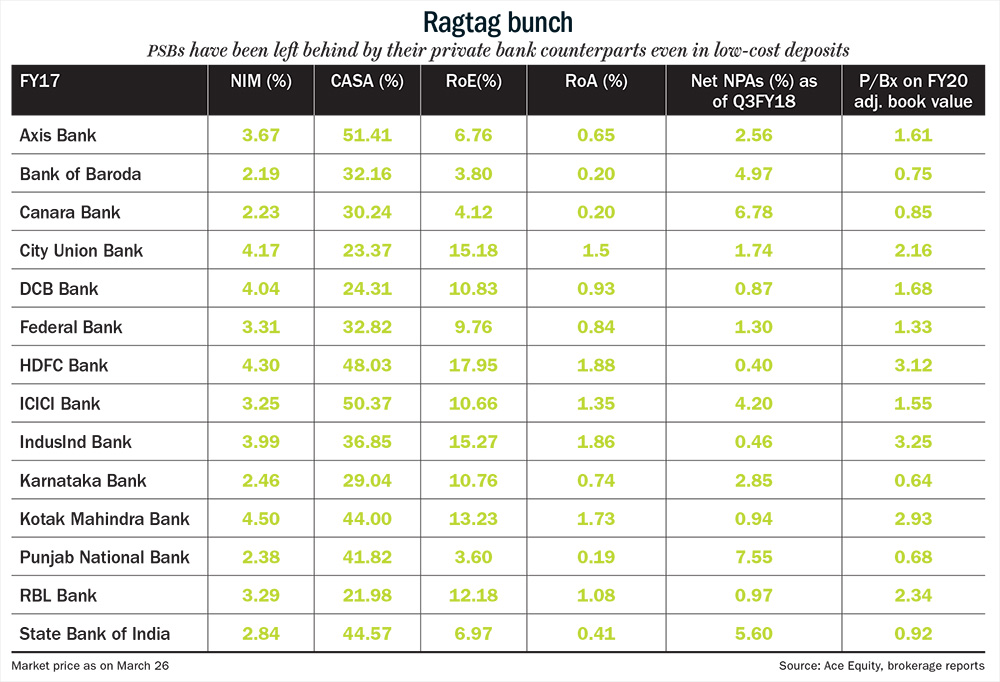

The Rs.12,968-crore-fraud at PNB has once again highlighted the frailty of PSU banks’ risk-management systems. The banking system is already creaking under the weight of NPAs of Rs.730,000 crore and panicked investors lost no time in pronouncing their verdict. The stock price of PNB has corrected 33% and the Nifty PSU Bank Index has also fallen 11% in wake of the scam. Among large PSU banks, SBI has corrected 12.6%, while Bank of Baroda is down 14.7%. After the pounding, most PSU banks now trade at 10-30% discount to their book value (see: Ragtag bunch). However, Abhimanyu Sofat, VP – research, IIFL, says that the current beaten valuations are not what one should be looking at as the quality of the book itself remains uncertain. “RBI, through its new norms, is pushing banks to quickly recognise stress in their books, via a resolution plan or by referring the stressed no-resolution accounts for bankruptcy proceedings. Even though some PSU banks are trading at half their book value, it is difficult to guess how the books will look in light of the new NPA norms,” he adds.

