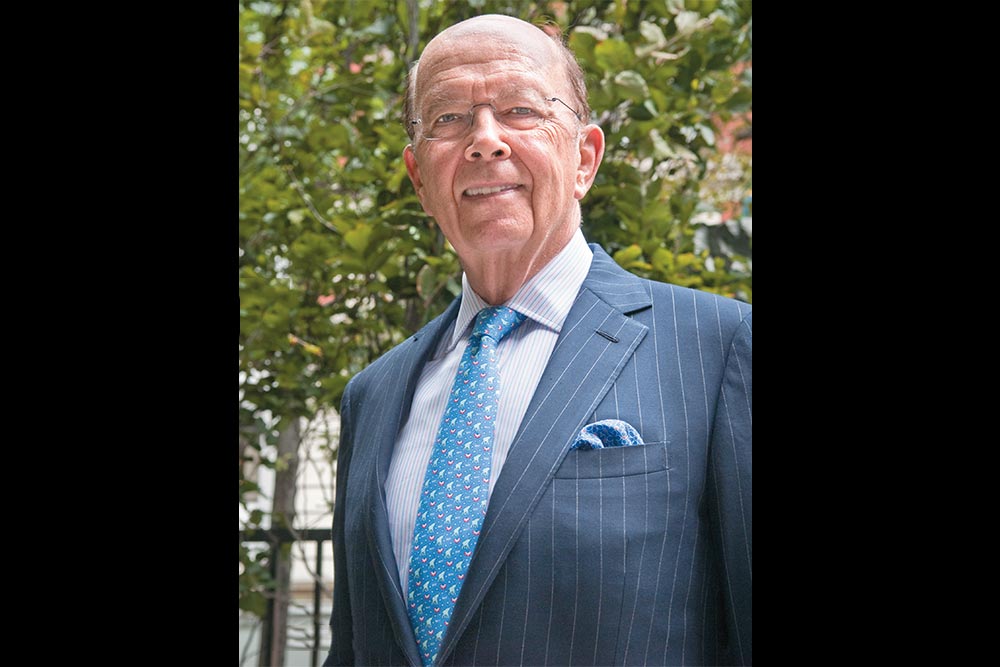

Sitting in his 25th floor office with a sweeping view of the Manhattan skyline, billionaire Wilbur Ross is the master of all he surveys, but he does not like what he is seeing. Ross’ composure is legendary, but this time irritation comes to the fore as he opines on the current state of affairs in the US. The King of Bankruptcy is not only frustrated by the regulatory overkill under the Obama administration, he is also worried that the US could lose its educational edge over the years. With visible agitation, he mentions, “The regulatory agencies are out of control and that is a huge problem for the economy.” Outside, his assistants’ phones ring incessantly, indicating that Ross continues to be a much sought-after financier and the distress hunter in him is very much on the prowl. Only, this time his sights are set far outside the United States. Financial services and energy continue to be his favourite hunting grounds and this quest has taken him across the Atlantic to the UK and Ireland and as far as China. Among his existing US investments, he is gung-ho on shale gas and believes a lower cost of energy will play an important role in reviving the US economy.

The Fed is pushing as much liquidity as possible with the aim of getting businesses to start investing, but bank lending does not seem to be taking off. Why?

First of all, I don’t think that the most recent quantitative easing (QE) is going to have any noticeable effect whatsoever. Even before QE3, banks here had almost $2 trillion of excess reserves. They have not been lending that out. By giving another few hundred millions of reserves to them nothing will change as they are not going to lend that out either. So I think it is an effort by the Fed to push a string. You can cut a string and tie knots in it, but to push a string is impossible. That is what they are trying to do.

Where I think it will have effect is, it might weaken the currency because of more printing. Two, it will help mortgage refinancing a little bit. We have been having a lot of refinancing anyway. In the first half of this year we had $79 billion of mortgages for refinance, probably saving the borrowers $10 billion. That is money sent to the consumer’s pocket that can be spent. That is important because consumption is 70% of our economy. So that will help marginally. If the dollar does weaken, then that will help exports. It may push commodity prices as well as other speculative assets up a little bit. But other than that it is not going to have any real effect. Each QE that is done has less effect than the last one.

