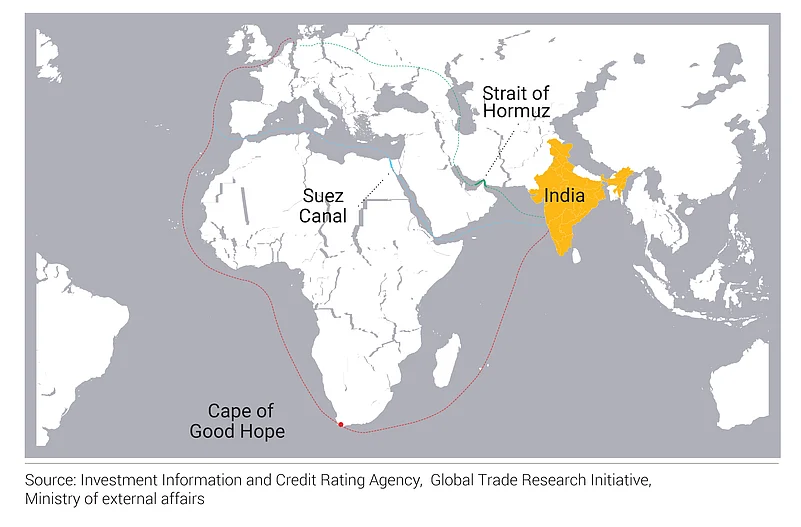

India relies heavily on the Suez Canal for trade with Europe, North Africa and the Americas. As much as 95% of India’s foreign trade by volume moves via sea routes, which stands at risk if the situation continues to deteriorate

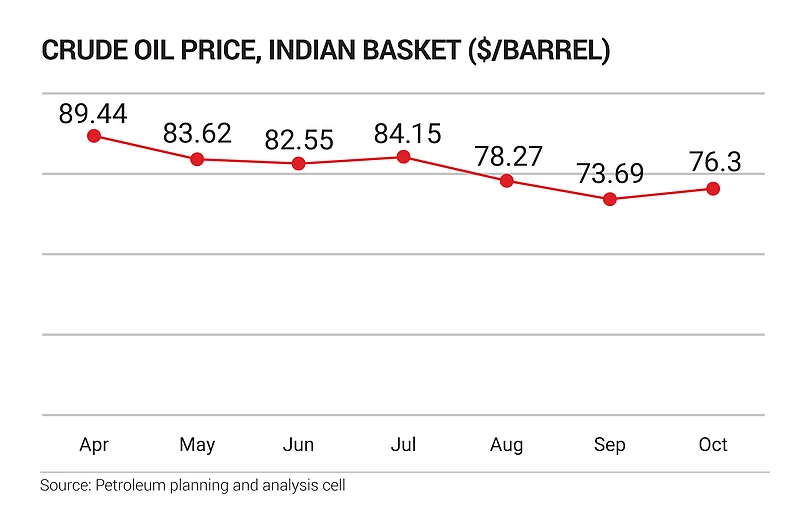

Any impact on shipping routes would place energy security at risk. After months of a steady decline, crude oil prices started to rise in October after Israel Prime Minister Benjamin Netanyahu vowed to make Iran ‘pay’ for firing missiles at Israel

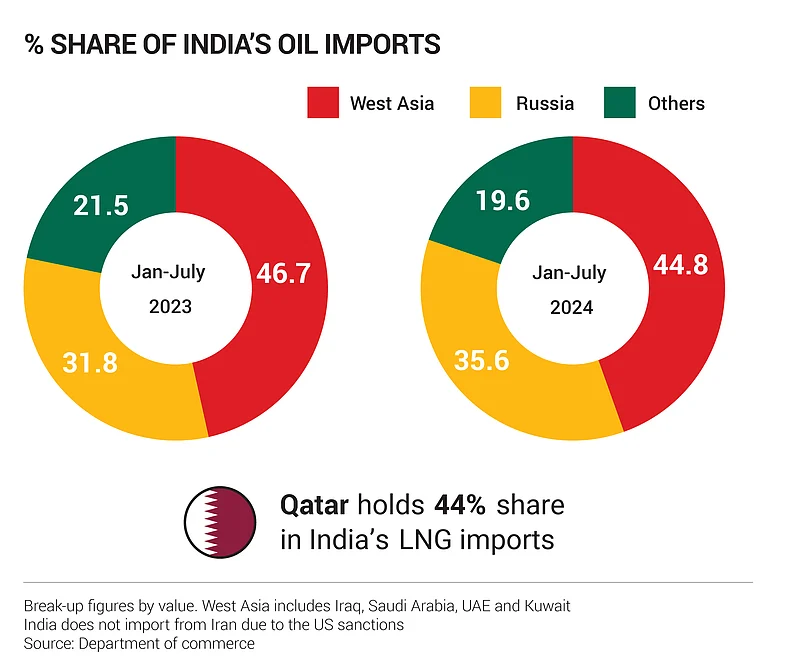

Oil purchase from Russia has increased, but not nearly enough to be significant. India continues to be heavily reliant on West Asia for oil and gas needs.

