XX… No, it does denote either kisses or a conjugal visit rejection, from the smiley-infested world we live in today. Nor does it refer to types of chromosomes. That’s an abbreviation I coined for ‘Xaggeration Xtrapolated’. We are in unprecedented times. I have witnessed markets hitting circuit breakers on the downside. I have also seen individual stocks hitting successive upper circuit. Needless to say, I have seen bull markets and bear markets. Bull markets have corrections as they ought to, and bear markets have pullback rallies. But, the events of the past two months in the financial markets made me term the goings-on as XX.

Back story

Like mutual fund pioneer, John Templeton, I am aware of the perils of his axiom, ‘This time it’s different’. But I am compelled to use his maxim, though in the opposite connotation. During the past few years, we have seen significant changes in our country, each one of them unprecedented — demonetisation, GST, NCLT, Article 370, NRC/CAA, AGR, IL&FS/DHFL/Yes Bank etc. Globally, we have seen change in geopolitical equations, covert and overt trade wars, compression of tax arbitrages across jurisdictions, near-zero interest rates for a decade across OECD countries, oil prices sub-$30, emergence of AI, social media destroying traditional media, shift in consumer behaviour with marketplaces gaining prominence, and so on.

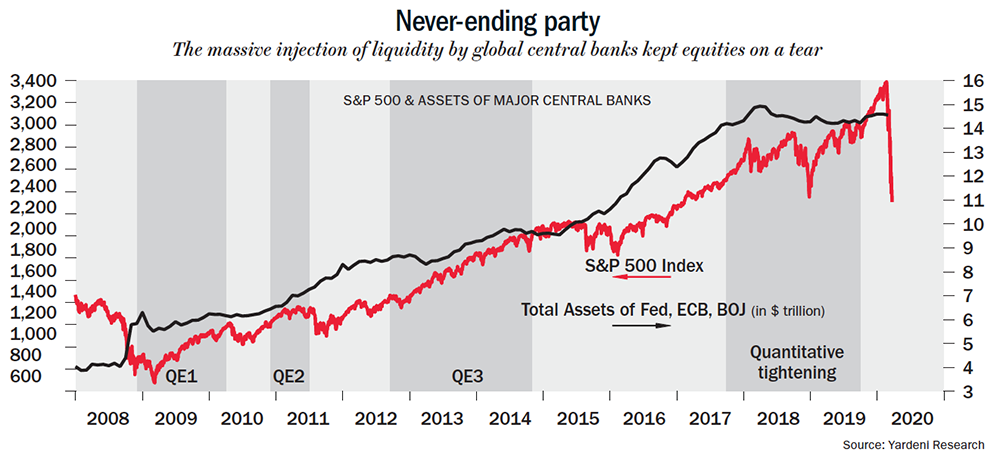

The combined effects of all the above is something either Jim Simons’ algorithm or some big-data firm can decode. But even that combined impact, might be a miniscule part of what has been driving markets. The biggest factor can be charitably described as ‘chimps with a bazooka’. The bazooka is armed with all the Puts that central banks across the world have underwritten. And chimps are ETFs. Add algorithm traders, cheap leverage and you have a heady mix.

The fundamentals of the global economy have been on a weak footing for the past decade. The trouble with this instant-coffee world obsessed with data, even if it’s useless, is that majority of the markets miss the big picture or choose to do so. That’s myopia on the verge of blindness. Public money-laden private funds and governments are equally in cahoots. Markets have threatened to slip into a coma on any bad news and governments have been accommodating with morphine shots to revive the patient. This has been going on for a decade.

And if one were to examine the phenomenon from point to point, it’s clear that whatever anaemic economic expansion eked out was only due to far higher leverage across the system. That also implies lower productivity. Clearly, monetary policy was broken, and further fiscal incentives only transferred the burden from corporates to the taxpayer. The consumer inflation numbers seem fudged anyway (with clumsy gimmickry of core inflation and so on, or the inflation basket itself is outdated — ask anyone if their cost of living has gone up by less than 5% in the past decade).