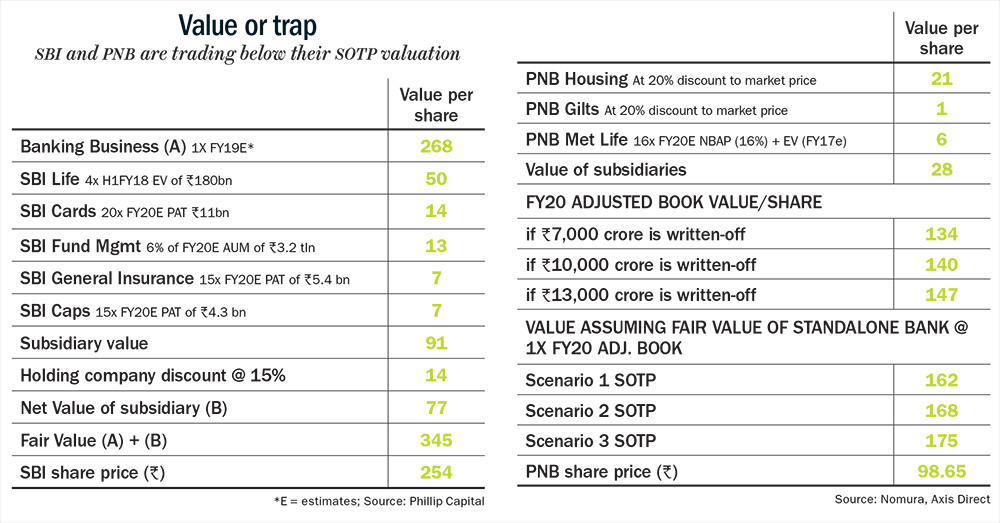

Analysts at the Tokyo-based financial services company Nomura though argue that the current valuation of some of the PSU banks are much lower than their sum-of-the-parts value, which takes into account the value of their non-core businesses. A sensitivity analysis done by Nomura shows that even if PNB writes off Rs.13,000 crore worth of loans on account of the Nirav Modi fraud, the bank’s sum of the part (SOTP) value is Rs.168 per share (which includes the value of its subsidiaries and its FY20 book value). At Rs.98 per share, the bank is currently trading at 40% discount to its SOTP value and at 27% discount to the bank’s FY20 adjusted book value of Rs.134 per share (see: Value or trap).

