I have a lot of emotional connect with Seedfund because I took my first step as an entrepreneur under their guidance,” says Phanindra Sama, co-founder, redBus. It all started in 2006 for Sama when redBus was selected by TiE Bangalore for mentorship in a workshop held by them. To mentor redBus, TiE Bangalore made an announcement to all its charter members, one of whom was the effervescent Bharati Jacob, founder-partner at Seedfund. She got in touch with redBus and asked them to tell her more about their business plan.

“In the first meeting, we said we needed Rs.30 lakh as funding — we were so naïve, we thought this was a huge amount,” smiles Sama. “Then, Bharati sat with us and did seven iterations of our business plan before finally arriving at Rs.3 crore as the funding we required.” Not only did Seedfund supply the money in 2007, Mahesh Murthy, another Seedfund founder-partner, helped redBus redesign its website. Sama says the changes were so good that the site remains untouched till date. redBus saw its revenues grow to Rs. 350 crore in FY12, when it turned profitable at last. Seedfund has seen redBus through this entire time, pitching into subsequent rounds of fundraising as well. For Sama, it was not just the money – he says it was Seedfund’s collaborative spirit that helped build redBus.

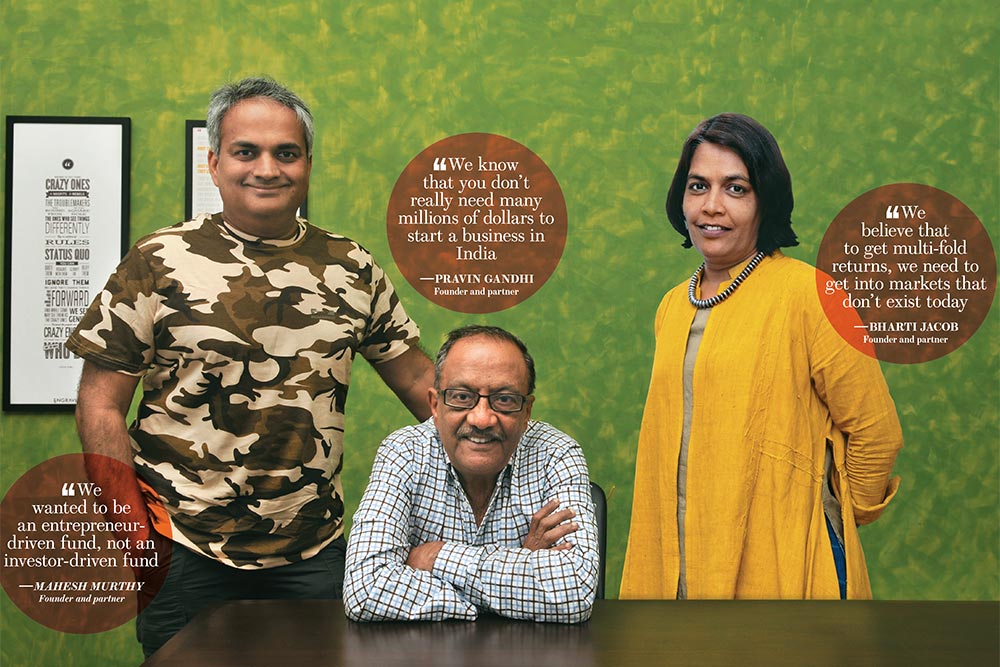

What sets Seedfund apart is the fact that it got into early stage investing years before it became fashionable to invest in pre-revenue start-ups. Moreover, unlike some investors, the founders knew a thing or two about running a business.

Pravin Gandhi had co-founded India’s first IT company, Hinditron Computers, in 1972 (subsequently merged with Digital Equipment Corporation in 1988). Murthy has over 26 years of experience in marketing and communications — this included running Channel V in India, and starting Pinstorm, a digital advertising firm. Both had stints in early stage investing: Infinity Ventures (Gandhi, 1999) and Passion Fund (Murthy, 2000).