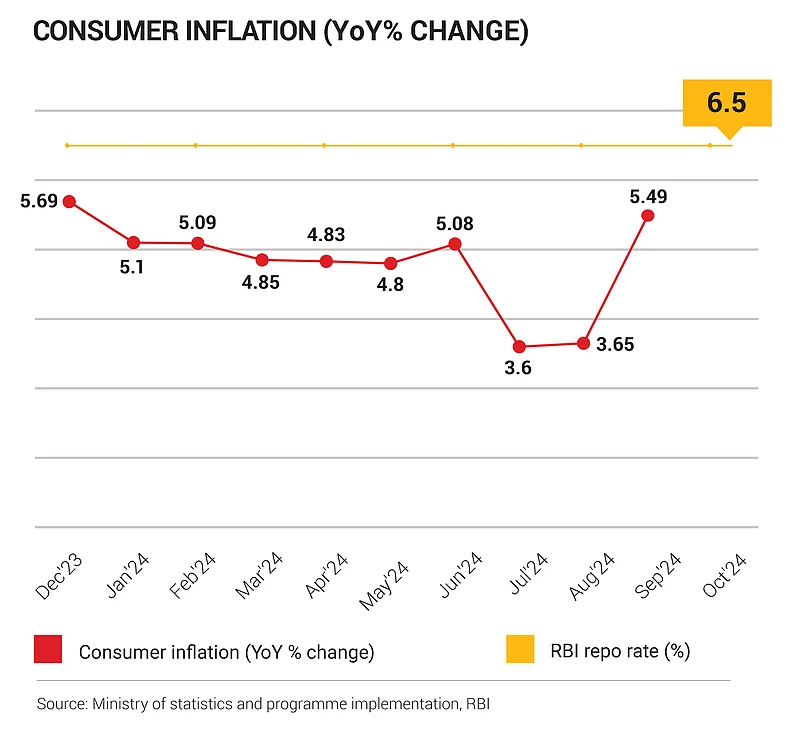

Following in the footsteps of crude oil price, consumer inflation reversed its declining trend and started to rise. The Reserve Bank of India’s Monetary Policy Committee cited this concern as the reason behind keeping the repo rate unchanged despite low consumer inflation

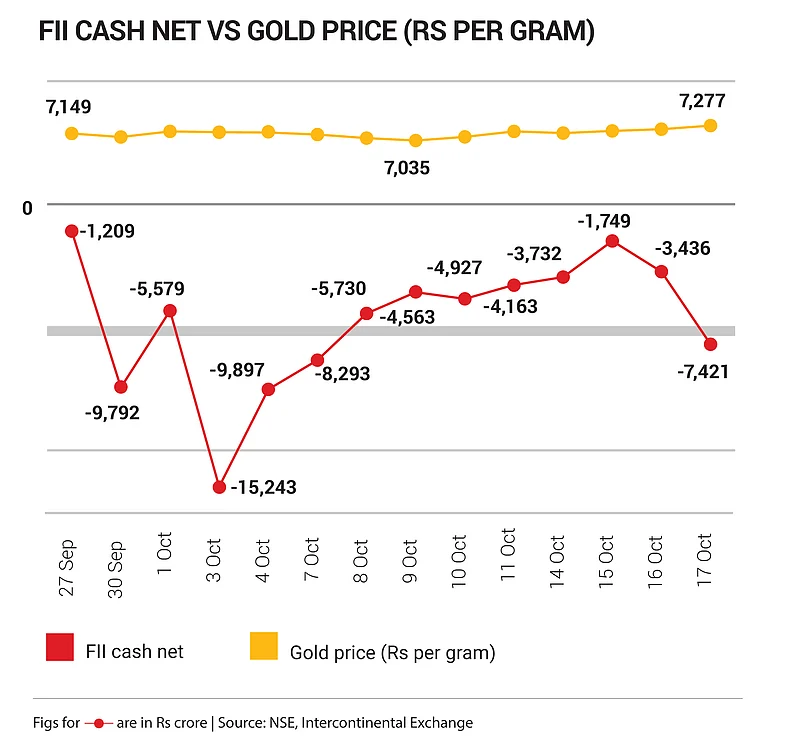

The stock market, which is forward-looking in nature, has also been declining since the start of October. Data reveals that foreign investors pulled out more than ₹60,000 crore in the first two weeks of October as gold prices surged to an all-time high

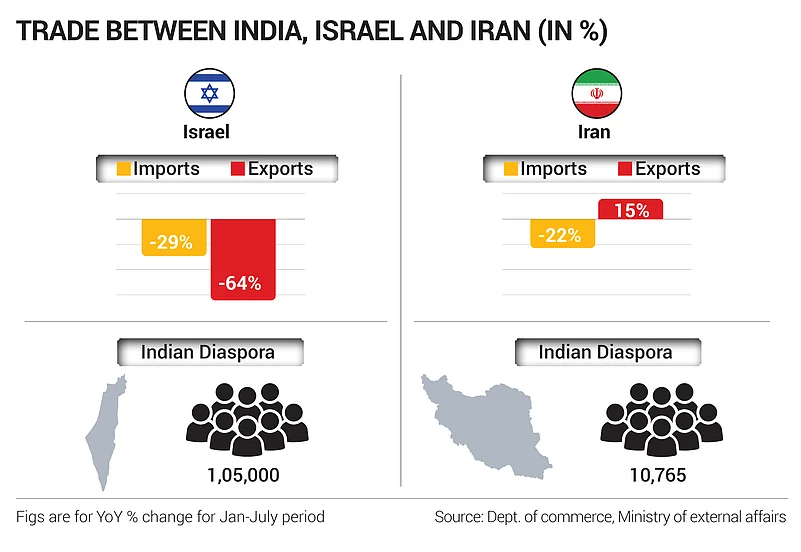

The conflict is set to impact profit margins for exporters and Indian companies. Bilateral trade with both Israel and Iran has taken a beating in recent months, with key commodities such as diamonds, Basmati rice and automotive diesel seeing major slumps