Behind the clamour for environmental, social and governance (ESG) compliance in business is the power of growing consciousness around the urgency of ensuring responsible and ethical economic growth. The compliance ecosystem is quickly getting bigger, with even the outliers realising that they may find themselves in sooner rather than later, pushed either by law or by business sense. And therein lies the challenge for companies, and an opportunity for platforms which can provide software solutions for data management, related to ESG disclosures in this case, and help respond to requirements by compliance frameworks.

From top 100 to 500 and now 1,000, the number of listed companies in India required to make ESG disclosures has only increased since the Securities and Exchange Board of India (SEBI) first made it mandatory in 2012. As if taking the cue, many other public and private companies in the supply chains of these top 1,000 companies voluntarily started assessing their ESG compliance. The rising awareness of the significance and relevance of ESG compliance in the international market further brought businesses involved in exports onto the bandwagon.

With disclosure parameters becoming more stringent, navigating the ESG landscape has become further complicated. The Business Responsibility and Sustainability Report (BRSR) framework in India, which replaced the Business Responsibility Report, is more detailed and comprehensive, necessitating more attention to data management.

Rise of Data Management Platforms

Gathering accurate and reliable data, consolidating and validating the collected data and identifying the material issues that are relevant and industry-specific are among the key challenges that companies face during ESG disclosure, says Chennai-based Thamil Mani Sethuram, senior partner at SWIFT-I Consulting which provides ESG consultancy.

Furthermore, reporting in accordance with global frameworks like the Carbon Disclosure Project (CDP), Climate Disclosure Standards Board (CDSB), Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), BRSR and Task Force on Climate-related Financial Disclosures (TCFD) also pose challenges to companies. While CDP and TFCD focus more on climate-related reporting, GRI, SASB and BRSR focus on ESG.

Consolidating and validating ESG-related data becomes even more challenging if the report has to include Scope 1, Scope 2 and Scope 3 emission data or if the organisation has business units which are spread across multiple geographic locations, Sethuram elaborates. “Once accurate data is available and consolidated, reporting in accordance with global frameworks like GRI, SASB or BRSR is relatively easy with the assistance of data management platforms,” he adds.

Underscoring the role of software platforms in ESG-related data management, Sethuram says, “ESG data management platforms simplify the ESG reporting process by providing a centralised system for data collection, integration, validation, analysis and reporting. This, in turn, enhances the efficiency, accuracy and consistency of reporting. In addition, these platforms often have built-in capabilities to analyse the data and provide useful insights through better visual features like charts, graphs and interactive dashboards.” The visually appealing features help in better interpretation and communication of insights, helping companies to identify areas of improvement and take data-driven decisions to improve their ESG performance, he elaborates.

Tech-Enabled ESG Readiness

ESG compliance is no longer a trend but a powerful driver of change in the corporate landscape. With increasing awareness about sustainability, social impact and responsible governance, companies are under pressure to align their operations with ESG principles.

According to Deloitte India’s ESG preparedness survey, launched in May 2023, Indian businesses see value in sustainability and building ESG capabilities. Over 70% of the 150 organisations that were evaluated on their preparedness for ESG policies, rules, disclosures and compliance are listed in India. Interestingly, 71% of these organisations participate voluntarily in ESG ratings, their representatives have said. “Most organisations (80%) report on their ESG efforts. The prevalent method used is sustainability reports (81%), followed by ESG reports (50%), and BRSR and integrated reports (44%),” the report adds.

Despite the interest, only 27% of the organisations claim to be well-prepared to handle ESG strategy and compliance requirements, it observes. Additionally, only 15% organisations believe that their suppliers are well-prepared to adhere to the organisation’s ESG requirements. That indicates a huge gap between intent and action. “With increasing demand from regulators, investors, and other stakeholders on the action taken and impact made on critical ESG aspects, it is important that data and analytics infrastructure should also evolve to meet the needs of internal and external stakeholders,” the report observes.

Through comprehensive data management, companies can identify specific areas with scope of improvement, set measurable targets and monitor progress towards achieving their ESG goals. Data management platforms facilitate data-driven decision-making, enabling organisations to implement sustainable practices, reduce their carbon footprint and ensure ethical business operations. They also facilitate effective stakeholder engagement by providing accurate, relevant and timely information.

Companies can generate comprehensive reports and disclose their ESG performance data to shareholders, investors, customers and regulatory bodies. This transparency fosters trust among stakeholders, enhances brand reputation and attracts socially responsible investors.

Rising Demand

Satish Ramchandani, co-founder and chief business officer of Updapt, an ESG tech company that offers SaaS-based ESG tools, agrees that there is an uptick in demand for ESG data platforms. “We have noticed significant interest from markets across geographies in the last 12 months with regards to our digital ESG tools to simplify their sustainability journey. This increase is on account of reporting regulations in many countries along with investors’ push, supported by supply chain assessments that form over 70% to 80% of emissions.”

Updapt’s solutions can be configured to meet any size, kind and complexity of an enterprise, Ramchandani explains. “It was designed using deep learning and market use cases. Any unique reporting and dashboard requirements of any of our clients may therefore be easily customised with little effort, making it quicker and more economical. Our platform is embedded with all domestic and international reporting standards and frameworks, including GRI, SASG, TCFD, BRSR, DJSI, CDP, etc.,” he adds.

Pune-based Credible, an end-to-end ESG data management and reporting platform, offers artificial intelligence-powered analytics to process complex ESG data from companies, identify key areas for improvement, set realistic ESG targets and track progress towards these goals. It currently works with 90 companies.

