The real estate sector has long been reeling due to a slowdown and oversupply. So much so, developers have been continuously selling their landholding to bring down debt. Reports suggest that the promoters of DLF would be infusing Rs.10,000 crore in the company by selling a 40% stake in the rental arm — DLF Cyber City Developers Limited (DCCD) — for an estimated Rs.12,000 crore.

In a separate transaction, the Gurgaon-based company will also raise about Rs.3,000 crore from institutional investors to ensure that the promoters’ stake remains within the 25% minimum public shareholding norm. All this is not new, as DLF has been trying to bring down its debt and regain investor confidence for the past five years, with very little success.

Once a darling of the bourses, the reversal in DLF’s fortune has been dramatic. In June 2007, its Rs.9,187 crore public issue was oversubscribed 3.47x, with investors vying to get their hands on the developer’s shares. With much fanfare, the company debuted with a market cap of Rs.97,183 crore. Since then, interest has dimmed. In August, its average deliverable volume on the NSE was 17.02%. Developers such as Kolte-Patil (59.77%), Godrej Properties (61.3%) and Oberoi Realty (68.55%) clearly, have found more favour with investors. DLF’s market cap has nose-dived 60% and is currently at Rs.29,559 crore.

Debt trap

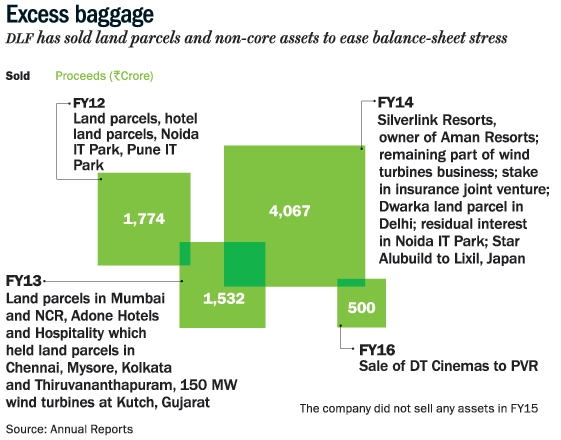

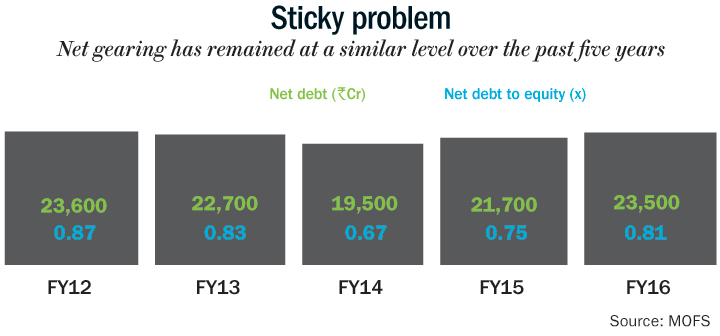

The company’s highly leveraged balance sheet — its gross debt rose 120% during FY08-16 — has been the main culprit behind its decline. It’s not that the management is unaware about it. Over FY12-16, DLF raised Rs.13,000 crore from divestment and QIP proceeds to reduce the debt. (See: Excess baggage) But the company’s net debt to equity ratio remained sticky, improving just marginally from 0.89x to 0.81x. (See: Sticky problem)

The de-leveraging plans failed because cash flows from its residential arm, DevCo remained negative amid weak market conditions. Burdened with a high interest outgo, the company has not been able to generate positive free cash flows. Despite the de-leveraging efforts, free cash flows, after accounting for interest outgo, has been negative to the tune of Rs.2,200 crore.

The success of the current round of equity infusion will also be dictated by the same variables. It’s not like the rental arm, DCCD, is free of debt. It has a debt of about Rs.15,000 crore, but given that it generates an income of Rs.2,400 crore, DCCD is in a much better place. Moreover, analysts expect DCCD’s rental income to grow at a consolidated rate of 15% over the next three years.

DevCo, with a debt of Rs.8,500 crore, however, is the looming problem. Currently, there is little evidence to suggest that DLF would be able to generate strong cash flows from pre-sales to sustain positive free cash flow. Analysts say the company needs to improve its annual pre-sales by 50-60% i.e. to Rs.4,500 crore-Rs.5,000 crore to achieve net cash flow break-even. This, they add, would be essential if a healthy capital structure emerging from any restructuring is to be sustained.

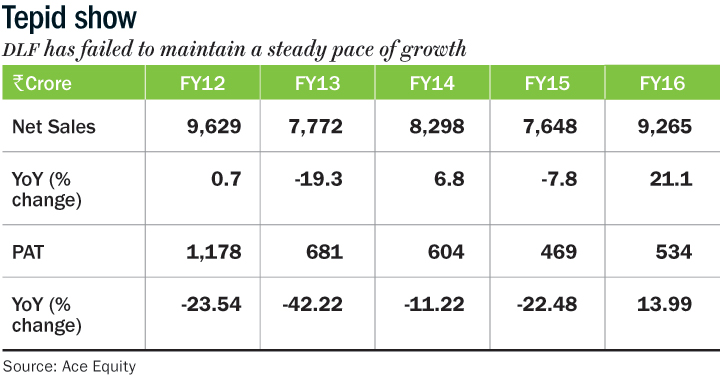

During FY16, DLF clocked pre-sales of Rs.3,100 crore, 20% lower than the previous year. This was also significantly lower than the five-year high of Rs.5,300 crore seen in FY12. Additionally, the topline has slipped to Rs.9,265 crore since FY12, and profit has plunged even more precipitously to Rs.534 crore. (See: Tepid show) Analysts at Motilal Oswal Securities estimate revenue to fall 9% in FY17 and just about recover to FY16-level in the following fiscal. Market conditions also remain far from flattering. According to PropEquity, at the current pace of home sales, developers in Gurgaon would take slightly more than four years to clear their inventory.

