labelling (IML) technology in India by importing three robotic systems from Taiwan and started finding ways to backward integrate its IML operations.

The IML process involves injecting a mass of molten polymer against the mould walls where the label is placed. Thereby, both the container and the label are formed in one go. The mould is chilled so that molten polymer hardens rapidly against its surface once it is injected. The molten polymer is injected at a temperature of 270-280° C. Within 20-25 seconds, the cooling takes place and the container and label gets fused. If there is a smaller container, the cooling time is 8-10 seconds.

The final output gives the impression that the artwork has been printed on the container and not labelled after the container is manufactured. Apart from better aesthetics, the process gives the branding longer life than traditional methods such as screen-printing and heat transfer labelling.

The IML labels need to withstand high temperatures at which the molten polymer is injected into the mould and also fuse with the plastic. So, a multi-layer film has to be used with inks and adhesives which are made from special chemicals. As the IML label is multi-layered, the branding of the product also remains protected from scratches and other wear and tear that comes from regular use.

While Mold-Tek Packaging was the first company to introduce IML in India six years ago, Rao was excited by IML as early as the 1990s. “My technical director A Subramanyam and I used to regularly visit ‘Interpack’ since the 1990s. With every passing year, we noticed how IML was increasingly being used in Europe. We knew that it was only a matter of time before IML starts to gain traction in India,” he recalls. Interpack is an annual trade fair for packaging industry held in Düsseldorf, Germany where all the latest technology trends are exhibited.

The prohibitive costs of robotics technology, however, meant that Rao had to wait till 2011 to launch IML in India. In late 2011, Mold-Tek imported three robots from Taiwan by incurring a cost of over Rs.10 crore. To ensure that Mold-Tek is able to increase its capacity in IML without worrying too much about costs, Rao, an engineer by training, started developing the robotic systems in-house along with his team. By the middle of 2012, Mold-Tek had developed 10 robots in-house. Today, the company has 45 robotic systems, including the three Taiwanese robots, and has also developed the capacity to develop in-mould labels in-house.

“After a lot of work in the past 2-3 years, we have stabilised our chemical combination for the labels, both in terms of quality and consistency,” says Rao. But he had to look beyond the precincts of his own company to make the labels perfect. “We hired someone from West Asia who worked in a flexible packaging company and had good knowledge about inks. It took him almost a year to develop the label,” he adds.

The introduction of IML spruced up the company’s profitability significantly. Mold-Tek has seen its profitability improve 560 basis points since FY12 — the year in which it commenced its IML operations. In FY12, the company’s operating margins were 11%, which surged to 17% in FY16 as the share of IML packaging increased from 5% in FY12 to 47% in FY16 (see: Saving grace). Screen printing and heat transfer labelling account for the rest.

During the same period, thanks to the higher margins the company’s profits grew by 24% every year on a rather sedate 12% average revenue growth. Improved profitability helped the company also improve its capital efficiency ratios. Its ROCE has improved from 19.5% in FY12 to 26% in FY16.

Packing more

While paints and lubes industry make for bulk of Mold-Tek’s revenues — 60% and 35% (See: Growth frontiers). Growing exposure to the food and FMCG industry is expected to be the catalyst for its future earnings growth. At present, Mold-Tek’s share from the food and FMCG space is 5%, which Rao says should double in the next year.

Kamlesh Kotak, director of equity research at Asian Market Securities, sees Mold-Tek as a play on consumption. “As the company increases its share in the food and FMCG space, its earnings should see further improvement.” Kotak’s optimism stems from the fact that IML containers command higher margins (around 17-18%) over conventional options such as screen-printing (10-12%) or heat transfer labelling (13-14%). Also, margins in the FMCG and food space are also about 300-400 bps higher at 20-22% than paint and lubricant segments, as IML has some inherent benefits, like the involvement of little or no human contact, which minimises the chances of contamination.

Mold-Tek is already seeing its list of clients in the FMCG and food industry grow. “From 2013-2014, we started making ice-cream tubs and small cups. Now, we have started making products for brands such as Ariel (Procter & Gamble) and Cadbury (Mondelez). We are also working with Haldiram’s and MTR Foods and are also in talks with ITC. From paint and lubes to food and FMCG, we are constantly expanding our addressable market,” says Rao.

Ankit Kedia, director at Manjushree Technopak, who looks after the IML operations of the Bengaluru-based firm, believes IML could grow 25-30% in India in the next five years. “As consumer-oriented companies face stress in their profitability, they will look for premiumisation and packaging plays a key role in making a premium product,” he says.

The fine print

It has taken a good amount of time for Mold-Tek to develop its capacities for IML and its credibility as a reliable supplier will keep increasing as its client list grows.