Because they were both passionate about early stage funding, they invariably found themselves on the same panel, judging business plans or giving ‘bhashan’, as they called them jokingly, on building companies ground up. They quickly realised they spoke the same language and Gandhi got Murthy to help out in some of Infinity’s start-ups such as IndiaGames and BrainVisa. It only made sense for them to come together and launch a fund when Infinity Ventures wound up in 2005. They roped in Jacob, who had worked with Gandhi at Infinity, because they knew they needed a presence in Bengaluru. After a stint with Lazard where she set offices for them in Chennai and Bengaluru, Bharati rebooted with Infinity Ventures in 2000.

Seedfund’s investment strategy was born from the lessons its founders had learnt in their previous investing stints. They knew that if entrepreneurs raised too much money at an early stage, the chances of failure were much higher because there’s always the pressure to expand quickly and show results even before the different legs of a business model have been figured out completely. “In the dot com era, VC funds failed because they over-invested in Indian firms,” says Gandhi, founder-partner. “They would invest $2-3 million according to US standards. Having set-up businesses on our own, we knew that you don’t really need so many millions of dollars to start a business in India but we were not completely confident to say we would break the mould.”

What was clear in 2006 though was that Gandhi, Murthy and Jacob wanted to prove that early stage investing could be profitable, that it doesn’t require a lot of money to build great companies. They believed that with the right team and space, they could build a great company with a little money and a lot of mentoring. “We wanted to be an entrepreneur-driven fund, not an investor-driven fund, and we wanted to make early stage investments in internet, telecom and mobile,” says Murthy. When the partners raised their first fund in 2007, the idea was to bring in more strategic investors (rather than financial investors) who added significant value to their portfolio companies. So they raised $15 million from marquee investors like Google, Motorola, Reliance ADAG, Sierra Ventures and Mayfield, and looked to invest anywhere between $0.5 million to $1.5 million in each venture they picked.

Taking the lead

Seedfund’s founders also decided that they would invest in companies breaking new ground in unorganised domestic sectors. “We don’t do momentum investing,” says Murthy. “We don’t have a copy-paste model because the US model will not work in India. We want the company to be the number one in the industry, not number two or three.” In fact, many of their investments — redBus, Vaatsalya, Carwale — are companies that became leaders and redefined the sector around them. For instance, there was no concept of low-cost healthcare in the country before Ashwin Naik and Veerendra Hiremath, both doctors, pioneered the concept of low-cost hospitals in tier 2 and tier 3 towns — Vaatsalya now has 17 hospitals across Karnataka and Andhra Pradesh. They hope to increase their network to 20 hospitals with revenues of Rs.70-75 crore by the end of FY13.

Because Seedfund’s portfolio companies are market leaders, they have to spend less on fighting for market share, which gives them more time to sustain the competitive advantage they have built for themselves. “We are not a large fund,” says Jacob. “Once you get into a war for market share, it becomes a capital game. We believe that for us to get multi-fold returns, we need to get into markets that don’t exist today.” So, the fund looks for firms that are not only capital efficient but also have the ability to breakeven within 18-24 months. And Gandhi adds: “We cannot be dogmatic about managing costs but if the world collapses you can still stay afloat, and make money when the cycle turns.”

Exit returns are also improved by betting on a market leader. “Exit is a long road for an angel or early stage investor,” Gandhi points out. “Typically, you stay on with the company till Series C funding [third round of venture financing] is in place because, if you exit before that, the other investors may think something is wrong with the startup” Strategic buyers, too, shell out top dollar only if a company has a distinct lead over its peers. That’s exactly what happened in the case of Carwale, the country’s largest automobile classifieds portal.