As for the banks, they are still not lending for several reasons. One is that you can only lend if there is a customer who wants to borrow. Now, big American corporations have lots of cash on their balance sheets. They also have access to the long term bond market, which they have been hitting pretty regularly as rates are very cheap and they want to lock them in. So there isn’t that much demand for bank loans.

So, it is not that corporates have stopped investing completely or doing new capital expenditure?

No, we would be in a severe depression if they stopped everything completely. But they are certainly not doing anything aggressively. Part of the reason for that is the uncertainty. Is the fiscal cliff finally past us? What will Obama Care really mean to corporate costs? What will the corporate tax rate be? What will individual tax rates be? There are so many unknowns right now that it is difficult for businesses to make long-term decisions like capital expenditure. Most of the important business decisions are long-term ones. How can you make those decisions when you don’t really know the rules of the game?

What do you think will be the long-term implication of this artificially low interest rates?

The real problem to me is that the Fed through QE has basically funded the deficits that the Obama administration ran up in the last couple of years. In their attempt to keep rates down, they have almost tripled their balance sheet. And how did they finance that? They financed the purchase of 10 and longer year bonds with overnight deposits from the excess reserves of banks. There are two problems with that. Interest rates now are very low. They are eventually going to revert to some higher level. If interest rates on US treasuries went to the average level that they were at between 1993 and 2010, instead of the interest burden being $250 billion a year, it would become $650 billion. That is a $400 billion a year increase in the deficit simply by interest rates reverting to normal. The treasury has also been issuing shorter and shorter securities.

Both the US Fed and the US Treasury are really having a classic mismatch. The treasury is funding permanent deficits with very short-term funding. The Fed is buying 10-year and 20-year bonds with overnight deposits. That is not going to have a happy ending. The Fed is also having a hard time getting inflation back in. With unemployment at 8.25% you are not going to have wage inflation. With China slowing down you are not going to get commodity inflation other than in, perhaps, food. But food is not a big component of spending by American consumers because the standard of living is so high.

Is the US then headed the Japan way? Is there a fundamental difference with respect to how the situation played out in Japan and how it is playing out here?

I think there are quite a few differences. To start off, the US economy was fundamentally stronger than the Japanese economy. The second difference is that the Japanese were very slow at fixing the banking system. With Troubled Asset Relief Program (TARP)and Federal Deposit Insurance Corporation (FDIC) we fixed the banking system very quickly. There is a huge difference. The US banks aren’t failing to mend because they are broken; they are failing to mend for the other reasons that I said earlier. Japanese banks, on the other hand, were failing to mend because they were broken. That is a fundamental difference.

The third big difference was real estate speculation. While it was a problem here it was not as big a problem as it was in Japan. I think there are several structural differences between the two countries. That tells me we may not be in for a protracted slump but if we are, it will be for different reasons than what happened in Japan. Also, when the Japanese did a stimulus, and this is similar to the US, a lot of this was wasted with bridges to nowhere. And things of that sort created a few jobs for a short period of time but didn’t do anything to fix the economy. That is true of a lot of Obama stimulus. Not only did it fail to stimulate the economy, it didn’t do anything for the future. In fact, he had talked about shovel-ready projects (these were ready for grabs infrastructure projects Obama had talked about as a measure to stimulate growth) but there were none really. There are still aren’t any. But, even if it were to happen, it is not a long-term solution.

What then is the solution?

The reason I supported Romney is that we need a rollback of the regulations. The Environmental Protection Agency (EPA) has essentially destroyed the coal industry in America. We are the only country that has a huge natural resource destroyed by government action. It’s crazy. Now the environmentalists are trying to destroy shale gas and shale oil. Both these things can transform this economy.

Because of shale oil we have already gone from being 50% dependent on outside imported oil to only 17% dependent and there is much more to come. The US could very soon be self sufficient in oil, not due to any government action but due to entrepreneurs finding shale oil, and we are starting to become an exporter of petroleum products. It is illegal to export crude oil from the US but not illegal to export petroleum products. So, for example the Gulf Coast ports used to be big importers and they would ship the oil up to the refineries in the mid-west and in the Texas panhandle. There was a big pipeline called the Seaway pipeline. On May 19, that pipeline was reversed. It is now bringing shale oil down from the Bakken field and Eagle Ford field to the refineries in the Gulf Coast. That is a tremendous change. If this trend continues it will remove the single biggest source of our balance of payments deficit, which is hydro carbon imports. It is hundreds of billions of dollars a year. That itself would add a percentage point or two to the whole economy.