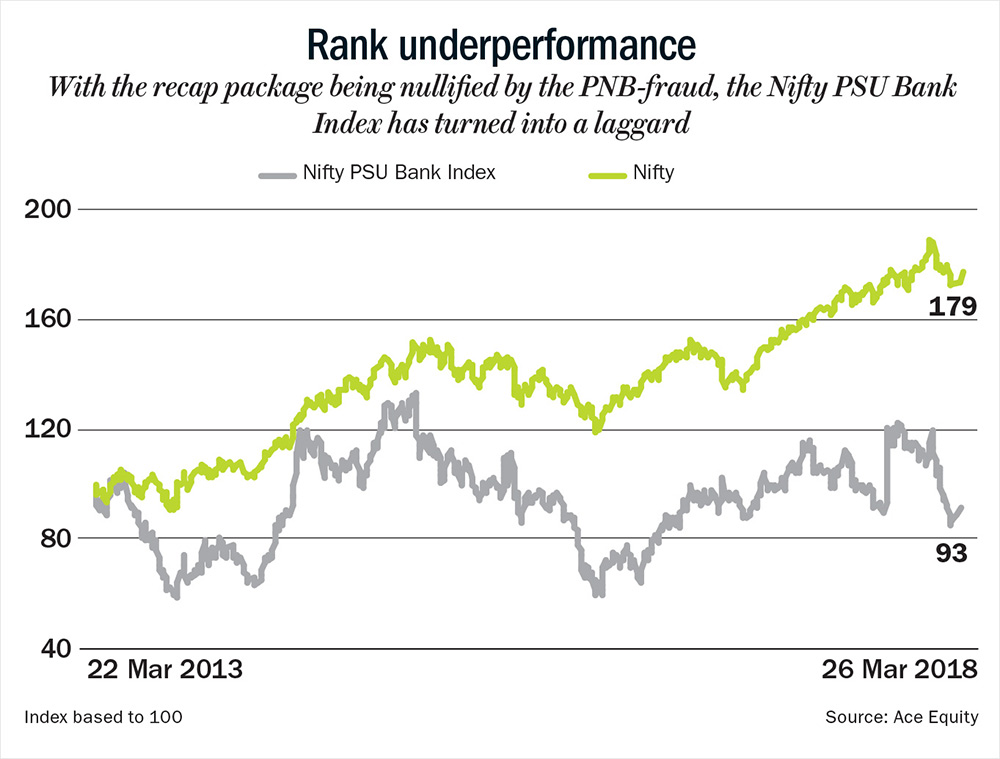

However, there is no sign of the broad-based positive sentiment that PSU banks glowed in after the government announced a Rs.2.1 lakh crore recapitalisation package last year on October 24. The Nifty PSU Bank Index gained as much as 21% the following day but is now trading even below the pre-recapitalisation level. “PSU banks were trading at low valuations and the mood was upbeat as resolution capital was being made available, but a large PSU bank like PNB getting hit with a fraud of this nature has dealt a body blow to the renewed confidence,” says Bharat Iyer, head of research, JP Morgan.

Playing it safe

The fraud has once again revived investors’ preference for private banks over PSU banks. “Private retail banks have not seen much correction. However, even among corporate lenders that have corrected, investors’ appetite is now more towards private banks,” adds Iyer. ICICI Bank’s stock price has corrected 8% and currently trades at 1.6x FY20 book value, while Axis Bank is down 4% and trades at 1.6x book value.

Harsha Upadhyaya, CIO (equity), Kotak AMC, says, “We are overweight on private corporate lenders as their NPA issues are not as serious as PSU banks.” As on H2FY18, net NPA of Axis Bank stood at 2.56% and that of ICICI Bank at 4.2%. Meanwhile, Bank of Baroda’s net NPA stands at 5% and that of SBI at 5.6%. Both the private lenders also have better return ratios. For FY17, ICICI Bank’s return on assets (RoA) stood at 1.3% and Axis Bank’s RoA was 0.6%. Meanwhile, SBI’s RoA stood at 0.4%, while that of Bank of Baroda was 0.2%.

Even though Bank of Baroda is trading at 0.7x FY20 adjusted book value and SBI at 0.9x FY20 adjusted book value that under valuation matters little if they are under-capitalised. That is where private sector banks are more comfortable than their PSU peers. As on Q3FY18, the CAR of both ICICI Bank and Axis Bank was more than 17%, while that of Bank of Baroda and SBI was about 13%.

Gautam Duggad, head of research (institutional equities), Motilal Oswal Securities, points out that private banks also score over their PSU counterparts by virtue of their various subsidiaries where value unlocking is in play. For instance, in FY17 ICICI Bank listed its insurance arms and raised Rs.4,049 crore. The bank is also listing ICICI Securities — the brokerage and merchant banking business — to raise Rs.4,020 crore. Axis Bank also has as many as 10 subsidiaries, which includes Axis Capital, Axis AMC, Axis Securities and Axis Direct. However, the bank has so far not announced any plans to sell its stake in these subsidiaries. Recently, the bank raised Rs.11,626 crore through a private placement to a clutch of investors led by private equity major Bain Capital. Such capital infusion is expected to help private players grow their book as and when the credit cycle picks up. Within PSU banks, SBI listed its life insurance arm in September 2017 and garnered Rs.5,600 crore from its 8% stake sale. According to reports, Bank of Baroda is also planning to sell its stakes in its subsidiaries such as BOB Capital Markets, BOB Financial, Baroda Pioneer Asset Management and Nainital Bank.

The now-beleaguered PNB, had raised Rs.1,321 crore by selling its 5.9% stake through PNB Housing Finance IPO last year and another Rs.125 crore by exiting from the AMC business. PNB also has a 33% stake in PNB Housing Finance, which at the current market price is worth Rs.6,000 crore. However, capital market regulations prevent any stake sale within three years of listing. Besides its stake in entities such as PNB Gilts (valued at Rs.470 crore at current market price) and UTI AMC (PNB’s stake valued at Rs.1,820 crore as per reports), reports suggest that the bank is also looking to monetise some of its office buildings and other fixed assets for about Rs.500 crore.

However, analysts remain wary of PNB. Kajal Gandhi of ICICI Securities, whose brokerage house has suspended its rating on PNB, says, “Erosion in net worth would curtail the bank’s capacity to raise capital which would impact future growth. As investigations in the fraud progress, the downside risk to the bank’s asset quality cannot be ruled out.” The current fraud also means that PNB’s management would be channeling most of its energies in getting its house in order, rather than focusing on growth. “A shift in the management’s focus to contain the damage and improve risk-management framework would keep the return ratios subdued,” Gandhi adds.

