Trouble mounted for Gautam Adani and his conglomerate after US authorities indicted the Adani Group chairperson, his nephew Sagar Adani, and six others for allegedly paying Rs 2,029 crore ($265 million) in bribes to Indian government officials. The bribes, intended to secure solar power contracts with state electricity distribution companies, were reportedly paid between 2020 and 2024.

The individuals indicted by US prosecutors include executives from the Adani Group, Adani Green, Rajesh Adani, Vneet Jain, and entities like Azure and the Solar Energy Corporation of India. US authorities claim that these payments were concealed from US banks and investors from whom the Adani Group raised significant funds for solar energy projects. The group was expecting over $2 billion in profits from securing these contracts.

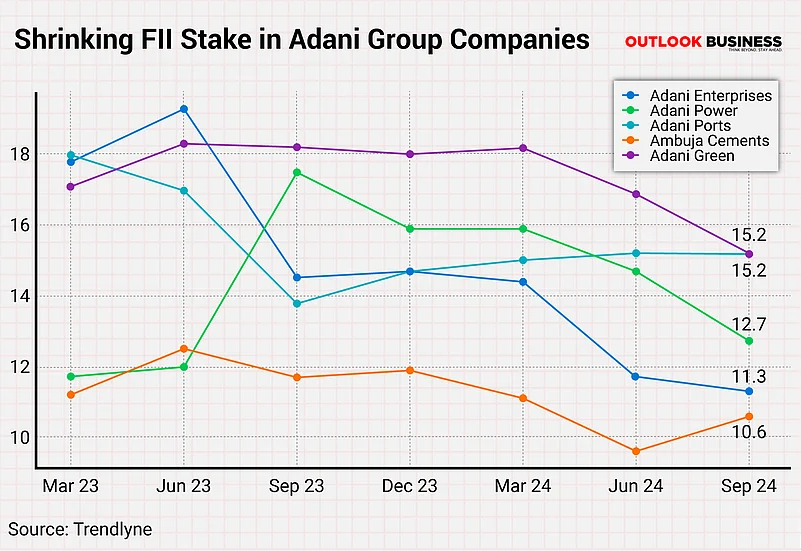

The US Indictment comes at a time when the Adani Group has been facing a significant decline in Foreign Institutional Investor (FII) interest.

Decline in FII Stake in Adani Group Companies

FII shareholding in the four out of top five Adani Group companies by market capitalization dropped sharply between March 2023 and September 2024, according to Trendlyne data.

As of September 2024, FII stake in Adani Enterprises stood at 11.3 per cent, down from 17.8 per cent in March 2023. Similarly, FII stake in Adani Green slipped to 15.2 per cent from 17.1 per cent, while Adani Ports saw its FII shareholding drop from 18 per cent to 15.2 per cent in just over a year.

This exodus reflects caution among institutional investors, who have raised concerns about the high valuations and volatility in Adani Group stocks.

Ambareesh Baliga, an independent market analyst, had earlier told Outlook Business that retail investors have been the primary drivers of momentum in Adani Group stocks, with institutional investors remaining cautious. “It appears that institutional investors are much more cautious but, buoyed by recent favorable reports surrounding Adani, retail investors have bought their stocks in large volumes,” Baliga said.

"Funds usually stay away from stocks with high valuations. They have minimal exposure to most Adani stocks. Moreover, the free float is also less in some Adani stocks, which creates more volatility,” Deepak Chhabria, founder and CEO of Axiom Financial Services had told Outlook Business, earlier.

Adani Group shares plummeted by around 20 per cent on Thursday, following the announcement of the US indictment on Wednesday.

Shares of Adani Enterprises were the hardest hit, crashing by 22 per cent. Adani Energy Solutions fell by 20 per cent, hitting a 52-week low of Rs 697.25. Other key Adani stocks, including Adani Green, Adani Total Gas, and Adani Power, also saw sharp declines, with losses ranging from 13 per cent to 18 per cent.

The US indictment adds to the challenges faced by the group after an OCCRP report accused the Adani family of using offshore funds in August 2023. In January 2023, US-based short-seller Hindenburg Research accused the Adani Group of stock manipulation and accounting fraud scheme, misuse of offshore tax havens and higher-than manageable debt levels. Previously, the Group has been accused of getting preferential treatment and environmental damage. With declining foreign investor confidence and legal challenges, the conglomerate's future remains uncertain.