2023 is proving to be a year of change for the popular Maharatna Bharat Heavy Electricals Limited (BHEL). Its chairman for four years, Nalin Shinghal, is set to superannuate on October 31, 2023. Shinghal will be replaced by a BHEL veteran, KS Murthy. Not only the management, but it also appears that the fortunes of the company are changing too.

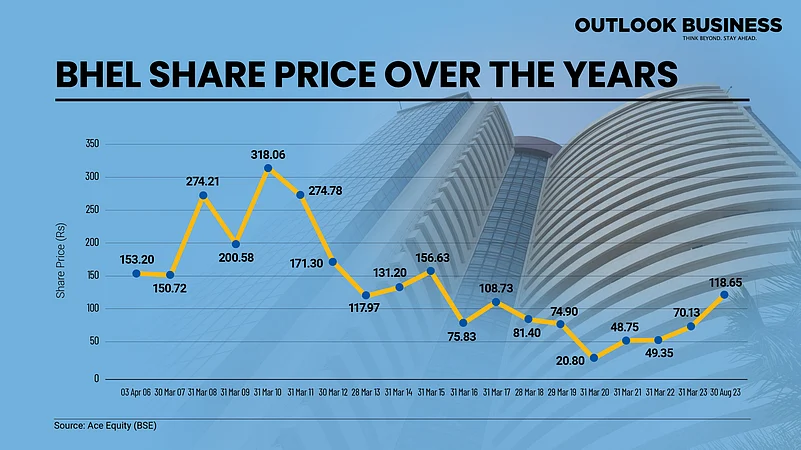

The 59-year-old Maharatna is attracting the attention of investors on the bourses. This year, the company has posted returns of over 57 per cent, significantly outpacing the BSE Capital Goods index which has seen returns of around 40 per cent till this date in 2023. The Maharatna has posted returns of over 100 per cent in the last one year, making it a multibagger stock.

While the money of the investors flows into the company, the Maharatna is seeing a robust order inflow as it has bagged several key projects in the last few months. NTPC, Adani Power Limited and NHPC are some of the biggest firms who have handed projects to the firm in Q2 FY24. The company also won the contract for India’s largest multipurpose hydropower project. The 2,880 Mega Watt (MW) project will come up in Arunachal Pradesh.

While the euphoria in the markets reflects the growing confidence in the prospects of BHEL, those tracking the company for years know the Maharatna is still far away from its glory days. A look at the company’s fundamentals and its value on the bourses over the years shows that the company is still the shadow of its past avatar. To put things in perspective, BHEL achieved its peak back in 2007 when its share price crossed Rs 370. At the end of September 16, the share price of the company stood at Rs 127.65. Behind the value destruction lies the story of India’s power sector. To understand whether the company can repeat the performance of its glory days, it is important to first look at how it reached the point where it is today.