Although private banks are favored, fund managers are buying into SBI and Bank of Baroda where there is some comfort in terms of capital adequacy and valuations. Data compiled by Ace Equity shows that as many as 23 mutual fund schemes bought 26 million Bank of Baroda shares in the month of February, while 36 mutual fund schemes bought 56 million shares of SBI. The latter is trading at a discount of 30%, if one takes into account its FY20 consolidated book value.

Risk spotting

Compared with other PSU banks, SBI has better risk-management practices. This is not the first time that entities from the gems and jewellery sector have defaulted on their dues. After taking into account the fraud, banks’ NPAs from this sector have gone up to 30% from 12%. SBI’s domestic loan book’s exposure to the gems and jewellery sector stands at less than 1%.

Analysts believe as more stress is getting recognised, it should help PSU banks such as SBI and Bank of Baroda to improve their operational performance. “NPAs and high slippage have been one of the key drags on net interest margin. With 60-80% of stress already recognised as NPAs, we believe incremental slippage will come off,” writes Adarsh Parasrampuria, analyst, Nomura in his report.

He reckons that with NPAs peaking, the pre-provisioning operating profit will see a reversal. Among the major corporat lenders, Bank of Baroda, SBI and Axis Bank have the highest provisioning coverage ratios. “Resolutions in some of the NCLT cases will also lead to interest income recognition in the sustainable debt portion. So, FY19 will see twin impact of lower reversals due to lower slippage and some income recognition in NCLT-related cases. We expect Bank of Baroda to recover first, followed by SBI, then Axis Bank and ICICI Bank,” he adds.

Interestingly, Bank of Baroda was also hit with a similar fraud back in 2015 when the current CEO PS Jayakumar was brought in. Just like PNB, Bank of Baroda’s troubles also had their origins in one of its domestic branches (Ashok Vihar in Delhi) which was allegedly used to channelise Rs.6,172 crore of black money to Hong Kong. After the fraud was detected, the bank’s provisions jumped five-fold and the bank reported quarterly loss of Rs.3,342 crore in Q3FY16, which was the highest-ever quarterly loss reported by any bank. Since then, Bank of Baroda has turned around the corner.

The bank’s RoAs which were negative (0.7%) in FY16 post the fraud, moved back into positive territory in FY17 and RoE, too, improved from -12.7% in FY16 to 4.6% in FY17. In Q3FY18, the pre-provisioning operating profit was up 40% on a YoY basis, improving from Rs.2,595 crore to Rs.3,650 crore. The domestic loan book was up 16.4% YoY, led by the 33.4% YoY growth seen in retail loans.

Analysts like what they have seen post Jayakumar’s entry. “Strong performance on all major operating metrics clearly suggests that the bank’s transformation effort is yielding the desired outcome. Analysis of stressed assets suggests that the bank is approaching the end of recognition of stressed loan cycle, which along with higher provisioning coverage ratio clearly indicates sharp moderation in credit cost from FY19,” says, Asutosh Kumar Mishra, analyst, Reliance Securities.

PSU banks have had a poor track record of generating wealth for their shareholders. Over the past decade, Nifty PSU Bank Index has given a negative return of 11.5%. In the same period Nifty has clocked 115% return (see: Rank underperformance). Among individual banking stocks, SBI has delivered 18.7%, while Bank of Baroda has remained flat over the past five years. During the same period, Axis Bank and ICICI Bank have given return of 102% and 71%, respectively. HDFC Bank which is largely retail-focused has posted return of 207% over the past 5 years, outperforming the benchmark Nifty.

That said, will the Nirav Modi-fraud serve as the perfect storm for the government to decisively address the systemic issues plaguing PSU banks? A set of sweeping reforms will definitely lift the mood and spark off investor interest across the space. Until then, investors would be better off sticking to select private and PSU banks.