Developing labels and robotics in-house also help Mold-Tek to keep its costs low. “Manufacturing of robotics in-house is around 50% cheaper and the cost of making label in-house is around 60%-65% cheaper,” says Jatin Damania, AVP-research, Kotak Securities. “In the past three years, we must have saved Rs.12-15 crore for the company by making our own robots,” adds Rao. He believes the ability to make labels holds an even bigger advantage for Mold-Tek. “Importing labels is quite expensive and a recurring cost for the company. We make millions of containers every month and we need as many labels.”

The shift from labour-intensive methods such as screen-printing to the technology-driven IML should also help Mold-Tek to drive more efficiencies in its operations. “Screen-printing used to occupy 70% of our space. Now, we are able to save a lot of space,” says Rao. Screen-printing requires putting one colour on the container and then letting it dry for 4-5 hours and then again putting another colour. The process can take 16-24 hours depending upon the number of colours that are used. “IML has a faster turnaround time,” adds Akhil Parekh, analyst at Nirmal Bang Institutional Equities.

From India, with love

Mold-Tek is not only focusing on India, but also looking overseas. In FY16, Mold-Tek set up a plant in Ras Al Khaimah Free Trade Zone to cater to the IML demand in Middle-East and North Africa (MENA). The plant has already started receiving orders from Shell, Akzo Nobel and RAK Paints. The RAK plant would solely focus on IML technology.

The RAK plant has started getting clearances from some clients. “We are getting clearances from a few dairy companies. Marmum, Al Ain and another three dairy companies have given clearances along with a couple of paint companies,” Rao said. According to him, the company will target customers in Oman, Muscat, Ras Al Khaimah and other Emirates in the UAE from its operation in RAK.

Speaking with analysts during an earnings call post 3QFY17 results, Rao said that RAK’s current capacity utilisation is negligible as the commercial operations only began at RAK in mid-November. The 3,000-tonne capacity would be generating sales of about Rs.50 crore when at full capacity, Akhil Parekh of Nirmal Bang estimates in a client note. By the end of FY18, sales from this plant is likely to be in the range of Rs.20-Rs.24 crore.

Back home, Asian Paints which is Mold-Tek’s largest client is yet to switch to IML. Asian Paints which accounts for 26% of Mold-Tek’s topline (See: Big appetite), is not opting for IML as the company’s policy is to have at least four suppliers. As things stand, there are not many suppliers in the IML industry that match the capacities and experience of Mold-Tek.

However, Rao is confident that its biggest client should also be making the switch over the next couple of years. For now, Asian Paints has opted for containers with heat transfer labelling technology. Mold-Tek is setting up two plants (Vizag and Mysuru) with capacity of 3,000 tonne each to cater to the additional demand from Asian Paints. These plants would be using HTL and screen-printing to meet Asian Paints’ pail requirements. At present, Mold-Tek’s capacity stands at 27,000 metric tonne with overall capacity utlisation at 72%. The Vizag, Mysore and RAK plant should take the total capacity to 36,000 tonne. The plants for Asian Paints are expected to be set up by end of FY18.

How it all stacks up

While globally, share of rigid packaging (22%) is more than flexible packaging (20%), in India rigid packaging commands only 30% share of the Rs.70,000 crore-packaging market. The rest is accounted for by flexible packaging. This explains why larger players in the packaging industry have focused on flexible packaging and not invested in developing technology for packaging using IML technology. Mold-Tek has a share of 20% of the rigid packaging market which includes the likes of Jolly Plastics, Cap Cons, Milan Décor, and Hitech Plast.

Even as the demand is growing at a steady pace, S Satish, vice-president — global sales and marketing at Cosmo Films, which is a supplier of IML label films, says that other Indian moulders have not yet developed IML technology.

Parekh at Nirmal Bang adds that Mold-Tek would continue to enjoy first-mover advantage even if competition were to pick up. “By the time any competition picks up in this space, Mold-Tek is likely to enjoy economies of scale and the low-cost structure due to backward integration will help it to sustain its competitive edge. The relatively smaller market size would also keep larger players out of this segment,” says Parekh.

The company is expected to bounce back from a lacklustre FY16 to post an average revenue growth of 18% over FY16-FY18. Profit growth is expected to be stronger at an average of 34% as operating leverage kicks in on the back of increasing IML share. Analysts see the share of IML packaging in Mold-Tek’s turnover increasing to 60% by FY18. At current market price of Rs.226.65 (as on March 25), the stock trades its one-year forward earnings. With the various growth triggers firmly in place and strong earning visibility, this stock surely looks like one that should definitely be packed in your portfolio.