Temporary respite

The equity dilution thus, analysts feel, may do nothing more than serve as a short-term boost. “According to the latest balance sheet, DLF has a total consolidated debt of Rs.24,536 crore. The Rs.10,000-crore infusion (though the net funds after QIP should be about Rs.7,500 crore) will help DLF save Rs.800 crore after tax. However, this will be a temporary balm unless DLF is able to fund its future projects through internal cash accruals without taking any further debt,” opines Siddharth Oberoi, founder of Prudent Equity, a Gurgaon-based investment advisory.

Sudip Bandyopadhyay, ex-CEO, Destimoney Securities, however, says that the equity infusion plan seems to suggest that the promoters have learnt their lesson on paying attention to minority investors’ interests. Corporate governance issues and unrelated diversification have more often than not deterred investors from looking at this counter. Even mutual funds’ exposure to DLF stands at 1.4% currently. Of the 40-odd domestic AMCs, only 15 have any exposure to DLF, with the highest number of shares (1.5 crore) being held by Birla Sun Life AMC.

Given that the Justice SN Dhingra inquiry commission was handed an eight-week extension to submit its report on the land deal between DLF and Skylight Hospitality, owned by Congress chief Sonia Gandhi’s son-in-law Robert Vadra, corporate governance issues are not behind DLF. Any adverse findings from this report could put the stock under pressure.

Banking on land

Nevertheless, the stock has run up 24% since June 29, when the reports of its new de-leveraging plan appeared. It is currently trading at 36x one-year forward earnings. Is there more upside? Oberoi doesn’t think so. “Although, the infusion does not make DLF a debt-free company, the debt to equity ratio will drop substantially from 0.9x to 0.53x post infusion. But at the current market price, most positives seem priced in. Real estate business in DLF’s geographical area remains muted. The downside now seems to be protected due to this development,” he adds.

Some investors are, however, looking beyond downside risks. A CIO of a fund house, whose Rs.11,850-crore-fund has 1.1% exposure to DLF, says, “They have got a good land bank in Delhi, Gurgaon and other markets. The market is slightly weak right now, but once it drops, there is no pressure on them. They can sell the inventory as the market picks up.”

Besides, the CIO adds that DLF has earned some goodwill as it has been executing older projects. “Meanwhile, they have new projects in certain pockets which have a huge premium. These are Rs.25,000 per square feet projects, which would see high margins and profitability, despite the current weak demand.” Launched in 2013, ‘The Crest’ and ‘The Camellias’ are premium projects that are under various stages of completion. ‘The Crest’ offers luxury apartments and penthouses in sector 54, Gurgaon, with rates for the later going up to Rs.18,500 per square feet. Camellias units, on the other hand, can cost up to Rs.35,000 square feet. As on Q4FY16, the company has sold approximately 50% in Crest and about 45% in Camellias.

Going ahead, the stock price can see an upside if the land bank is monetised, but the fund manager says that it will take time due to the oversupply in the market. Currently, the company has 31 million square feet under construction and a fully paid land bank of 230 million square feet located in Gurgaon (45%), Delhi (5%), and other metros (25%).

Monetising assets

Market observers say Real Estate Investment Trusts (REITs) could also help in monetising DLF’s assets and repair its cash flow. “Once REITs become a reality, DLF will get a completely different valuation. Then, nothing will be locked up. They will start raising money through REITs and liquidating through it too. Today, assets like DLF Emporia and others are locked up and they are not able to encash it,” says Bandyopadhyay.

REITs are listed entities that invest in leased office and retail assets. They allow developers to raise funds by selling completed buildings or assets under construction to investors and listing them on the stock exchange. Investors earn a return on that investment through rental income and capital appreciation. Significantly, it also gives overseas investors a chance to invest in lease rental, generating assets, an asset class otherwise prohibited to them.

While REIT’s as a concept has been around for a while, regulations in 2014 didn’t manage to excite investors. The government is, however, trying to remedy this by already exempting them from the dividend distribution tax. The interest in REITs will finally depend upon the yield offered. “REIT is one vehicle which has not taken off in India because you need borrowing costs to be lower. So if REITs are giving yield of 200 basis points above repo rate, they will be lucrative,” says Sanjiv Bhasin, executive vice president, markets and corporate affairs, IIFL.

However, tapping REITs is still some time away. As things stand, the stock is currently trading at a 30% discount to its net asset value of Rs.240 per share, according to analysts at Motilal Oswal Securities. While the discount seems sharp, any upside would depend on whether pre-sales pick up or not, going ahead. With continued uncertainty on this front, investors continue to mull their bets.

Just one email a week

Just one email a week