It is rare to find men like Philipe Haydon in India’s corporate world. The fact that he isn’t a promoter but has still put in 37 years with a company makes him one of a kind. He started off as a medical representative and moved up over three decades to become the company’s CEO in 2007. Go deeper and you will discover that within the pharma-to-FMCG herbal company, longevity isn’t the exception; it’s rather the rule. “Barring personal care, all other division heads are people who have spent decades in Himalaya. The biggest advantage is that there is no change in vision or value system,” says Haydon.

The founder family and also chairman Meraj Manal is known to believe that continuity brings progress. And, the company’s progress hasn’t skipped competition’s attention. “On a monthly basis, our chairman gets one or two offers from MNCs to buy Himalaya. But it is not up for sale, it will never be. It will always remain privately held,” Haydon disappoints the prospective buyers.

Himalaya Drug Company was founded by M Manal in 1934 when he felt that converting the unfriendly powders, mixes, and herbs into tablets can help people take up Ayurveda. Later, when he validated Ayurveda with scientific research, the company also managed to convince medical practitioners to prescribe their medicines, which helped them build their credibility and improve their acceptability Haydon admits that the journey hasn’t been easy, but the legwork paid off. One of its flagship brands, Liv.52, hasbeen a true winner and has been on India’s top 10 OTC drugs’ list for a long time.

The diversification towards personal care and consumer products, seemed like a logical progression. “The transition has been smooth. Healthcare companies have found it easier to get into personal care/FMCG rather than vice versa,” says Haydon.

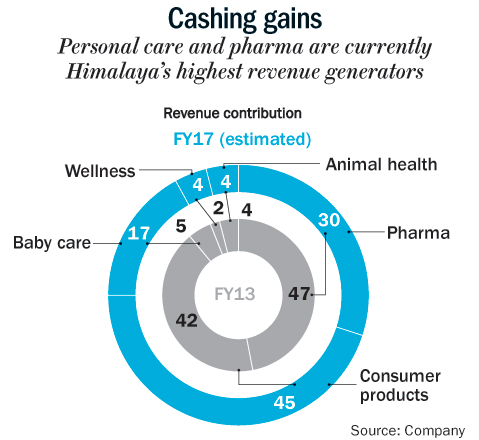

Himalaya’s management decided to diversify towards the end of the last millennium. Haydon reminisces, “We were pretty much a pharmaceutical company till 2001 with 98% of our revenue coming from that sector.” Fifteen years later, things definitely look a lot different. Personal care now contributes 45% to overall revenue, pharma chips in 30%, its new divisions, baby care and wellness, bring in 17% and 4% respectively, while animal health makes up for the balance. (See: Cashing gains) Its India operations alone brought Rs.1,800 crore in 2015-16 and the company is present in over 90 countries across Europe, Middle East, South Africa and South East Asia. It has four subsidiaries in Bengaluru, Singapore, Houston and Dubai, which is its largest overseas market. While the company refuses to divulge its consolidated revenue, the plan is to get to a billion dollars by 2020 with the Indian subsidiary bringing just 50% of the estimated revenue target. “My target for the Indian arm is to get to Rs.3,400 crore by 2020, which I can achieve even by conservative growth estimate of 19%,” says a confident Haydon.

The larger roadmap is to emerge as a leading player across some of its stronghold categories as well as new businesses. Haydon picks up two to three new areas, which can be high growth drivers for the company — “Himalaya’s mother care, which was launched in 2015. We are the first company to build a range around mother’s health (during and after pregnancy), baby care, and also wellness, which is an emerging category in India.”

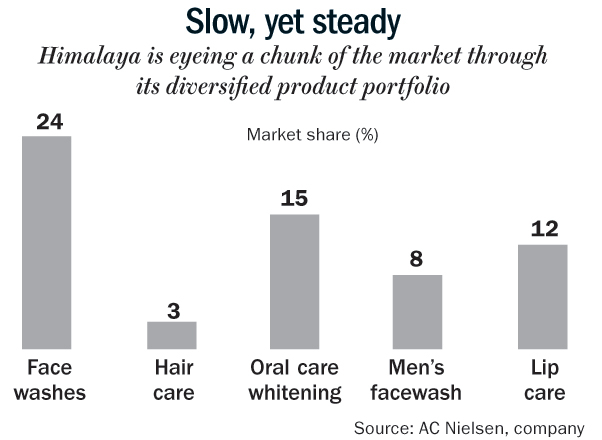

The company is confident that it will be able to replicate its success in personal care in these emerging segments as well. Rajesh Krishnamurthy, who had a long stint with Colgate-Palmolive before being roped in as head of the personal care vertical in Himalaya in 2012, details the strategic shifts during the past four years. “In 2012, this business (personal care) was Rs.400 crore and now, we are at Rs.1,000 crore growing at an average of 25% over the past couple of years. The market share of our facewash was at 17% which has now gone up to 24%,” he glows with pride. Much of this growth also comes from Himalaya’s foray into new segments such oral care, hair care and men’s personal care.

Its Neem facewash, which was launched in early 2000s, rakes more than Rs.500 crore for the company, besides being a market leader in that segment. “When we launched our neem-based facewash, there was no problem-solution product in early 2002-03. As the product found traction at chemist shops, the demand started increasing from general and modern trade as well. From thereon, it became the most preferred facewash brand to use for acne/pimples,” says Haydon.

Himalaya has always built its products around problem-solution, which, according to experts, always works in India — be it dandruff, hair fall or acne in this case. Prateek Srivastava, co-founder, Chapter Five Brand Solutions, who has consulted the company, decodes what could have worked in favour of Himalaya’s facewash, and why it continues to be a cash cow for it.

