Just like Chakravyuha engulfs Abhimanyu in the epic Mahabharata, Deepak Fertilisers & Petrochemicals was also engulfed with a multitude of problems. Two consecutive years of severe drought in rural India impacting fertiliser business, delay in mining owing to regulatory changes impacting its technical ammonia nitrate (TAN) business, shutdown of natural gas supply, a key feedstock, by the government for two years on account of non-existence of a clear policy on allocation of gas to private sector companies, resulted in bunching of receivables and debt on the company’s balance sheet. Not to mention the high volatility of raw material prices from ammonia to natural gas, falling prices of iso propyl alcohol (IPA), the failed takeover of Mangalore Chemicals and a bleeding real estate business.

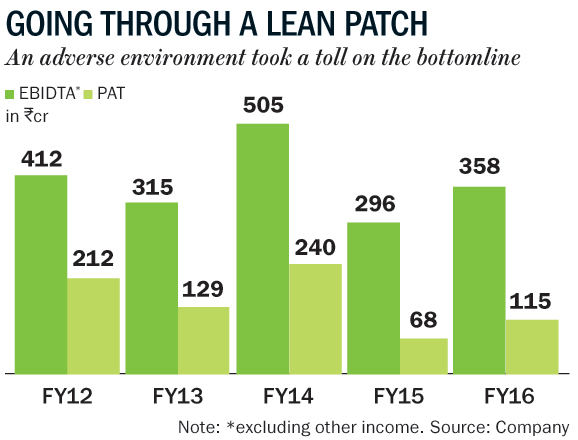

All of the above resulted in operating profit falling by 23% over the past two years to Rs.428 crore and net profit declining by 15%, despite a revenue growth of 15% to Rs.4,590 crore.

But the company’s ability to build formidable businesses in all the segments it operates — be it fertilisers, industrial chemicals, mining chemicals — held the stock in good stead through its tough times. The company has managed to build a leadership position in key specialty chemicals and the fact it is fully vertically integrated from natural gas to complex fertilisers gives it a strong position in the segments it operates. When the fertiliser business went through tough times, the company’s ability to scale up its mining chemicals and IPA business through imports helped it sail through a difficult period. The complex fertiliser business collapsed to sales of Rs.120 crore in FY15 from average sales of Rs.600 crore owing to non-availability of natural gas supply.

In India, due to excessive subsidy being given to urea as against phosphates, the urea price is only 20-25% of complex fertiliser price against the world average of 50%. This is the main cause for excessive usage of urea which is perceived as a cheaper fertiliser but in reality distorts the balanced nutrition and affects farm level productivity. The result is a declining response of crops to fertiliser use; the amount of food grain produced per kg of fertiliser applied declined from around 13 kg in the 1970s to less than 4 kg by 2015.

Urea accounts for around 75% of total farm subsidy of around Rs.70,000 crore per annum. With direct benefit transfer, the government is likely to discourage use of urea and encourage NPK shortly. Already, the numbers suggest a 22% decline in usage of urea and an increase in the usage of complex fertilisers. The NPK consumption should grow by 2-3x more that the consumption of urea going forward and that should work well for Deepak Fertilisers.

So the company is quadrupling its capacity to 1.1 MTPA at the cost of Rs.750 crore. Its brand, Mahadhan, has a dominant market share in NPK in states of Maharashtra, Gujarat, AP, Karnataka, and is expanding into other parts of India. NPK has two key raw materials – potash and phosphoric acid. The new complex fertiliser facility has the flexibility of using key raw material phosphoric acid from multiple sources of countries like Egypt, Russia etc. This will improve the cost of production — as the key raw material is cheaper by 5% when procured from distributed sources — leading to a better-diversified market positioning of the products and economies of scale resulting in operating leverage.

Thanks to falling ammonia prices, the company has an alternate source to manufacture complex fertilisers. Thanks to its vertically integrated manufacturing capability, it can use ammonia rather natural gas for manufacturing of complex fertiliser and technical ammonium nitrate. The plant is operating at a capacity of 70% pre-expansion, and as the demonetisation impact recedes, we expect the rub-off effect of a good monsoon to lead to an improved demand for complex fertilisers. This in turn will give thrust to the growth of the complex fertiliser business. The first phase of capacity expansion to 600,000 MTPA was completed by December 2016 and the rest is set for completion in 2017. As a result, the fertiliser business is likely to see strong volume growth over next three years.

Chemicals play

The company also has leadership position in coal, iron ore, metals mining blasting consumable chemicals called TAN. This is a high-margin business (in excess of 25%) and has grown more than 13% per annum over the past five years. The past couple of years have, however, been challenging owing to the collapse of demand globally, slowdown in China and domestic regulatory issues restricting mining in India. However, things are starting to look up with the government driving increased coal production and the decline of low-quality imports from China.

The company’s industrial chemicals business is led by IPA,which is used as a disinfectant and an industrial solvent is mainly used in pharmaceuticals, cosmetics, dyes and printing inks. The IPA market in India is estimated to have reached 125,000 MT, with the company having 65% market share (manufacturing and imports) and is witnessing a steady demand growth. The company faced a problem last year with falling prices of IPA, on the back of volatile raw material prices, inventory losses, leading to lower margin. The scenario though has changed over the past couple of months on back of stable prices. Normalised margins and increased demand from the pharmaceutical industry should keep the momentum going.

Deepak has also built a formidable position in the manufacturing of nitric acid in India and competes with GNFC, RCF, and National Fertilizer. Thanks to increased demand, the company is expanding its capacity by investing in excess of Rs.550 crore in this business.

What’s ahead

The company, with a vision to build first dedicated industrial mall for home improvement products, constructed a 400,000 sq ft mall on surplus land it owned. This has cost the company Rs.100 crore over the past five years in earnings along with current capital employed of Rs.250 crore. The company expects to lease out balance 150,000 sq ft in 15 months and break even at the end of this period. However, we are not incorporating any turnaround till we see action on the ground.

The company has filed a scheme for demerger of TAN and complex fertiliser business as 100% subsidiary. The construct of the scheme signals a potential value creation for shareholders. The company maintains that its long-term debt equity ratio post all expansion will not exceed 0.5x. The company has earned an average ROCE of 18% in the past, before it collapsed to 8% over the past two years.

The return will improve dramatically on the back of revenue growing in excess of 18% and earnings growing at a faster clip thanks to the release of payments by the government, increasing presence in the value-added segments. In short, patient shareholders will see superior returns.

While Deepak’s performance has been volatile, the company has been exemplary in terms of corporate governance in transparency to minority shareholders seeking in-depth information on the working of the company. The company remains one of the best bets in the agriculture space and is likely to outperform over the next couple of years.

The writer’s firm and clients have a position in the stock