In India, while we see companies across the board struggling with their environment, social and governance (ESG) performance, the public sector undertakings (PSUs) from strategic sectors like coal, petroleum and power face greater challenges and heavier responsibilities. The actions of these carbon-intensive sectors become critical when it comes to achieving the ambitious national climate targets.

In recent years, PSUs have shown promising performances on ESG indicators. However, the need to manage future risks better and faster is increasing against the backdrop of divestment and privatisation goals, as investors are preferring ESG-friendly assets.

Talking about how those two factors are behind the need to adopt good ESG practices, Avinash Gupta, managing director and CEO, Dun & Bradstreet, says, “It has become critical for PSUs to take a deeper view of ESG performance, monitoring and disclosures and have robust processes to measure and track key performance indicators related to ESG risks.”

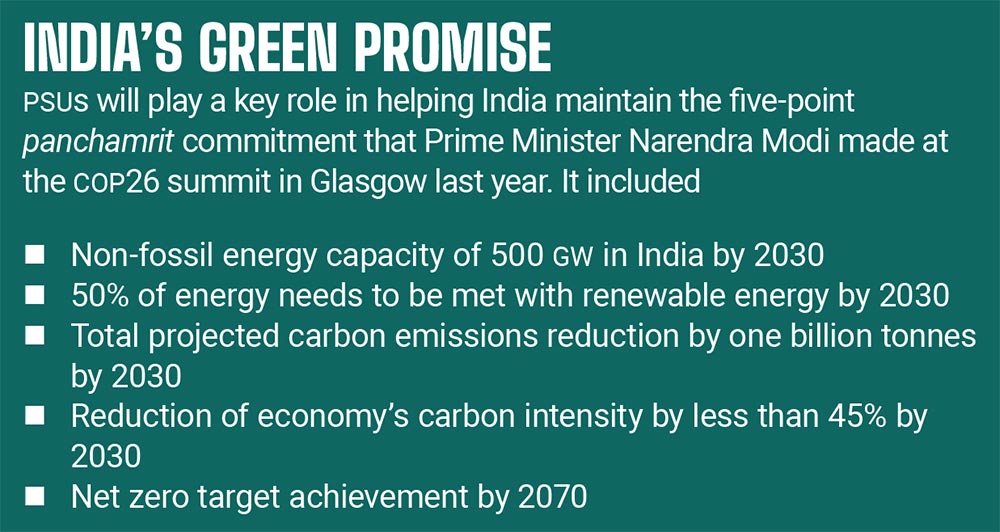

At the United Nations Climate Change Conference at Glasgow last year, Prime Minister Narendra Modi committed India to an ambitious five-point Panchamrit mantra—reaching non-fossil energy capacity of 500 GW by 2030; meeting 50% of energy requirements from renewable energy; reducing the total projected carbon emissions by one billion tonnes; reducing the carbon intensity of economy by less than 45% (all by 2030); and achieving the net zero target by 2070.

Here, PSUs can help. “Given their size and scale, PSUs will be a major driver to [seal] a green new deal. For India to move ahead on its climate goals, it is critical for PSUs to stand up and deliver. The intrinsic expectation today from any business is to adopt sustainable business practices and be a net contributor,” says Gupta.

Mixed Feelings

Two recent studies gave a mixed report card to PSUs on their ESG performance. The latest ESG risk assessment conducted by CRISIL, which covered 586 companies, including private sector companies and PSUs, found that the latter are ahead on the social front, almost in line with private firms on the environmental front but lag on governance parameters.

The CRISIL report also said that while PSUs score better on social aspects like gender diversity, attrition and pay ratio between CEOs and median employees, they typically do not have a mechanism for measurement for environmental metrics, such as emissions, water and waste generation or disposal, among other things.

These inferences were corroborated by another study done by ESGRisk.ai earlier this year, which looked at 603 top NSE companies, including 539 private sector companies and 64 PSUs. It revealed that PSUs are lagging as far as environmental and governance criteria are concerned.

Sankar Chakraborti, chairman, ESGRisk.ai, says, “The key issues where PSUs are not performing well are reduction in greenhouse gas emissions and waste management. Setting energy, water, emissions and waste targets for Sustainable Development Goals is a challenge for PSUs.” But, he adds, PSUs are adopting net-zero pathways and diversifying their portfolios now.

There is no reason why PSUs cannot catch up, says Suresh Krishnamurthy, business head, research and infra advisory, CRISIL. “A well-chalked-out strategy for decarbonisation can help many of the PSUs improve their benchmarking vis-a-vis private firms on many of the environmental parameters,” he adds.

Course Correction

PSUs are already reducing their consumption of fossil fuels, diversifying into renewables and reducing emissions.