Some (relevant) data

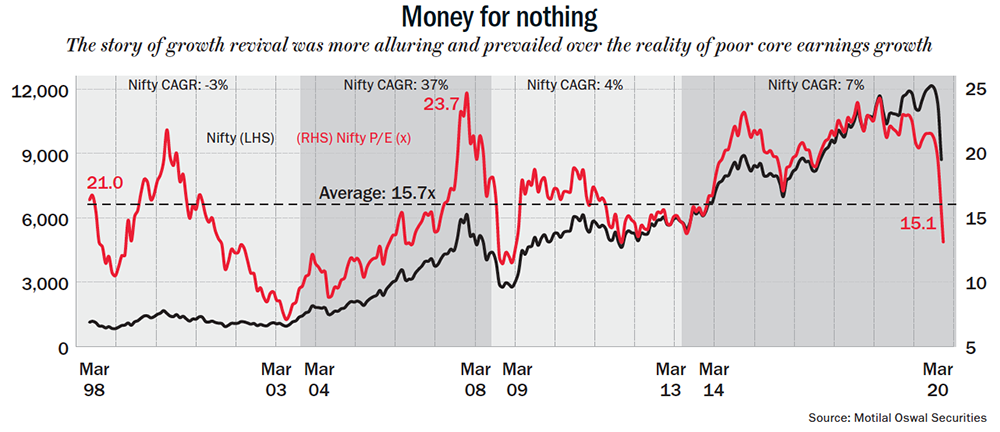

The earnings growth of Nifty companies has been meagre, to say the least. They have grown less than 7% p.a. in the past five years (See: Money for nothing). However, Nifty doubled from 6,200 to 12,400. Implicitly, the Buffett-quoting brigade led the multiple expansion in ‘quality’ stocks. It’s not as if the base multiple was ridiculously cheap; we were at 18x in 2014 and over the past two years, the market became very narrow and skewed. It eased the promotion of a host of analysts/relationship managers to money managers. You got paid 2/20 for investing in those specific dozen stocks which every man and his dog knew about, and were invested in. Just as an empty mind quickly becomes a devil’s workshop, the aforementioned excess liquidity had to find its way somewhere. Acknowledging the ‘risks in the markets’ and bad economic data, the liquidity stuck to those dozen stocks, leading to a bubble in their valuations.

It’s obviously not the first time this has happened, nor will it be the last. During the tech boom towards the end of the last century, Wipro traded at 300x and Infosys at 200x, never mind the scorching 100% growth in earnings. I am not even talking about shams such as DSQ Software and Pentasoft. Technology, media and telecom (TMT) stocks were destined to go all the way to heaven, and rest of the markets were touted as ‘old economy’ and considered ‘untouchables’. Similarly in the run-up to the 2008 global credit squeeze, infrastructure, real estate and steel stocks wore that halo. This time the darlings were mostly consumer stocks and non-corporate financials.

It’s obviously not the first time this has happened, nor will it be the last. During the tech boom towards the end of the last century, Wipro traded at 300x and Infosys at 200x, never mind the scorching 100% growth in earnings. I am not even talking about shams such as DSQ Software and Pentasoft. Technology, media and telecom (TMT) stocks were destined to go all the way to heaven, and rest of the markets were touted as ‘old economy’ and considered ‘untouchables’. Similarly in the run-up to the 2008 global credit squeeze, infrastructure, real estate and steel stocks wore that halo. This time the darlings were mostly consumer stocks and non-corporate financials.

Lessons from the past

The technology bubble burst in 2000 due to the fundamental cocktail of high interest rates and high valuations, which eventually seemed unjustified with flat EPS growth. The benchmark fell 40% in less than two years. It would need more than double that time to cover lost ground. The second phase (2003-2006) was based on low interest rates, cheap valuations and 60% growth in EPS, albeit on a depressed base, owing to positive operating and financial leverage. Liquidity started chasing the stocks, and the foundation was being laid for the next bubble.

2006-2008 was the phase in the run up to the Lehman Brothers-induced global credit crisis, index earnings were up 85%! This is the time when EPS and P/E started chasing each other and catapulted the Sensex to 21,000. In hindsight, Lehman became the poster boy for that super-normal growth and super-rich valuations to mean revert. The benchmark lost 60% in little more than a year (quicker and deeper than the last time in 2000). The fourth phase between December 2008 and June 2010 saw some recovery in stock prices owing only to undervaluation, despite weak earnings growth. By November 2010, the Sensex had regained all its lost ground (little short of two years – again quicker than the last time).