The India Today Group and the German media firm Axel Springer bought a majority stake in the firm. Seedfund invested $0.7 million in 2006, and made a 9x return on exiting in 2010. There are other exits as well but not quite in the Carwale league. Seedfund invested $0.9 million in online financial services website Rupeetalk in 2009, which it sold to NetAmbit in an all-stock deal in 2010. Its photo sharing site, Lifeblob, was bought out by another portfolio company, Printo. Seedfund also exited personal health records portal Mumbai-based Healthizen and Saas startup Uhuroo. As some of the investments didn’t quite scale up the way they were expected to, it made better sense to exit.

Building brands

Seedfund’s partners agree that they prefer consumer businesses even though they are sector agnostic. “In a B2C business, you get to create a good brand and, if done well, you can get a non-linear return,” notes Jacob. “That’s why there is a bias toward B2C businesses.” For instance, Seedfund picked up a stake in after sales service company, Jeeves Consumer Services, in early 2012 — Jeeves Home Care offers a single annual maintenance contract (AMC) for all your electronic gadgets irrespective of the brands. “It was a great business idea,” says Jacob, who promptly signed up for an AMC for all her gadgets. “Indians hold on to their home electronics for a long time and Jeeves created a business model around it. We decided to invest because it was clear that they understood the back-end extremely well, which is very important in a B2C business,” she explains.

Jeeves’ founders Alok Sen and RN Balasubramanya have reason to be happy. “Seedfund is not like other VCs,” says Sen. “They helped us in re-branding and upgrading our technology. It was not what I had assumed of a VC. I thought they would only be interested in the monthly review of numbers.” Jeeves hopes to clock revenues of around Rs.20 crore in FY13.

Apart from Jeeves Consumer Services, Seedfund has invested in Innoz Technologies which has developed a SMS based search engine, education technology firm LurnQ and Bengaluru-based SportsKeeda, India’s largest multi-sport crowdsourced content website from its second fund, Seedfund II. After its first fund was fully invested in around 18 companies, Seedfund raised $54 million for its second fund in 2011. The investment strategy remains the same but the larger fund they have raised not only allows them to invest bigger amounts but lets them stay with companies for a longer period of their growth phase.

Certainly, that took care of the growth phase of companies, but Seedfund’s partners also realised that they were missing out on nurturing early phase business plans. Not wanting to miss out on such opportunities, they launched an incubator called the Seedfarm as part of the second fund. “Whenever we are not sure of the market and the business model we like to test it out,” says Jacob.

Here, they test out still-nascent business models and ideas by providing money and office space, so that entrepreneurs can validate their business model. Seedfarm invests up to Rs.1 crore per incubatee for the first year, and if the model is validated, the business receives follow-on funding of about $2 million. That’s how Seedfarm has incubated about seven companies, including Bengaluru-based My Dentist, the dental chain, and affordable healthcare provider Jeevanti, which went on to receive follow-on funding.

While Seedfund tests out new and innovative business models in their incubation centre, they tell you there is no sure-shot formula for success when it comes to investing. “We have seen enough business cycles to know that no one can predict the future including us. We only go with our gut saying this is an idea that could work,” says Murthy. That said, now all eyes are on companies like redBus and Vaatsalya, which are set to give Seedfund blockbuster returns when they exit.

Gandhi wants the investor community to remember Seedfund as a pioneer of early stage funding, and their success might just ensure that. “We will prove to the world that our experiment worked and early stage investing can be profitable,” says Gandhi calmly. “Since we didn’t bracket ourselves to a particular theme, we made some unconventional investments. We have our preferences but we evaluate a business only on its ability to make money.”

Already the early space investing space is hotting up with funds such as Blume Ventures, Kae Capital, YourNest Angel fund and the newly formed Ventureast Tenet Fund and India Quotient placing their bets on pre-revenue start-ups. While Gandhi definitely sees this as a step in the right direction, he feels early stage investing will take off when domestic capital enters the eco-system because, when it comes to understanding the nuances of doing business in India, there can be no one better than the Indian entrepreneur who has already been there and done that. Quite like the folks at Seedfund.