Story Of Changing Times

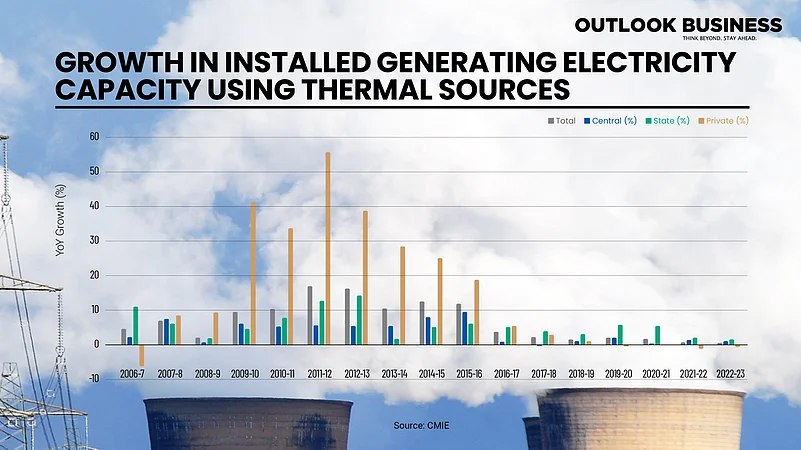

Established in 1964, the public sector unit primarily manufactures power generation equipment. The fate of the company for most of its history mostly relied upon the expansion of thermal power capacity. At the start of the 21st century, India’s thermal power capacity stood at 74,429 MW. Recognising the need for expanding the capacity and liberalising the power sector, the Atal Bihari Vajpayee government passed the Electricity Act 2003. Liberalising power generation, transmission and distribution, the act invited private players to significantly participate in the sector.

The data and studies available for the following years show that the sector witnessed a solid boom due to participation by private players. Looking at the data from around 2007, the year-on-year growth in thermal electricity capacity was the highest in the private segment. The graph started rising and peaked in 2012.

World Bank’s report of private sector participation in Indian power sector, written by Mohua Mukherjee, said that the share of private sector in India’s installed capacity increased dramatically between 2006 and 2012. The data shows that the private sector share increased from 13 per cent in fiscal 2006-07 to 27 per cent in 2011-12.

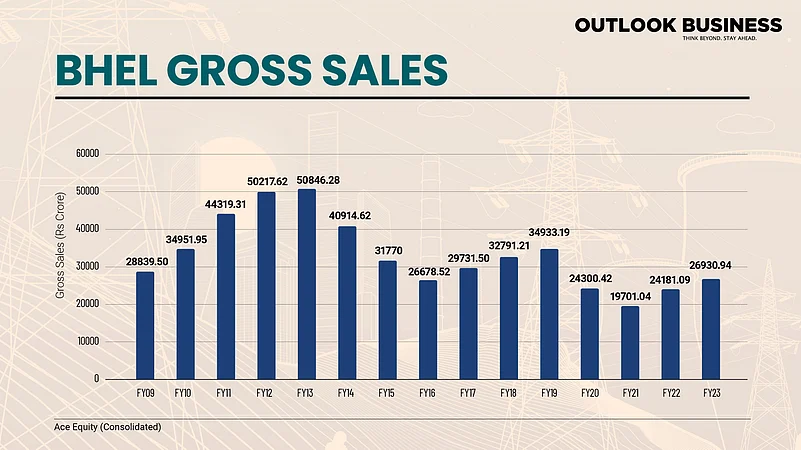

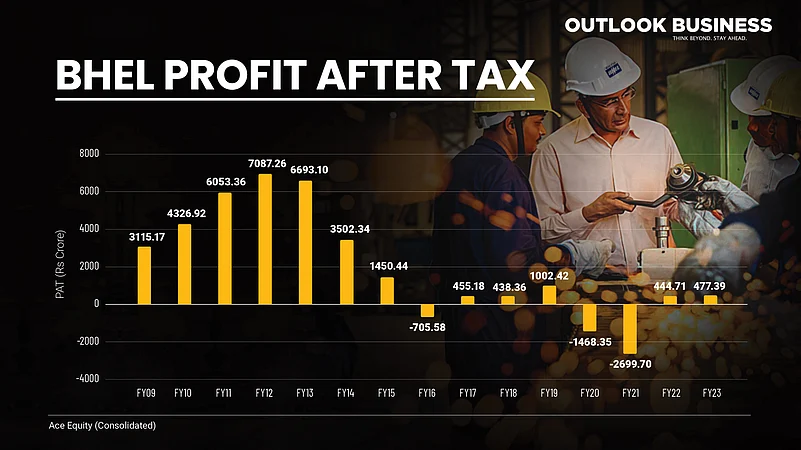

Given the boom in the power generation segment, BHEL stood as the leading equipment manufacturer to gain. The company’s financials reflect the gains it made during this time. The gross sales of the company rose from Rs 28,839 crore in FY09 to Rs 50,217 crore in FY 12. Along with the gross sales, the company’s profit after tax also more than doubled from Rs 3,115 crore to Rs 7,087 crore.