“We have helped companies track and calculate over 200+ million metric tonnes of CO2e emissions with 99% accuracy, saving them over 3,000 work hours annually. Our platform also automates workflows and alerts users of possible data anomalies, ensuring accuracy in reporting,” says Jitesh Shetty, CEO and co-founder of Credible.

Shetty identifies interesting trends in the profusion of data platforms. “We have seen a surge in companies seeking specialised reporting, like [for] BRSR in India and TCFD, GRI in the US and the Asia-Pacific regions. The demand for ESG portfolio management has grown, particularly among investment banks and fund managers, which aim to monitor their portfolios’ ESG footprint. Ultimately, there is a clear trend of companies gravitating toward data management platforms for their ESG requirements,” he adds.

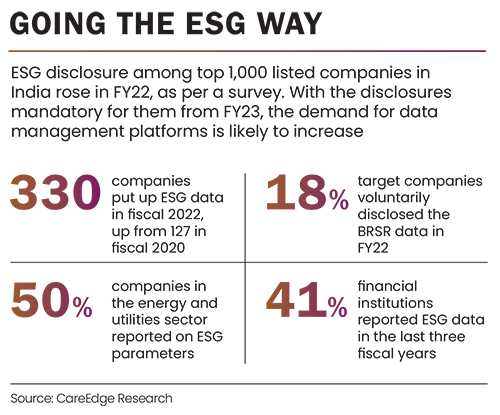

Just around 49% of the organisations are aware of the ESG reporting processes and rules in India, according to the Deloitte ESG Survey. Such circumstances logically raise the necessity for ESG data management platforms. CareEdge Research, in its study released earlier this year, said that ESG reporting by Indian corporations has increased by 160%. The study, which is an analysis of reports from the top 1,000 listed companies in India, noted that the number of companies disclosing ESG information rose from 127 in fiscal 2020 to 330 in fiscal 2022 and attributed it to SEBI’s advocacy for ESG disclosures. In FY22, 18% of the target companies voluntarily submitted BRSR data, the research showed. The emergence of ESG consultancy and data platforms is thus supported by the fact that the corporate sector is considering ESG compliance more seriously than ever before.

The impact is felt beyond data management. “We have enabled a 10% emissions reduction in the first year for a large apparel manufacturing company that we worked with early on. We have also supported a large electronics manufacturing company to design an ESG strategy, set up and track key ESG performance indicators and develop a five-year roadmap,” claims Ankit Jain, the co-founder and CEO of Stepchange, a data management platform that helps corporates with ESG measurement, reporting and benchmarking.

He claims that the company has supported some of the largest banks in India in calculating their portfolio emissions and designing strategies around reduction. “We have so far accounted for 250 million tonnes of CO2e across key Indian clients and have one of the largest carbon accounting databases with over 75,000 emission factors for different products and services in India,” Jain adds.

Customising Solutions

Data management platforms also provide customisable dashboards, effective approaches that adhere to international standards, a plethora of ESG benchmarks and visualisation options. While Credible offers data visualisation options that bring the company’s ESG metrics to life through interactive charts and colourful heat maps, Stepchange provides ESG risk assessment and scenario analysis tools that help its clients understand their exposure to ESG risks and opportunities. Updapt offers self-assessment, peer benchmarking, predictive analysis, SBTi pathway, supplier assessment, risk management and more.

As stakeholders, clients and investors are crucial in the world of ESG practices. The former can influence the demand for sustainable goods and services while the latter can make their power felt by allocating capital to businesses that are in line with their sustainability goals.

“Data management platforms also help in improving stakeholder engagement as some platforms allow the stakeholders, say, the investors, to directly log into the platform and generate charts, graphs or comparisons that they require,” says Sethuram. He explains that such measures improve transparency and credibility significantly within the stakeholder community. All these have resulted in a high demand for reliable data management platforms, he notes.

Alliance of Experts

Even if businesses make every effort to offer the best ESG solutions, industry experts believe that that they will need to do more to up the ante. For data to make sense, there must be an expert to provide insights. “ESG data management has been a challenge for companies globally for some time now. The reasons are the type of information needed, various sources, accountability, skill set and above all, accuracy and reliability,” observes Shailesh Tyagi, partner and head of Deloitte Climate Change & Sustainability (DCS), Deloitte Consulting, South Asia. There are various solutions available but most are in their nascent stages, he notes.

“There is a need for tech experts and ESG experts to come together to help companies report on ESG parameters,” says Tyagi.

According to Think Change Forum, an independent think tank, the value of ESG investments in India is between $30 and $40 billion and this value is increasing quickly, but the demand for ESG specialists is outpacing their supply. It adds that India’s efforts to achieve net-zero emissions are being seriously hampered by the lack of professionals with standardised skill sets in the ESG sector. For instance, during the next 10 to 20 years, the clean energy sector alone will need more than 100 million professionals worldwide, it says.

Sethuram concurs. “While data management platforms can help companies collect and analyse ESG data, trained experts bring in their expertise and insights to navigate the complex data landscape that is crucial for effective decision-making and strategic planning,” he says. ESG experts have a better understanding of the different metrics, indicators and reporting frameworks, he adds. “They are also well-versed in the regulatory requirements and reporting framework related to ESG [compliance]. All this helps the company navigate the evolving ESG landscape and make informed decisions,” he elaborates.

Effective interpretation of ESG data requires a collaborative effort between ESG experts and technology professionals. While tech experts possess the skills to design and optimise data platforms and are capable of handling the vast amounts of ESG data generated by organisations, ESG consulting firms offer profound knowledge of sustainability principles and reporting frameworks. Their collaborative efforts will define the future of the ESG ecosystem.