Since then and until now, I would keep it under the fifth phase (2011 till 2019). The reason is simple. Recall all that tectonic change mentioned in the beginning and juxtapose it with Index earnings. It merely doubled in the past 11 years, since 2008. Even a bank FD doubled in lesser time. However, the Sensex almost tripled to 42,000 since June 2008.

Why we are where we are

Now, why would anyone pay an equity risk premium for FD commensurate return? Is it not quirky? What is on display here is the undying belief of institutional investors in central banks, post the Lehman bailout (See: Never-ending party). Hence, zero interest rates, which in turn help governments overburdened with debt, is welcomed. These bottom-scraper rates are not seen as a deeper underlying problem but become de rigueur. The flattish yield curve signifying a prolonged recession is ignored. Poor core earnings growth is dismissed as one-off in light of fiscal stimulus or hope of growth revival in the near future. And with all these assumptions, FIIs chasing relative return have net pumped in almost Rs.5 trillion in equities since 2011 until January 2020, and mutual funds with their SIPs got another Rs.3.75 trillion. Presumably, LIC’s inflows would be a positive number as well.

For sure, equity markets are a forward-looking asset class, and so the expectation of better growth keeps the market going until real underlying growth catches up. But if the digression gets prolonged, you know you are treading on thin ice, which thins quicker under a rising dawn.

For sure, equity markets are a forward-looking asset class, and so the expectation of better growth keeps the market going until real underlying growth catches up. But if the digression gets prolonged, you know you are treading on thin ice, which thins quicker under a rising dawn.

World Wars have been triggered by seemingly inconsequential events. But, warlike conditions had always been brewing under the surface. Its only in hindsight can we say that a particular event triggered the war. Financial markets are similar where reasons get attributed post collapse. Various small events keep occurring until that one event which turns into a snowball and takes the elephant down. And nobody can predict in what form and when such an event will take shape.

I have seen ridiculous prices way back in 2000, and I have been forced to wonder over the past two decades if such prices shall be seen again. Bear markets are a part of investing, and to imagine a perennially upward sloping index made no sense considering all that I have read and seen over the years.

We have seen reasonable prices in many stocks and sectors over the past decade, but have not really seen ridiculously cheap prices, which is what a deep bear market throws up.

Even though I thought markets should correct significantly, I attached a low probability to it, given all the power central banks yield these days, and the fact that zero/very low discount rates actually change everything in the world of finance. This is what forced me to throw in the towel and not wait for those ridiculous prices and buy a chunk (though thank God nowhere near fully) at reasonable prices. So even when my framework told me to steer clear and wait for ‘as long as it takes’ as Buffett says, I was not fully convinced. Nor could I bet on the ‘expected fall’ since the only way to do that was to keep buying Puts and paying premiums, until the eventual collapse.

Virus, seriously?

The virus and the news (who knows how much fake), on which there has been an overdose from all imaginable directions and sources, seems to be the event that has triggered the long overdue correction in the markets. The five-year Index return stands at -6%, as on 19 March, 2020. Even the broader Nifty 500 has returned -6% over that period. It has taken only two months to wipe out the gains of almost four years (the Sensex was last at this level in May 2016). We have fallen 35% from the top, and this is on account of only Rs.120 billion of net outflow (FII and MF combined till 19th of March) against the 70x combined net inflows over the past decade. Surely the economic impact of the virus shall be devastating, but the “Nanga nahayega kya aur nichodega kya” economic environment is already abysmal. As it is, the market was out of sync with the economy for many years.