“With herbal brands, usage experience is not always pleasant. But Himalaya took care of the sensorial aspect as well. They were the first to develop a neem-based product highlighting its quality as an anti-infectant. You want to use a safe and natural product for your face and, over the years, the brand has won over the trust of its consumers,” he sums up.

Baby boom

In a country where the population is over one billion and counting, it is no surprise that baby care is fast becoming a huge market in India, and is currently estimated to be around $14 billion.

While the company forayed into this category in 2004, it has gained traction only in the last two to three years and grew 60% during this period. The category now brings in 17% of its revenue. Its strategy in this segment is very different from its competitors (be it Dabur, Johnson & Johnson or Pampers). “Himalaya is the only baby care company which has not advertised its products; they are promoted only through doctors. So, at the cost of sacrificing some turnover, we are building credibility,” says Haydon.

But what is the game plan to differentiate them in a category that is dominated by homegrown and multinational players? “More than 65% parents prefer to use natural products when it comes to their kids. Our entire range is herbal, that is what makes it unique. Secondly, we want to increase our distribution reach through the medical fraternity, clinics and maternity homes that form 50% of the baby care universe,” says Chakravarthi NV, head, baby care, Himalaya. According to him, more than competition, his biggest challenge is that the product usage life span is three years — both for babies and mother care. “So, we need to be at the right place, at the right time, with the right communication,” he says. And their For Moms range launched in 2015 may just be in time. Srivastava tends to agree. “The Indian consumer is evolving. Mothers also feel that they need to take care of themselves. So, they might be starting this category at just the right time,” he says. The company is also eyeing the Rs.2,000 crore category diapers market, which is one of the fast-growing segments in baby care, thanks to the increasing tribe of working mothers. Despite being a late entrant, Himalaya hopes that its ‘natural’ product will help take on the biggies in this segment — Huggies and Pampers. While it is yet to make a serious dent in this category, it hopes that the soon-to-be launched pant diapers will help it gain market share. Another way in which it is trying to capture the mindset of young mothers is through gifting. “Traditionally, people would gift sweets or gold when a baby is born. Since that’s changing, we came up with nine different gift packs with creams, diapers, wipes, oils and powders for the newborn. These gift packs range between Rs.100 to Rs.675 and contribute 17% to our baby care revenue,” shares Chakravarthi.

All’s well

Haydon is betting big on the wellness category to become one of the growth engines for the company. He says, like in the US, people in India will no longer go to chemist shops for medicines addressing minor ailments. In the next couple of years, he believes that OTC drugs for cold, fever, joint pains, etc will find more shelf space in retail chains and stores. “Our over-35 population is the largest in the world. As you grow older, the need for wellness products increases since one starts worrying about deficiencies, digestion and joint pains. While it hasn’t reached the point of inflection, the brands have to start working to take advantage of that emerging opportunity,” says Srivastava. Keeping that in mind, Himalaya launched a wellness division last year to cash in on this trend when that happens. The company is developing non-prescription drugs for immunity, joint care, women’s health and vitality as well as therapeutic massage oils, balms and creams. It started with 36 products and presently offers more than 56 products in this category.

But what gives Haydon confidence that it’s coming to India? “I have a firm opinion that whatever happens in the West comes to India, sooner than later, and the next big game changer for us is going to be the wellness industry. In the supermarkets of the Asia-Pacific region, wellness forms a large category. The trend is bound to follow in India with the increasing presence of modern format stores.”

Himalaya is working with some key players in modern trade as they crave their niche in this segment. “Today 80% of products are picked up from chemists; we see that trend shifting in the next few years where people will actually go to supermarkets and buy these OTC drugs,” says Haydon. They have set up more than 1,000 wellness zones in retail stores and hypermarkets as a dedicated zone for their products with over 200 wellness advisors trained to help consumers choose the right product.

But it is not an easy segment to be in. While Dabur and Emami may be the old-timers that Himalaya is used to competing against, there is one name that has caught everyone’s attention — Patanjali. Some of Patanjali’s products directly compete with those of Himalaya’s. For instance, Patanjali’s Neem and Tulsi facewash was launched at a 15-20% price discount to that of Himalaya’s. Are Haydon and Krishnamurthy worried?

“So far, we have not seen any impact on our market share. Which is why I am bullish about the loyalty of Himalaya users,” says Haydon. “We expect some of our customers to try out the new products in the market. Since our facewash is affordable and has strong brand equity, we are not worried about losing our customers to competition. We will take necessary steps if the need arises, but we don’t feel the need right now,” adds Krishnamurthy. According to Haydon, the company’s differentiator is clearly their research capabilities which helps them develop products combining both traditional Ayurveda and scientific methods, and the emerging wellness segment is huge enough to accommodate a couple of strong players.

The strategy is also to build a strong portfolio of products in personal care to reduce its dependence on one or two flagship products. Over the next three years, the focus is to build its presence in hair care and men’s care, which has significant growth potential by expanding distribution. “We are present in 1.3 million stores. We want to expand our secondary category distribution for products like shampoo, toothpaste, and winter care,” says Haydon. Typically, the medical and modern trade, where Himalaya is strong, are not the primary channels for such categories — general trade is and the company is working towards it.

The management agrees that they need to catch up on the distribution front. Himalaya stores currently contribute about 4-5% to overall revenue and modern trade makes up for 20%. “There is a two-pronged strategy. We have 110 own-stores; we are ramping them to 200 by 2020. We are also increasing distribution from 1.3 million stores to 2 million by end of next year,” says Haydon.

While the company has been successful in transitioning from being a pharma to a FMCG company, the key to its success will be its ability to carve a niche in the larger segments of baby care, men’s care and wellness, rather than go all out in their pursuit to grab market share from its competitors. After all it was clever positioning of the brand that made Himalaya the success it is today.

Just one email a week

Just one email a week