Then we have shale gas. We are becoming an exporter of shale gas. We have so far the most shale gas in the world. That fuels the chemicals industry. Dow Chemical is now starting to build chemical plants here instead of other countries. The shale industry could add a couple of percentage points to the GDP. If it is just left on its own, it doesn’t take one penny of Federal funding to do it. All it takes is for the Federal government to not screw it up.

You clearly seem to be putting in a lot of money into shale in the US? Where else in the world do you see investment opportunities in shale?

China has potentially huge reserves of shale gas. They might even have half the reserves of the US. We think we have 24 trillion cubic meters of natural gas in shale. The Chinese think they have 36 trillion. If they are right it is going to be another huge powerful change in their economy. I was talking with some of the people there because under Chinese laws 51% of any mineral concession must be Chinese controlled. In the other 49% I think you are going to find American investors and American companies bringing the American technology because in America over 1 million wells have been fractured over the past 60 years with almost no environmental problems.

Over 1 million wells is a lot of history and knowledge.That now can be brought to bear into China, which could be the next base for major shale gas developments. If China and the US use much more natural gas than coal then that will solve a lot more of the pollution problems. A vast majority of China’s electricity is from coal. In the US, some years ago, coal met 50% of electricity needs and natural gas was 20%. Now both are around one third. So natural gas consumption is growing because it is not only far less pollutive but also much cheaper. It is a good thing from the economy and environmental point of view.

Which are the other areas where you see investment opportunities for your fund?

Shale oil will have a huge impact on the shipping industry. It could change the price structure of crude oil. Right now, you have two benchmarks for crude oil pricing: WTI & Brent, the latter usually trades $20 a barrel higher. Once the US becomes a net exporter, that differential is going to narrow and bring Brent down to the WTI price. That is good news for India because India has to import a lot of oil.

The second thing is that this will ensure that the price of oil is not too high because all this supply is not in the hands of the cartel. Similarly, shale gas is going to affect Qatar and the other Gulf countries, which are big exporters of natural gas. It is going to change many economies and the flow of shipping.

Another thing that will change the flow of shipping is that it is very hard to build refineries in the West because of the environmental considerations. India and China are building coastal refineries that are intended not just for domestic consumption but also for exports. So that means now crude will be hauled all the way into those countries, some used domestically and some refined and re-exported. That is going to create demand for marine transport as well.

Right now, marine transport is in terrible shape not because demand for crude has fallen but because too many ships were ordered back in 2007 and 2008 when charter prices were quite high. That supply will gradually work its way through. And business will get a boost again. So we have been very active in crude, natural gas and petroleum product tankers. That is where our Navigator buy fits in.

You have made investments in Ireland and the UK. But you have held back from Spain or Italy…

It is too early. Spain is just beginning to recognise its banking problems. My guess is that the problem is a lot bigger than they think it is. The next problem that they need to deal with is the real estate crisis. There was terrible overbuilding, far worse than even in the US. That is going to take a long time to fix. The third problem is that under the Spanish system, the provinces have very much their own control over their budgets. They have been running up huge debts and deficits. Catalonia is the biggest province and also the most heavily indebted province. What really has to happen is that the European Central Union needs to get better control over European states and within the European states, countries like Spain have to get better control of their provinces. If somebody doesn’t have control over things, you can’t keep it from getting out of hand.

What is a bigger worry going forward? A weak US economy or the currently dormant Eurozone crisis?

For the US economy, it is hard to make a multi-year prediction until we have clarity on policy issues. As for Europe, I think it will be better both for Greece and for the EU to kick Greece out. When the crisis first came up a couple of years ago you couldn’t do it because there were no safety mechanisms in place. But now with Mario Draghi running the central bank you have a lender of last resort. I like to jest: we used to have an Italian Pope and a German central banker. Now you have an Italian central banker and a German Pope and, at least from the central bank point of view, it is working better. If they let Greece stay and make more concessions then they are rewarding bad behaviour. Once Greece gets kicked out it would send a strong message to the other countries that you need to start getting your act together. You can’t solve a debt crisis by putting on more debt. You can solve the debt crisis only by reforming the underlying assets.