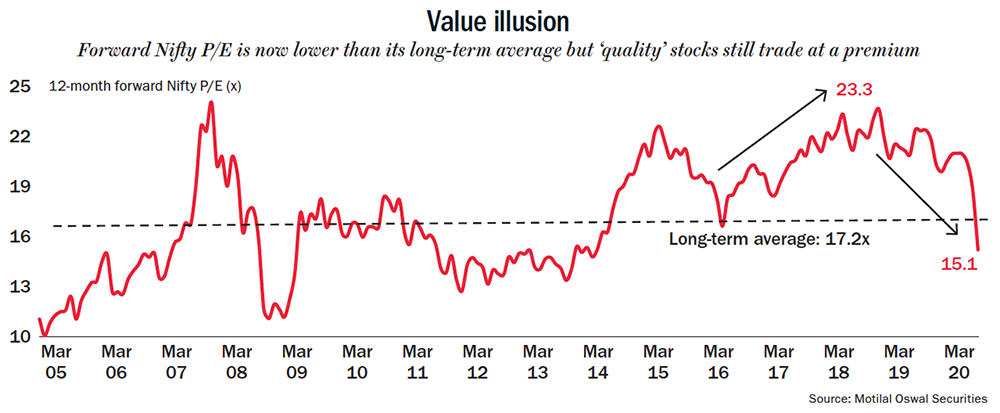

As the market overshoots in either direction, here are some more data-driven reasons to expect further downside: First, a lot more money is queued up heading for the door as can be observed from the above mentioned liquidity inflows and outflows. Two, the earlier bear markets saw more than 50% drawdowns. We are far away from there even if we don’t go all the way this time. Three, we shall be at a median-ish P/E band of 15-16x closer to 25,000 for the Sensex. This number could be even lower given that FY21 may see sharp earning downgrades. Severe bear markets can go to as low as 12x (See: Value illusion). Four, we may be looking at supply shocks (and/or past monetary stimulus rearing its ugly head) leading to high inflation. Finally, and most importantly, the ‘pied piper’ stocks have still not corrected enough to what one may call intrinsically reasonable prices.

As the market overshoots in either direction, here are some more data-driven reasons to expect further downside: First, a lot more money is queued up heading for the door as can be observed from the above mentioned liquidity inflows and outflows. Two, the earlier bear markets saw more than 50% drawdowns. We are far away from there even if we don’t go all the way this time. Three, we shall be at a median-ish P/E band of 15-16x closer to 25,000 for the Sensex. This number could be even lower given that FY21 may see sharp earning downgrades. Severe bear markets can go to as low as 12x (See: Value illusion). Four, we may be looking at supply shocks (and/or past monetary stimulus rearing its ugly head) leading to high inflation. Finally, and most importantly, the ‘pied piper’ stocks have still not corrected enough to what one may call intrinsically reasonable prices.

However, it is not all gloom. All the above only implies that the stocks that went to outrageous valuations are unlikely to do much for the next decade. But besides those stocks (which also comprise the Index to a large extent), there is a whole world of stocks which have almost halved, have a stable business, don’t have any balance sheet issue and are not run by crooks. Intrinsically, they are at ridiculous valuations no matter what assumptions one may make. It won’t even need an eagle eye to find those gems; they are scattered on the road.

Moral of the story

Given the ferocity of the fall, and the angle at which it has fallen with hardly any pullback and that too without outrageous net liquidity outflows, only indicates the omnipresence of ETF money compounded by algorithmic traders. The IPO of the country’s premier exchange is stuck in a case allowing early and preferential access to some such players. So, serious money can be made by these machines. But technology can be destructively brutal, and these hot money machines have XX impact on the markets, which only leads to more volatility than desired, and can cause serious market dislocations. What adds fuel to the fire is the availability of stock futures to raise the traded volume. Imagine, if the market falls 10% daily, it can shave off 65% value in two weeks. That sounds more like the Argentinean or Zimbabwean inflation nightmares of the past. Ideally, regulators need to figure out a way to keep the role of the machines to a manageable level. They also need to ban or at least limit the use of leveraged products, which don’t serve much purpose except to increase trading volume, so that the exchange gets a premium IPO valuation.

As for investors, they would do well to remain mindful of the risks and evaluate them appropriately before fishing for return. Despite having heard ‘markets can remain irrational longer than you can remain solvent’, it’s quite hard to steer clear for half a decade if the valuations remain elevated. Jhoot bhi agar sau baar bola jaaye to sach lagne lagta hai. So come what may, valuation comfort is perhaps the only basis to invest on and sleep well. On second thoughts, sleeping well may be a thing of the past; the machine-age mixed with social media infodemic and catalysed with virtually free and unlimited leverage is likely to make XX bouts occur more often than ever before. So, brace!