The post-2008 period was also notable. The UPA government led by Manmohan Singh was trying to offset the effects of global recession by introducing fiscal stimulus packages to boost liquidity and economic activity in the country. However, the recovery had gone awry when the GDP growth slowed to around 5 per cent in 2011 and 2012.

Amidst the worsening macroeconomic scenario, BHEL was able to sustain its performance on the back of strong expansion by private players, but signs of stress started appearing. The capex by private players slowed down following 2012 which reflected in the order books of BHEL.

In its annual report for 2012-13, the company noted, “Indian Power Sector is witnessing a slowdown since the past few years. Issues of coal linkages, environmental clearances, land acquisition and fund constraints have resulted in non-finalisation of new projects, especially in the private sector and some of the ongoing projects are on a slow execution path.”

Amit Anwani, Research Analyst at Prabhudas Lilladher, says that the company suffered the consequence of slowdown in the power sector in the following years. “A lot of private players went down after the boom of late 2000s and early 2010s. Buoyed by government’s push for industrial spending, many private players had entered the market but had to suffer losses.”

The state of the thermal industry worsened so dramatically that a special Parliament’s Standing Committee on Energy set up in 2017-18 found that assets worth Rs 2.36 lakh crore were stranded. Institute for Energy Economics and Financial Analysis noted in a report on India’s thermal sector, “A far too ambitious expansion program was undertaken, almost entirely funded by financial leverage. Financial problems were compounded by cost overruns, project delays, floods, earthquakes, fuel supply interruptions, PPA contract cancellations, and a lack of accountability by promotor groups.”

The ensuing stress in the power sector meant that BHEL found itself in a tough position. The company’s financial situation fell off the cliff. From a PAT of over Rs 6,000 crore in financial year 2013, the company posted loss of Rs 705 crore in financial year 2016.

Given the challenging atmosphere for the company, the leadership had to regroup to realise the need to move towards diversification as a new challenger threatened to upend the market.

Diversification Bet

Recognising the shifting trends in the energy market in 2018, BHEL’s then chairman BP Rao had declared, “One of our priority areas will be to focus in a big way on new opportunities.”

The company’s chairman announced that it will focus on power transmission, railway locomotives and offshore drilling rigs. Towards its diversification bid, the company spent around Rs 232 crore in fiscal 2018-19 to develop new capabilities.

Talking about the diversification bid of power equipment manufacturers, Hetal Gandhi, Director - Research, CRISIL Market Intelligence and Analytics , says, “As the power segment made up for a large portion of their business, the bid to diversify business was slow initially. However, it does appear that the pace has picked up.”

For BHEL in fiscal 2012-13, 81 per cent of its order book consisted of projects from the power sector while 11 per cent belonged to industry and the rest to international operations. This figure for the fiscal 2022 stood at 76 per cent for power and 24 per cent in the industrial segment. While the growth was slow in these years, the fiscal year 2022-23 saw an improved diversification performance for the company. The share of the industrial segment jumped to 40 per cent after the company clocked over Rs 9,537 crore worth of orders, highest in 13 years.