From a stock market perspective, is there any chance of a 2008-like crisis emerging because of the Eurozone debt situation?

I don’t see that happening if they kick Greece out and they build a proper firewall around Spain and Italy. Spain and Italy are trying very hard to reform. The problems and the opportunities are different but they are trying hard. They are a little bit like Ireland, which is trying the hardest. When someone is trying hard but circumstances beyond their control prevent them, they should be helped. It is just that some people aren’t trying. Greece hasn’t privatised one asset and hasn’t made any serious proposals to reform itself. How can you reward behaviour like that? Whereas Spain has done all kinds of belt tightening things and its problems are mainly in the banking sector.

What is really happening now — and it is a good thing coming out of the crisis — is that you are finally getting the true integration of Europe into a federal system. When the EU was formed it was flawed as you did not have a lender of last resort. While you had a central bank and the individual countries had given up control over monetary policy, they didn’t give up control over fiscal policy. That was a huge flaw and that has led to this whole crisis. As they move towards an integrated federal model it is the best thing and perhaps a generation from now you will have a truly unified Europe.

What if there is a backlash in Germany because Greece is being funded for bad behaviour. The voters might just say we don’t want them to have fun at our expense.

The EU was formed for political reasons by Germany and France. Those political reasons still hold true. Germany is not going to go out of the EU. I think Draghi has done a very good job. He went to Germany and met with the industrial foundations and now he has got support from the business community. No central bank has gone directly to the German power structure and tried to enlist their support. The EU has been good for Germany. It is part of the reason that their economy is so strong. The other part is the labour reforms they put in some years ago. Germany had costs way out of control, so it went through a five-year period of very severe austerity, no wage increases, productivity increases and now Germany is arguably the healthiest in Europe. So I don’t see the Germans complaining about Greece.

How about Italy — the second biggest economy out there? Is there any danger of Italy unraveling?

Mario Monti has done a wonderful job putting in reforms but if political leadership goes back to Berlusconi, the risk is that they will roll back reforms. Look at what is happening in France. Sarkozy had put in a few reforms like raising the retirement age and providing tax-free overtime wages in order to get people to work longer hours. Francois Hollande has rolled that back in addition to putting in the 75% tax and 1% wealth tax. There is a brain drain happening and many of young professionals are emigrating. Many French people are buying property in England, Monte Carlo, Luxembourg and Brazil. The one European nation I would worry more about is France because it is far bigger than Italy or Spain. Its banking system is grossly undercapitalised and in the longer term, I think France is scarier than Italy.

Is there anything besides government interference that worries you a lot? Because in distress we look at the downside more than the upside...

Distress is downside. But as for the US, the biggest thing that I worry about for the longer term is our educational system. As we become more and more of a high technology society, our population needs more and better education. It is not getting it. More than 37% of our working age population doesn’t have anything more than a high school degree. Georgetown University just issued a study saying that by 2018, 44% of jobs in this country will require more than a high school degree.

Well, what is going to happen to all these people who don’t have a high school degree? Then, within these high schools, many of them are no longer teaching advanced maths and advanced science. That makes the students they churn out unqualified for most jobs. In most factories today in the US there is very little physical labour. It is all computerised and numerically controlled. These people simply can’t work there.

That, in turn, has led to a very alarming thing. In 1983, 72% of working age people participated in the workforce, meaning they had jobs or wanted jobs. That has today come down to 63%; 36% of the working age population doesn’t have a job and doesn’t want one. Another 8% roughly doesn’t have a job but wants one. Probably another 8% has a job but is it a part-time job or not a very good one.

We are now in a situation where approximately half of our working age population is either unemployed or under-employed. That is not a healthy thing and it is the education system that is failing. That to me is the biggest long-term problem because there are three things that built America. First, cheap energy; I think we are going to get that back with shale. The second was entrepreneurship. We are starting to lose some of that. The third is technology. So far we have had more patents than anybody in the world. But in the past three years, the number of American patent applications has not gone up. China’s applications keep going up. Now the world’s largest and fastest super computer is China made. Patent applications are not the only indicator but it is one way of getting a feel for the numbers. The US has to re-emphasise on technology.