Atul Sobti, director general of the Standing Conference of Public Enterprises, an apex body of the public sector enterprises (PSEs) in India, explains how they are embracing ESG: “PSEs adopt ESG in spirit when they sign a memorandum of understanding with their administrative ministry at the beginning of each financial year, wherein the parameter of environment sustainability carries varied weightage depending upon the relevance of the PSE in ensuring sustainability and environmental impact. This parameter is amongst the significant list of parameters for performance evaluation of PSEs at the end of the year.”

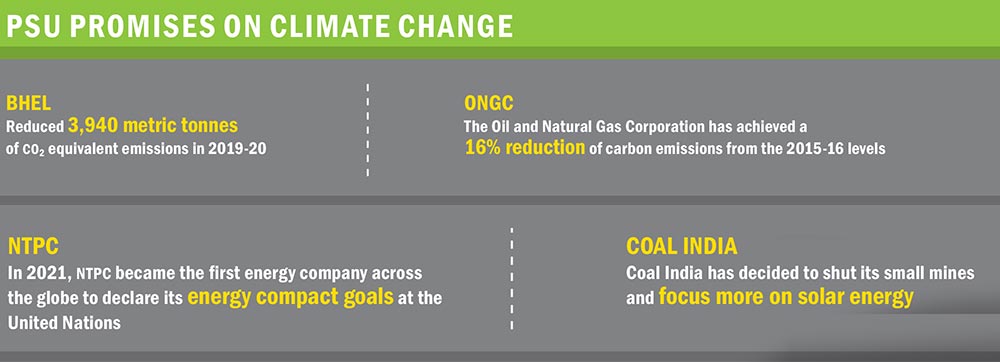

The numbers and the spirit match up. As Sobti mentions, Bharat Heavy Electricals Limited reduced 3,940 metric tonnes of CO2 equivalent emissions in 2019-20. The Oil and Natural Gas Corporation has achieved a 16% reduction of carbon emissions from the 2015-16 levels. In 2021, the National Thermal Power Corporation Limited (NTPC) became the first energy company across the globe to declare its energy compact goals at the United Nations. Coal India has decided to shut its small mines and focus more on solar energy. The list goes on.

Quoting the examples of renewable energy forays of the NTPC and the National Hydroelectric Power Corporation, Prarthana Borah, director, CDP India, the Indian arm of the not-for-profit charity that runs the global disclosure system, says, “From the data we have analysed on PSUs reporting to the CDP as well as our experience interacting with sustainability departments in PSUs, what comes out very strongly is the interest and transition that are planned towards renewables.”

Having said that, Borah also points to the aspect of shifting to more efficient processes in the current PSU assets. “This is an area that still requires much intervention. In this context, it may also be mentioned that PSUs do not have a clear strategy for assessing climate risk and even if they do, it does not come out strongly in CDP data that was assessed,” she adds.

Addressing environmental challenges can also be an opportunity to strengthen performance on social and governance indicators. Ashwini Hingne, senior manager in the climate programme at the World Resources Institute, says, “PSUs need to look at the current low carbon transition as an opportunity to create good quality livelihoods, improve their governance practices to ensure that transparency, accountability and inclusion strengthen the ways in which they do business.”

Communicate, Collaborate, Commit

Both Krishnamurthy and Chakraborti agree that disclosures are important to do well on the ESG spectrum. Krishnamurthy says that disclosure is an issue in many PSUs. “Companies with poor disclosures score lower on the ESG scorecard. Typically, the quality of disclosures is poor in the case of companies that have not adopted a well-laid-out ESG strategy,” he says.

He also says that PSUs are lagging behind on governance mainly due to frequent appointment of directors, bunching up of retirements, changes in leadership and lower number of independent directors on board. Also, most of the independent directors are affiliated to the government in one form or the other.

Setting board-approved policies is a challenge for PSUs, says Chakraborti, adding that in corporate governance, transparency and voluntary disclosures are critical when adopting ESG practices. “ESG covers issues ranging from a company’s target on climate change to setting policies on data privacy and security. Companies performing well in their ESG practices have a better ESG risk management framework that involves disclosures, initiatives, strategies and targets,” he explains.

With the Securities and Exchange Board of India making business responsibility and sustainability reporting mandatory from FY2023, the top 1,000 companies will have to get their ESG act together sooner rather than later.

These challenges, however, are not unique to India, as found in a recent report by Oxford Economics and SAP titled Closing the Green Gap: Corporate Sustainability Goes from Commitment to Impact. The report said that the way forward for organisations included formulating a clear plan, communicating to the employees who can then translate the vision of the top management to action, setting clear goals, integrating processes, technologies and data, developing strategies with inbuilt sustainability, involving customers, partners and suppliers and harvesting data to measure and manage ESG performance.

PSUs are also better placed to work together in their ESG pursuit as synergistic action to achieve shared goals promises better and quicker results. “Collaborative approach among PSEs in various areas such as joint technological development, especially in areas of climate change, sharing of resources, knowledge and experience can further enhance their performance in ESG,” says Sobti.