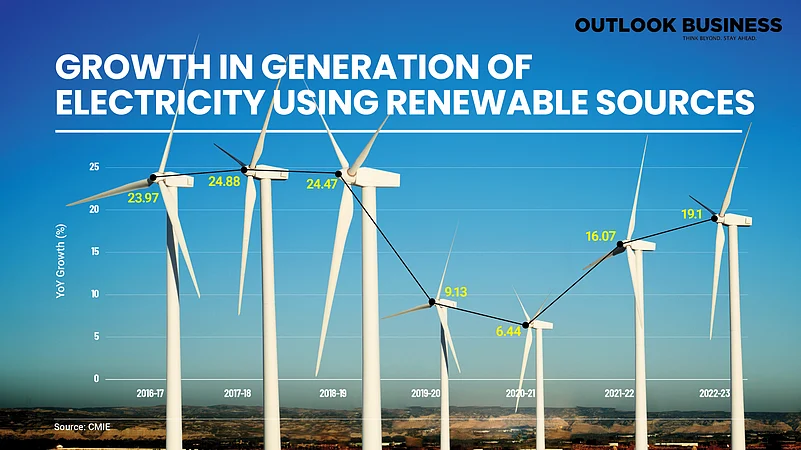

The diversification bid came amid India’s renewables focus. At a time when thermal capacity expansion was muted, growth in renewables energy capacity remained quite resilient.

Anwani said that the story of BHEL has to be seen in the larger canvas of changing energy priorities. “India is looking to meet 50 per cent of its energy requirements through renewables. In this context, diversification becomes an important aspect for the company as significant investment in expanding thermal capacity is unlikely.”

Commenting on the diversification programme of the company, Aamar Deo Singh, Head Advisory at Angel One Ltd, says, “As part of its diversification plan, BHEL has also used its Pressurised Fluidized Bed Gasification technology for coal gasification and has inked MoUs for the development of coal gasification projects with Coal India Limited and NLCIL. BHEL reported a rise in new orders of over 17 per cent to Rs 23,548 crore in 2022–23 compared to the previous year as a result of its diverse business approach.”

In April this year, BHEL-led consortium was also awarded the contract for 80 vande bharat trains for Rs 120 crore per train. The company had also received an order for Super Rapid Gun Mounts from the Ministry of Defence.

The financials of the last two fiscal years indicate the company might have started to recover from setbacks of pandemic, which struck the firm at the time when it was already struggling due to headwinds in the power sector. The profit after tax for BHEL was recorded at Rs 477 crore in FY23, a significant increase from the loss of Rs 2,699 crore in FY21.

Improvement in profits and a rise in order books has prompted many to wonder: Are good days ahead for the Maharatna?

Return To The Glory Days?

In the 2010s, the country’s peak demand deficit, a measure to see how much of country’s power demand was met, saw a significant decline. It reduced from –12.7 in FY 2010 to –1.6 per cent. However, the last few years have seen an uptick in power deficit. The peak power deficit at the end of fiscal 2023 stood at –4.0 per cent. The company is expecting significant orders from the thermal sector.

In an interview to Economic Times, its chairman Nalin Shinghal said, “In the shorter period, we are expecting over the next two to four years significant number of orders in the thermal side.”

The recent surge in orders has clearly uplifted the mood of the dalal street, due to which the company has seen a rally in its stocks. However, analysts studying the company caution that the road to the previous highs remains long. Anita Gandhi, Director at Arihant Capital, opines, “While confidence in BHEL's recent developments and diversification efforts is positive, the company's future performance on the stock market will depend on various factors, including its ability to effectively execute orders, maintain profitability, and adapt to changing market dynamics.”

The order backlog of the company stood at over Rs 1 lakh crore in the last financial year. Analysts argue that the company has to improve its order execution if it were to retain the confidence of the investors.

“While it is good that the company is getting a lot of orders right now, the old issues of slow execution and multiple delays can hinder the company’s prospects,” Anwani argues.

In a detailed report on the company, brokerage firm JM Financial recently argued that the prospects for the company are bright. It said, “With increasing incidence of energy and peak power shortages in India, ordering for the thermal power projects is about to rebound in a meaningful way over the next 3-4 years. Along with revival in thermal capex, BHEL will also benefit from its strategic diversification into non-power businesses in recent years.”

Whether the sun keeps shining on one of the largest capital goods makers of the country remains to be seen. With world and India increasingly focusing on renewables, questions over the long-term business of the central government undertaking will continue to linger. However, with thermal power being the most important source of energy, the importance of the Maharatna is here to stay for some time to come.